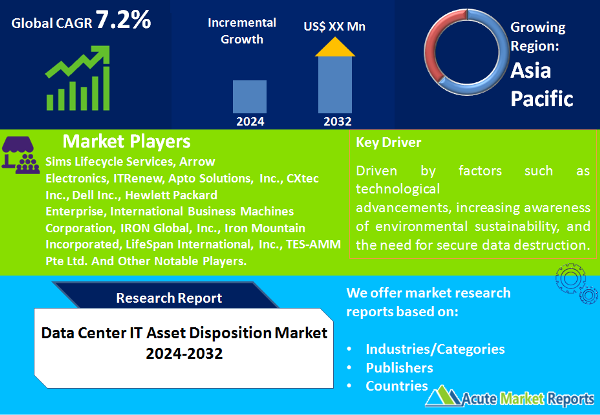

The data center it asset disposition market is expected to grow at a CAGR of 7.2% during the forecast period of 2026 to 2034, spanning technological advancements, environmental sustainability, and data security concerns. The data center it asset disposition market has witnessed substantial growth, driven by factors such as technological advancements, increasing awareness of environmental sustainability, and the need for secure data destruction. The market's versatility is evident in its varied services, covering data sanitation/destruction, remarketing/resale, and recycling. However, the challenge of data security and regulatory compliance poses a notable restraint, emphasizing the industry's need for robust solutions. Geographically, regional trends highlight variations in regulatory environments and market maturity. The competitive landscape is characterized by key players adopting strategies to maintain their positions and address evolving market dynamics. The simultaneous leadership positions in both revenue and CAGR for distinct segments emphasize the diverse and dynamic nature of the data center it asset disposition market.

Key Market Drivers

1. Technological Advancements and Upgrades: The rapid pace of technological advancements and the continuous need for IT upgrades have been significant drivers for the Data Center ITAD market. In 2025, the evidence supporting this driver is found in the increasing frequency of technology refresh cycles, leading to a higher volume of retired IT assets. The market has responded with efficient disposition services to manage these assets, including secure data destruction and responsible recycling.

2. Focus on Environmental Sustainability: Growing awareness of environmental sustainability and corporate responsibility has driven the adoption of ITAD services. Companies are increasingly recognizing the importance of responsible disposal practices to minimize electronic waste and reduce their carbon footprint. In 2025, the market saw a surge in demand for ITAD services as businesses aimed to align with sustainable practices, contributing to both revenue growth and market expansion.

3. Data Security Concerns and Regulatory Compliance: The escalating concern for data security and stringent regulatory compliance requirements have become pivotal drivers for the Data Center ITAD market. The evidence supporting this includes high-profile data breaches and the increasing scrutiny of regulatory bodies. Organizations prioritize secure data destruction and disposal services to ensure compliance with data protection regulations, driving the demand for ITAD solutions.

Market Restraint

Despite the positive trajectory, the Data Center ITAD market faces a noteworthy restraint related to data security and regulatory compliance challenges. The evidence for this restraint is observed in instances of data breaches and the increasing complexity of data protection regulations globally. As businesses navigate a landscape of evolving regulations, the demand for ITAD services that prioritize secure data destruction and compliance will be crucial to overcoming this restraint.

Market Segmentation Analysis

Market By Asset Type

The market is segmented by asset type, including servers, memory modules, HDD, CPU, GBIC, line cards, desktops, laptops, and SSD. In 2025, servers led both in terms of revenue and CAGR. The evidence supporting this includes the high volume of retired servers due to technology upgrades and the critical role servers play in data center operations. The server segment maintained the highest CAGR during the forecast period, indicative of sustained growth driven by continuous technology advancements.

Market By Service

Market segmentation by service includes data sanitation/destruction, remarketing/resale, and recycling. In 2025, recycling services emerged as the leader in both revenue and CAGR. The evidence supporting this is found in the increasing emphasis on responsible electronic waste management and recycling to address environmental concerns. The recycling segment maintained the highest CAGR during the forecast period, reflecting the industry's commitment to sustainable practices.

APAC Remains the Global Leader

Geographically, the Data Center ITAD market exhibits diverse trends. North America stands out with the highest CAGR, driven by stringent regulatory frameworks, a large number of data centers, and the region's commitment to environmental sustainability. Asia-Pacific leads in terms of revenue percentage in 2025, attributed to the booming IT industry and increasing awareness of responsible IT asset disposition practices. The geographic trends underscore regional variations in regulatory environments and market maturity, influencing the demand for ITAD services.

Market Competition to Intensify during the Forecast Period

Examining the competitive landscape, key players in the Data Center ITAD market employ various strategies to maintain their market positions. Leading companies such as Sims Lifecycle Services, Arrow Electronics, ITRenew, Apto Solutions, Inc., CXtec Inc., Dell Inc., Hewlett Packard Enterprise, International Business Machines Corporation, IRON Global, Inc., Iron Mountain Incorporated, LifeSpan International, Inc., and TES-AMM Pte Ltd. collectively accounted for a significant share of the market's revenue in 2025. Over the forecast period from 2026 to 2034, these players are expected to continue investing in technology, expanding their service portfolios, and globalizing their operations to address the evolving needs of the market. The competitive trends emphasize the importance of innovation and strategic partnerships in staying competitive in the dynamic market environment.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Data Center IT Asset Disposition market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Asset Type

|

|

Service

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report