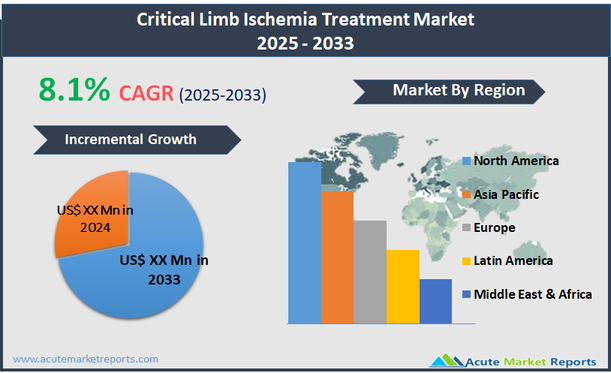

The Critical Limb Ischemia (CLI) treatment market involves medical and surgical interventions used to restore blood flow to limbs that have severe arterial blockages, typically in the legs. CLI is a serious condition characterized by chronic pain, sores, and ulcers due to inadequate blood flow, often leading to limb amputation if untreated. Treatments for this condition range from pharmacological therapies aimed at symptom management and improving blood flow, to invasive procedures like angioplasty, stenting, and surgical bypass, as well as advanced therapies like stem cell and gene therapies aimed at vascular regeneration. The Critical Limb Ischemia treatment market is projected to grow at a compound annual growth rate (CAGR) of 8.1% from 2026 to 2034. This growth is driven by an aging global population, increasing incidence of diabetes and peripheral artery disease (PAD), which are major risk factors for CLI. The market is witnessing significant advancements in minimally invasive technologies that offer alternatives to traditional open surgeries, which tend to be riskier and require longer recovery times. Innovations such as drug-coated balloons and bioresorbable stents are improving outcomes for CLI patients, making treatments more effective and less burdensome.

Rising Incidence of Diabetes and Peripheral Artery Disease

The critical limb ischemia (CLI) treatment market is primarily driven by the rising global incidence of diabetes and peripheral artery disease (PAD), conditions that significantly increase the risk of developing CLI. Diabetes, which affects blood flow by damaging blood vessels and nerves, has been increasing dramatically worldwide, fueled by rising obesity rates and aging populations. Similarly, PAD, characterized by narrowed arteries reducing blood flow to the limbs, is becoming more prevalent with lifestyle factors such as smoking and high cholesterol levels. The combination of these conditions leads to a higher incidence of CLI, necessitating effective and timely treatments to prevent severe outcomes, including limb amputation. The demand for advanced therapeutic interventions, such as angioplasty and stenting, alongside pharmacological treatments to manage symptoms and improve limb perfusion, has surged, driving substantial growth in the CLI treatment market.

Advancements in Minimally Invasive Technologies

There is a significant opportunity in the CLI treatment market stemming from advancements in minimally invasive technologies. Techniques such as endovascular surgery, which includes angioplasty and stent placements, are becoming more sophisticated, with the introduction of drug-coated balloons and bioresorbable stents enhancing the efficacy of procedures. These innovations not only improve patient outcomes by restoring blood flow more effectively but also reduce recovery times and the risks associated with more invasive surgeries. The shift towards less invasive treatments is likely to expand the patient base eligible for intervention, as these technologies reduce the overall strain on patients and healthcare systems, making treatment viable for a broader demographic, including those who may not be candidates for traditional surgery.

High Cost of Treatment

A significant restraint in the CLI treatment market is the high cost associated with advanced therapies and surgical interventions. The expenses involved in endovascular surgeries, particularly with newer technologies like drug-eluting stents and regenerative medicine approaches, can be prohibitive. These costs are often exacerbated in healthcare settings without adequate insurance coverage or in regions with less developed healthcare infrastructure. The financial burden of CLI treatment can limit access for many patients who cannot afford these advanced therapies, thereby restricting market growth.

Need for Personalized Treatment Approaches

One of the major challenges in the CLI treatment market is the need for personalized treatment approaches tailored to individual patient conditions and responses. CLI manifests with varying degrees of severity and may respond differently to treatment depending on the underlying cause and the patient’s overall health profile. Developing treatment protocols that are universally effective can be difficult, as clinicians must consider numerous variables, including comorbid conditions like diabetes and the extent of arterial occlusion. The challenge lies in integrating diagnostic tools, patient data, and treatment modalities in a manner that optimizes outcomes for diverse patient groups, requiring ongoing research and adaptation of clinical practices.

Market Segmentation by Treatment

In the Critical Limb Ischemia (CLI) treatment market, segmentation by treatment is divided into Medication and Devices. The Devices segment currently accounts for the highest revenue due to the critical nature of the interventions needed for CLI, which often require immediate and substantial restoration of blood flow to prevent limb loss. Devices such as stents, angioplasty balloons, and atherectomy systems are extensively utilized to physically open blocked arteries and are essential for the majority of severe CLI cases. The technological advancements in these devices, including drug-eluting stents and cutting balloons, have improved patient outcomes significantly, justifying their high cost and integral role in CLI management. However, the Medication segment is expected to witness the highest CAGR from 2026 to 2034. This growth is driven by the increasing development and use of pharmacotherapies that can complement device-based treatments or serve as initial management options to improve blood flow and reduce pain in CLI patients. Innovations in medications that target the underlying mechanisms of atherosclerosis, promote angiogenesis, or prevent thrombosis are expanding the treatment landscape for CLI, providing opportunities for less invasive and potentially cost-effective approaches prior to or in conjunction with surgical interventions.

Geographic Segment

The Critical Limb Ischemia (CLI) treatment market is characterized by distinct geographic trends. In 2025, North America accounted for the highest revenue percentage, driven by an advanced healthcare infrastructure, high prevalence of peripheral artery disease, and significant investment in healthcare research. The robust medical device industry in this region, coupled with high awareness and healthcare expenditure, supports the extensive use of advanced CLI treatments, including both medications and devices. However, the Asia-Pacific region is expected to exhibit the highest CAGR from 2026 to 2034. This anticipated growth is driven by rising healthcare spending, increasing prevalence of diabetes and smoking-related diseases, and improving healthcare infrastructure, which are expanding access to treatment options in these regions. Rapid urbanization and lifestyle changes contributing to higher rates of conditions predisposing to CLI also play a critical role in this growth.

Competitive Trends

In 2025, the competitive landscape in the CLI treatment market was shaped by prominent players such as Boston Scientific Corporation, Cesca Therapeutics Inc., Abbott Laboratories, Pluristem Therapeutics Inc., Rexgenero Ltd, LimFlow SA, Micro Medical Solutions, and Cardiovascular Systems, Inc. These companies focused on innovation and expansion of their CLI treatment portfolios, which included the development of advanced devices like drug-coated balloons, stents, and novel therapeutic platforms such as cell therapy products. Boston Scientific and Abbott Laboratories, with their strong global presence, led the market in terms of revenue, primarily through continuous innovation and wide distribution networks. From 2026 to 2034, these companies are expected to further enhance their market presence by investing in emerging markets and focusing on the integration of new technologies such as bioresorbable scaffolds and next-generation drug-eluting stents. Strategic collaborations and acquisitions will likely be key strategies for these firms to broaden their product offerings and strengthen their market positions. Additionally, investments in clinical trials to explore new applications and indications for existing products will be crucial to address the unmet needs in the treatment of CLI, aiming to improve patient outcomes and reduce the incidence of limb amputations.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Critical Limb Ischemia Treatment market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Treatment

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report