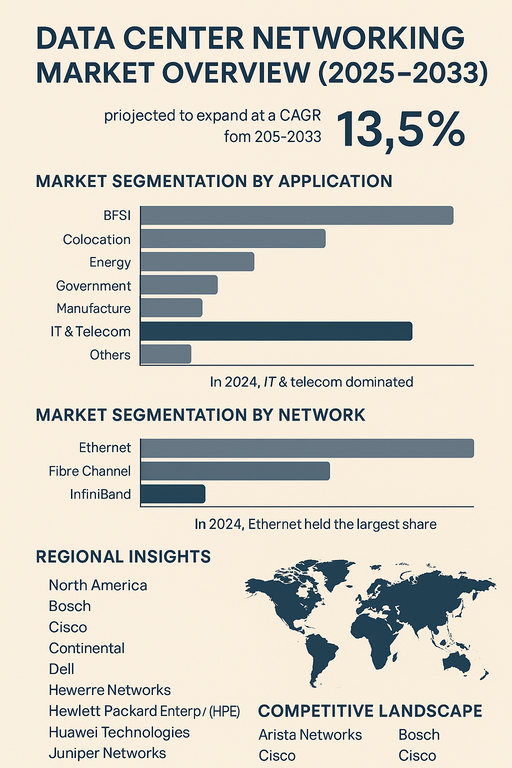

The global data center networking market is projected to expand at a CAGR of 13.5% from 2025 to 2033, driven by the exponential growth of cloud services, increasing data traffic, and digital transformation initiatives across industries. Data center networking solutions are essential for ensuring high-speed connectivity, low-latency performance, and secure data handling in large-scale IT environments. Rising adoption of virtualization, edge computing, and AI-driven analytics is further propelling demand for next-generation networking architectures.

Rising Data Volumes and Cloud Adoption Fueling Growth

The rapid increase in global data generation, fueled by streaming services, IoT, and enterprise digitalization, is boosting investment in advanced networking solutions. Ethernet, Fibre Channel, and InfiniBand technologies are evolving to support high-performance computing (HPC) workloads, storage networking, and scalable data-intensive applications. BFSI, IT & telecom, and colocation service providers are leading adopters, while healthcare and government sectors are embracing secure and resilient data networks for critical operations. Strategic initiatives by hyperscale cloud providers and colocation operators are further driving market penetration.

Challenges: High Deployment Costs and Network Complexity

Despite robust growth drivers, the market faces challenges such as high capital expenditures for network equipment, integration complexity in hybrid environments, and cybersecurity risks associated with expanding data flows. Limited interoperability across vendors and the need for continuous upgrades to meet evolving standards add to the challenges. However, trends such as software-defined networking (SDN), automation, and intent-based networking are reducing operational complexity and improving efficiency, positioning the market for sustained growth.

Market Segmentation by Application

By application, the market is segmented into BFSI, colocation, energy, government, healthcare, manufacturing, IT & telecom, and others. In 2024, IT & telecom dominated, supported by data-heavy applications, cloud computing, and 5G infrastructure deployments. Colocation services are expanding rapidly as enterprises shift to hybrid IT models. BFSI and healthcare sectors are growing steadily with investments in secure and compliant data networks, while manufacturing and energy verticals are adopting networking solutions to support Industry 4.0 and smart grid initiatives.

Market Segmentation by Network

By network type, the market includes Ethernet, Fibre Channel, and InfiniBand. Ethernet remains the most widely deployed technology due to its scalability, cost-effectiveness, and ability to support diverse workloads. Fibre Channel continues to hold a significant share in storage area networking for enterprises requiring high reliability. InfiniBand is growing strongly in high-performance computing (HPC) environments, favored for its low-latency and high-bandwidth capabilities critical in AI, scientific research, and advanced analytics.

Regional Insights

In 2024, North America led the market, fueled by hyperscale cloud providers, rapid enterprise digitalization, and robust investments in next-generation data centers. Europe followed with strong adoption in BFSI, government, and colocation services, particularly in Germany, the UK, and the Nordics. Asia Pacific is the fastest-growing region, with China, India, and Southeast Asia experiencing a surge in cloud adoption, digital transformation, and government-backed smart city projects. Latin America and Middle East & Africa (MEA) are emerging markets, where growing internet penetration and investments in new data centers are creating significant opportunities despite infrastructure challenges.

Competitive Landscape

The 2024 market was characterized by strong competition among global networking and IT leaders. Cisco, Arista Networks, and Juniper Networks led with comprehensive switching, routing, and SDN portfolios. Hewlett Packard Enterprise (HPE), Dell, and Huawei Technologies strengthened positions with integrated networking and server solutions. Extreme Networks focused on software-driven networking and edge deployments. Industrial players such as Bosch, Continental, and ZF Friedrichshafen contributed with networking applications in connected manufacturing and smart mobility. Competitive differentiation is driven by performance, scalability, energy efficiency, automation, and seamless integration with cloud and edge infrastructure.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Data Center Networking market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Component

| |

Application

| |

Network

| |

Organization Size

| |

Data Center

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report