Industry Outlook

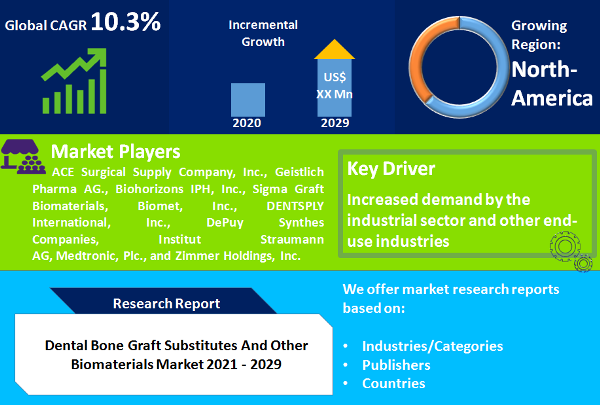

The dental bone graft substitute and other biomaterials market is set to reach US$ 2,337.8 Mn by 2030 from US$ 969.0 Mn in 2021 highlighting impressive growth at a compounded annual growth rate (CAGR) of 10.3% during the forecast period from 2022 to 2030. As per the statistics provided by the Global Burden of Disease Study (GBD) periodontitis is considered as the sixth most prevalent disease worldwide affecting approximately 743 million people worldwide. The global prevalence rate of periodontitis is 11.2%, factors responsible for the disease etiology are chewing of tobacco & betel nuts, craving for sugar candies and poor oral hygiene.

Bone grafts are commonly used in dental implants to restore edentulous area of missing teeth. They are frequently used to repair fractured jawbone and promote dental bone healing. Since 2015, USFDA has restricted the use of dental bone grafts and other biomaterials in patients below 18 years of age. Changing regulatory norms are a setback to the dental bone graft substitutes market.

"Excellent osteoconduction and osteoinduction properties makes allograft the most desired dental bone graft"

Allograft are usually taken from cadavers that have donated their bones and it is sourced from a bone bank. Due to their excellent osteoconduction and osteoinduction properties they are frequently used in reconstructive dental procedures as structural and particulate graft. The sterilization of allografts is a very critical procedures as incidence have been reported for a possible risk of disease transmission or reaction. Xenografts are obtained from non-human species such as bovine and corals sources which finds prominence in dental surgeries as calcified matrix. Ceramic material will be a trendsetter throughout the forecast period on account of its enhanced osteointegrative properties. It can be used alone or in combination with calcium phosphate and bioactive glass to give structural base for dental implants to the jawbones deformed due to severe atrophy.

"Increasing number of dental surgeries performed will propel the dental bone graft substitutes and other biomaterials market growth in North America"

North America is currently leading the regional segment. The key factors responsible for the dominance of North America are increasing number of dental surgeries performed and rising geriatric population with jawbone deformities. Healthcare insurers have started providing favorable reimbursement to its customer opting dental bone graft surgical procedures. In Europe the dental bone grafts market is driven by domicile of major players such as DENTSPLY International, Inc., Institut Straumann AG, Geistlich Pharma AG etc. Supportive regulatory scenario provided by European Medical Agency (EMA) in expediting product approval results in positive traction for the dental bone grafts market. Asia Pacific serves as an attractive destination for the business expansion of dental bone graft substitutes and other biomaterials by establishing subsidiaries and retail outlets for key players. Increasing number of patients suffering with oral health issues such as eroded crown and jawbone atrophy due to chewing of tobacco and betel nuts. Rampant growth in medical tourism due to affordable dental surgical procedures have a positive impact on the dental bone graft substitutes and other biomaterials market in Asia Pacific.

Market assessment was thoroughly studied to understand the organic and inorganic market growth strategies applied by key players manufacturing bone graft substitutes and other biomaterials. Existing competition among key players is mapped under the competitive landscape segment. Diverse range of dental bone graft substitutes are covered in the product portfolio segment. Archrivals competing in the market are ACE Surgical Supply Company, Inc., Geistlich Pharma AG., Biohorizons IPH, Inc., Sigma Graft Biomaterials, Biomet, Inc., DENTSPLY International, Inc., DePuy Synthes Companies, Institut Straumann AG, Medtronic, Plc., and Zimmer Holdings, Inc.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Dental Bone Graft Substitutes And Other Biomaterials market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Raw Material

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report