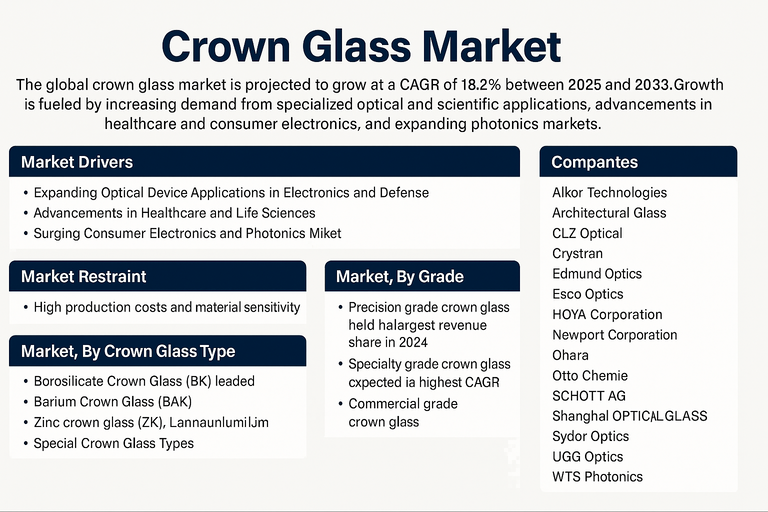

The global crown glass market is projected to grow at a CAGR of 18.2% between 2025 and 2033. Growth is fueled by increasing demand for specialized optical glass in precision instruments, scientific research, electronics, and medical device manufacturing. Crown glass types offer low refractive indices and minimal dispersion properties, making them essential in optical components like lenses, prisms, microscopes, and cameras. The market is driven by heightened demand for advanced optical systems across automotive, defense, healthcare, and industrial automation sectors. Enhanced melting processes and glass formulations that improve consistency, color fidelity, and mechanical strength continue to bolster adoption. Ongoing innovations in optical coatings and manufacturing precision also support sustained interest and growth across diverse end-user industries.

Market Drivers

Expanding Optical Device Applications in Electronics and Defense

A primary driver is the growing utilization of crown glass in optical components such as camera lenses, optical fibers, and precision imaging devices. Demand from telecommunications, augmented reality devices, and laser systems requires high-clarity glass that can endure harsh operating conditions. Defense and aerospace sectors also utilize crown glass extensively for night-vision systems, periscopes, and targeting optics, which raises consumption rates across these industries.

Advancements in Healthcare and Life Sciences

The healthcare industry is increasingly employing crown glass optics in diagnostic equipment, surgical instruments, and scientific imaging devices. Its consistent optical properties support precise light transmission, making crown glass ideal for endoscopes, microscopes, and laser surgery equipment. The global focus on healthcare infrastructure improvements and R&D into biomedical devices will bolster long-term demand for specialty crown glass grades tailored to specific wavelength and durability requirements.

Surging Consumer Electronics and Photonics Market

Consumer electronics continue to support the crown glass market as producers demand light-weight, high-transmittance glass for compact optical modules. Growth in digital cameras, VR headsets, and wearables, along with the rapid pace of innovation in photonics and optoelectronics, will maintain a strong consumption trajectory through the forecast period.

Market Restraint

High Production Costs and Material Sensitivity

Despite strong drivers, the crown glass market faces challenges stemming from high-energy consumption during glass melting and the cost of precision grinding and polishing. Raw material price fluctuations especially for barium, zinc, lanthanum, and borosilicates can hinder stable production. Producers also face increasing pressure to comply with strict sustainability standards and emissions regulations, which adds further complexity and may restrain margins for smaller suppliers.

Market By Crown Glass Type

By crown glass type, borosilicate crown glass (BK) led the global market in 2024 due to its broad use in optical lenses, lab glassware, and heat-resistant applications owing to its outstanding clarity and thermal stability. Barium crown glass (BAK) is projected to register the highest CAGR during the forecast period because of its high refractive index and low dispersion properties that improve lens sharpness in high-performance optical assemblies. Zinc crown glass (ZK) and lanthanum crown glass (LaK) continue to grow steadily due to their role in premium-grade optics for specialized cameras and laser equipment. Other specialty crown glass types will gain interest in niche industrial and research fields that require highly customized solutions.

Market By Grade

By grade, precision grade crown glass accounted for the largest revenue share in 2024 owing to its widespread use in advanced optical instruments where extremely tight tolerances are critical. Precision-grade glass supports manufacturing of high-end telescopes, microscopy equipment, and scientific measurement tools, creating consistent demand. The commercial grade crown glass segment is expected to witness robust growth driven by its adoption in consumer optics such as cameras and eyewear. Specialty grade crown glass is projected to achieve the highest CAGR as niche applications in laser optics, photonics, and defense demand tailored solutions for extreme performance environments.

Geographic Trends

Asia Pacific led the crown glass market in 2024 and is projected to register the highest CAGR through 2033. Rapid advances in electronics, automotive manufacturing, and photonics in countries like China, Japan, and South Korea support robust demand. The region also benefits from cost-competitive production, strong R&D capacity, and expanding optics and photonics sectors. North America is an important regional market driven by healthcare and defense procurement as well as sustained innovation in optoelectronics and scientific research tools. Europe retains significant market share supported by a strong optical component manufacturing base and sustained demand from premium automotive and aerospace industries in Germany, France, and the United Kingdom. Latin America and the Middle East & Africa are poised for moderate growth as regional investments in healthcare, telecommunications, and defense capabilities gradually enhance demand for advanced glass materials.

Competitive Trends

The competitive landscape of the crown glass market features a diverse mix of global manufacturers and specialized regional players that leverage continuous innovation in glass formulations and finishing technologies. Leading companies such as Alkor Technologies, Architectural Glass, CLZ Optical, Crystran, Edmund Optics, Esco Optics, HOYA Corporation, Newport Corporation, Ohara, Otto Chemie, SCHOTT AG, Shanghai Optics, SUMITA OPTICAL GLASS, Sydor Optics, UQG Optics, and WTS Photonics maintain competitive advantages through extensive product ranges, stringent quality standards, and collaborative partnerships with optical equipment makers and research institutions. Market leaders focus on sustainability, supply chain optimization, and expanding service networks to support long-term customer relationships. Going forward, competitive success will hinge on precision engineering, product customization, process automation, and the capacity to meet diverse technical requirements across end-user industries such as healthcare, automotive, and defense.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Crown Glass market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Crown Glass Type

| |

Grade

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report