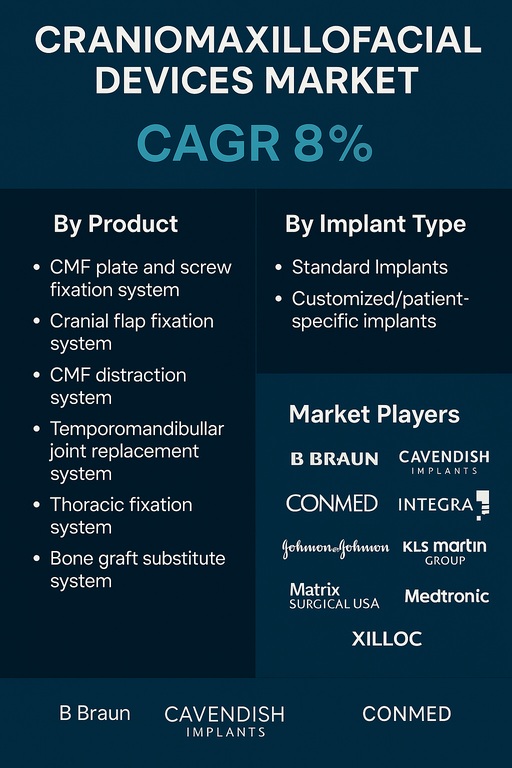

The craniomaxillofacial devices market is projected to grow at a CAGR of 8.0% during the forecast period of 2025 to 2033, driven by an increasing volume of trauma surgeries, orthopedic and reconstructive interventions, and a rising emphasis on advanced surgical solutions for facial and cranial structures. Craniomaxillofacial (CMF) devices enable surgeons to address congenital deformities, fractures, tumor removal, and trauma repair with enhanced precision and long-term structural support. Rapid advancements in surgical techniques, 3D-printed patient-specific implants, and increased demand for minimally invasive procedures also support strong growth across all major global healthcare markets.

Market Driver

Growing Trauma Cases and Road Accidents: A significant rise in road accidents and sports injuries is creating sustained demand for robust craniomaxillofacial plates, screws, and fixation systems to manage complex facial fractures, orbital fractures, and cranial trauma.

Expanding Use of Patient-Specific Implants: Advancements in 3D printing and CAD/CAM technologies enable customized CMF implants tailored to individual anatomies. Personalized solutions improve surgical outcomes and healing times, encouraging rapid adoption across hospitals and specialized surgical centers.

Adoption of Bioabsorbable and Titanium-Based Materials: New materials, such as bioabsorbable polymers and titanium alloys, offer optimal strength, biocompatibility, and lightweight designs. Surgeons prefer these advanced biomaterials as they reduce long-term complications, support bone regrowth, and decrease the need for revision surgery.

Market Restraint

High Cost of Implants and Surgical Procedures

Despite clinical advantages, high procedural and material costs, along with the need for specialized surgical expertise and post-operative care, restrict market growth in lower-income regions. Limited reimbursement options in developing economies further restrain widespread adoption.

Market Segmentation by Product

The Product segment includes MF plate and screw fixation systems, Cranial flap fixation systems, CMF distraction systems, Temporomandibular joint replacement systems, Thoracic fixation systems, and Bone graft substitute systems. In 2024, MF plate and screw fixation systems held the largest market share, driven by widespread use in trauma and reconstructive surgeries. Cranial flap fixation systems and temporomandibular joint replacements also hold substantial share due to increasing neurosurgery and TMJ disorder interventions. CMF distraction systems and thoracic fixation systems are projected to show steady growth owing to advances in surgical techniques and a greater focus on improving long-term outcomes.

Market Segmentation by Implant Type

The Implant Type segment comprises Standard implants and Customized/patient-specific implants. In 2024, standard implants dominated due to broad availability and affordability. However, customized/patient-specific implants are projected to register the highest CAGR during 2025 to 2033 as personalized care options improve surgical accuracy, reduce surgery times, and support faster recovery. Continued progress in additive manufacturing and imaging technologies is anticipated to drive rapid adoption of patient-specific devices in tertiary care centers worldwide.

Geographic Trends

North America led the market in 2024 owing to its advanced healthcare infrastructure, robust reimbursement policies, and significant investments in surgical innovation. Europe followed closely due to increasing clinical expertise and supportive regulations for customized medical devices. The Asia Pacific region is projected to record the highest CAGR over the forecast period, driven by a rise in healthcare investments, surgical tourism, and increasing demand for advanced reconstructive surgery across countries like China, India, South Korea, and Japan. Latin America and the Middle East & Africa present long-term growth opportunities as healthcare access and infrastructure gradually improve and local distributors enhance availability.

Competitive Trends

The competitive landscape is marked by a strong emphasis on product innovation, material development, and strategic collaborations. Major players such as Acumed, B. Braun, CAVENDISH IMPLANTS, CONMED, INTEGRA, Johnson & Johnson, KLS Martin Group, Matrix Surgical USA, Medartis, Medtronic, Stryker, XILLOC, and Zimmer Biomet hold significant shares. Leading companies differentiate themselves by leveraging next-generation materials and technologies including bioabsorbable solutions, virtual surgical planning, and additive manufacturing to optimize performance and improve surgical accuracy. Expanding partnerships with research institutions and academic centers also supports clinical training, enhances surgeon familiarity with new devices, and strengthens long-term relationships with hospitals and specialty care networks. Companies investing in emerging geographies and supporting continuous innovation are expected to sustain competitive advantage and maintain strong growth trajectories through 2033.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Craniomaxillofacial Devices market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Implant Type

| |

Location

| |

Material

| |

Application

| |

Resorbability

| |

Device Type

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report