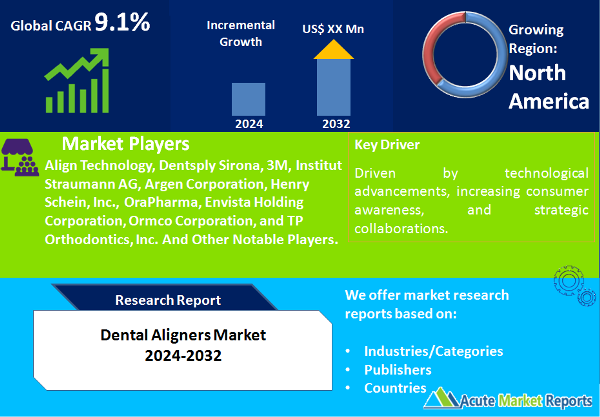

The dental aligners market is expected to grow at a CAGR of 9.1% during the forecast period of 2026 to 2034, driven by several key factors that shape its competitive landscape. The dental aligners market is poised for continued growth, driven by technological advancements, increasing consumer awareness, and strategic collaborations. While challenges related to affordability and accessibility persist, market players are actively addressing these issues. The segmentation analysis highlights the dominance of clear aligners and the evolving preferences in material choices. Leading players such as Align Technology, Dentsply Sirona, and 3M dominate the market, leveraging innovation and strategic partnerships to maintain their positions. Emerging companies are also entering the market, particularly in regions with high growth potential, focusing on cost-effective solutions to address accessibility challenges. Strategic collaborations between technology providers and healthcare institutions are a notable trend, aiming to enhance patient care through the synergy of technological expertise and clinical knowledge.

Innovative Technological Advancements

The dental aligners market is propelled by continuous innovations in technology, with key players like Align Technology investing significantly in research and development. Advancements such as 3D printing technology for custom aligners and digital treatment planning have revolutionized the orthodontic landscape, providing more precise and personalized solutions. This technological edge has allowed companies to gain a competitive advantage, meeting the evolving demands of both orthodontists and patients.

Increasing Consumer Awareness and Demand for Aesthetic Dentistry

Consumer awareness regarding the benefits of orthodontic treatment and a growing demand for aesthetically pleasing dental solutions are driving the dental aligners market. Patients are increasingly opting for clear aligners over traditional braces due to their cosmetic appeal and comfort. This shift in consumer preferences is contributing to the market's growth, with companies like Dentsply Sirona capitalizing on the rising demand for clear aligners.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations between dental aligner manufacturers and healthcare providers are becoming integral to market growth. Established players are actively engaging with dental clinics and orthodontic practices to implement aligner technology effectively. These partnerships aim to combine technological expertise with clinical insights, ultimately improving the overall patient experience and treatment outcomes. Such collaborations have become a key trend, shaping the competitive dynamics of the dental aligners market.

Affordability and Accessibility Challenges

While the dental aligners market is experiencing growth, affordability and accessibility remain significant challenges. The high cost of orthodontic treatment with aligners can limit their adoption, especially in emerging economies. Addressing these challenges is crucial for market expansion. Emerging companies are focusing on developing cost-effective solutions, but widespread accessibility issues still pose a restraint to the market's full potential.

Market Analysis by Product Segmentation: Clear Aligners Dominate the Market

In the product segmentation of the dental aligners market, two key categories stand out: braces and clear aligners. In 2025, clear aligners emerged as the highest revenue-generating product, driven by the increasing preference for aesthetic solutions. During the forecast period from 2026 to 2034, clear aligners are expected to exhibit the highest compound annual growth rate (CAGR), indicating sustained market demand for this product category.

Market Analysis by Material: Polyurethane Plastic Dominate the Market

The market's material segmentation includes metal, polyurethane plastic, polyethylene terephthalate glycol, acrylic resin, and other materials. In 2025, polyurethane plastic and acrylic resin accounted for the highest revenues, reflecting their widespread use. However, during the forecast period from 2026 to 2034, polyethylene terephthalate glycol is expected to exhibit the highest CAGR, indicating a shift in material preferences.

North America Dominates in Terms of Revenues, While APAC Leads in Terms of Growth

Geographically, the dental aligners market exhibits diverse trends, with varying CAGR and revenue percentages across different regions. In the forecast period from 2026 to 2034, Asia-Pacific is expected to experience the fastest growth in terms of CAGR, driven by a burgeoning population, increasing disposable income, and a growing emphasis on oral aesthetics in countries like China and India. Meanwhile, North America is anticipated to maintain its position as the highest revenue-generating region, owing to a well-established healthcare infrastructure, high awareness about orthodontic treatments, and a significant market presence of key players. This geographical analysis underscores the dynamic nature of the dental aligners market and the unique factors influencing growth and revenue in different regions

Market Competition to Intensify during the Forecast Period

The dental aligners market's competitive landscape is characterized by the presence of key players, including Align Technology, Dentsply Sirona, 3M, Institut Straumann AG, Argen Corporation, Henry Schein, Inc., OraPharma, Envista Holding Corporation, Ormco Corporation, and TP Orthodontics, Inc. These companies are expected to continue their dominance in 2025 and throughout the forecast period from 2026 to 2034. Align Technology's focus on technological innovation, Dentsply Sirona's strategic collaborations, and 3M's market presence contribute to their strong positions. The overall outlook suggests a competitive market where companies are likely to leverage their strengths to maintain or enhance their market shares.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Dental Aligners market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Material

|

|

Age Group

|

|

End-User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report