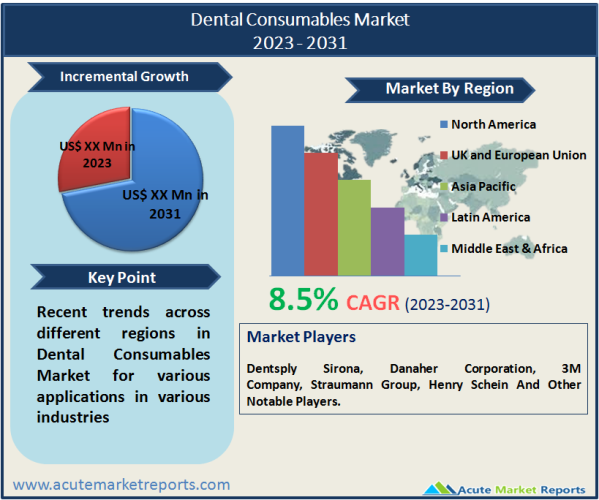

The dental consumables market refers to the sector that encompasses various dental products and materials used in dental procedures. These consumables are an integral part of dental practices and contribute to the overall revenue of the dental industry. The market is expected to witness a CAGR of 8.5% during the forecast period of 2026 to 2034, influenced by factors such as the growing prevalence of dental diseases, increasing dental awareness, advancements in dental technology, and the rise in cosmetic dentistry procedures. The prevalence of dental disorders such as dental caries, periodontal diseases, and tooth loss is on the rise globally. This has created a demand for dental consumables, including dental restorative materials, orthodontic products, and prosthetics. As dental disorders continue to affect a significant portion of the population, the need for dental consumables is expected to grow.There has been a growing awareness of the importance of dental health and aesthetics among individuals. Increasing focus on oral hygiene, dental care, and cosmetic dentistry has led to an increased demand for dental consumables such as teeth whitening products, dental implants, and aesthetic restorative materials. The desire for a bright smile and improved dental appearance has contributed to the growth of the dental consumables market. The dental industry has witnessed significant technological advancements in recent years. These advancements have led to the development of innovative dental consumables that offer improved performance, durability, and aesthetics. For example, the introduction of digital dentistry has revolutionized the fabrication of dental restorations, leading to increased accuracy and efficiency. The adoption of advanced technologies in dental practices drives the demand for corresponding consumables.

Increasing Prevalence of Dental Disorders

The rising prevalence of dental disorders is a significant driver of the dental consumables market. Dental disorders such as dental caries, periodontal diseases, and tooth loss affect a large portion of the global population. According to the Global Burden of Disease Study, oral diseases affected around 3.58 billion people worldwide in 2017. This high prevalence creates a demand for dental consumables, including restorative materials, dental implants, and orthodontic products. Numerous epidemiological studies have reported the high prevalence of dental disorders. For example, a study published in the Journal of Dental Research estimated that dental caries affected 2.3 billion people worldwide in 2017. Another study in the Journal of Periodontology found that severe periodontitis affected approximately 743 million individuals globally in 2017. These findings indicate the widespread occurrence of dental disorders, driving the demand for dental consumables.

Growing Dental Awareness and Aesthetic Dentistry

Increasing dental awareness and the growing emphasis on dental aesthetics are driving the demand for dental consumables. People are becoming more conscious of the importance of dental health and hygiene. Additionally, there is a rising demand for aesthetic dental procedures, including teeth whitening, veneers, and cosmetic restorations. These procedures require the use of dental consumables such as teeth whitening products, dental adhesives, and aesthetic restorative materials. The American Academy of Cosmetic Dentistry reported that 86% of patients undergoing cosmetic dentistry procedures were driven by the desire for an improved physical appearance. The increasing popularity of smile makeover shows and the prevalence of social media platforms further indicate the growing interest in dental aesthetics. These factors contribute to the demand for dental consumables related to aesthetic dentistry.

Technological Advancements in Dentistry

Technological advancements in the field of dentistry have played a significant role in driving the dental consumables market. Innovations in dental materials, imaging techniques, and digital dentistry have improved the quality and efficiency of dental procedures. Advanced technologies such as CAD/CAM systems, intraoral scanners, and 3D printing have transformed the fabrication process for dental restorations, leading to improved accuracy, aesthetics, and patient comfort. Research studies and clinical trials demonstrate the impact of technological advancements on dental practice. For instance, a study published in the Journal of Prosthetic Dentistry compared the fit of CAD/CAM-fabricated crowns to conventionally fabricated crowns, revealing superior fit and marginal adaptation for CAD/CAM restorations. Another study in the Journal of Clinical Orthodontics evaluated the accuracy and efficiency of intraoral scanners in orthodontic diagnosis and treatment planning, highlighting their significant benefits. These advancements contribute to the adoption of dental consumables associated with new technologies.

Lack of Dental Insurance Coverage and Affordability

One major restraint in the dental consumables market is the lack of dental insurance coverage and the affordability of dental treatments. Dental treatments can be expensive, especially for individuals without insurance coverage or those residing in regions with limited access to affordable dental care. The cost of dental consumables, such as dental implants, orthodontic braces, and high-quality restorative materials, adds to the financial burden for patients seeking dental treatment. According to the Centers for Disease Control and Prevention (CDC), in the United States, 26.4% of adults aged 18-64 did not have dental insurance coverage in 2019. The lack of insurance coverage often leads to delayed or avoided dental care due to cost concerns. A study published in the Journal of Dental Research found that cost was a significant barrier to accessing dental care for individuals without insurance. Another study in the Journal of Public Health Dentistry reported that patients with dental insurance were more likely to receive preventive dental services compared to those without insurance. The affordability of dental treatments is also a concern globally. The World Health Organization (WHO) states that dental care costs are a significant barrier in low-income countries, leading to limited access to essential dental services. A study published in the Journal of Oral Health and Dental Management reported that dental care expenses accounted for a significant portion of out-of-pocket healthcare expenditures in many countries, highlighting the financial burden on individuals seeking dental treatment.

Ceramic Materials Dominate the Product Segment

The dental consumables market can be categorized into two main product segments: dental restoration products and dental restoration materials. Ceramic materials held a significant share in terms of revenue in 2025, in the dental restoration materials segment. Ceramic restorations, such as porcelain veneers and ceramic crowns, are highly valued for their excellent aesthetics and biocompatibility. The demand for ceramic materials is driven by the rising demand for cosmetic dentistry and the increasing focus on esthetic outcomes. The global ceramic dental material market is projected to witness substantial growth due to the growing adoption of ceramic restorations. Dental implants are expected to exhibit the highest CAGR during the forecast period of 2026 to 2034, in the dental restoration products segment. Dental implants provide a long-lasting and natural-looking solution for tooth replacement. According to a study published in the Journal of Dental Research, the global dental implant market is projected to experience significant growth due to the rising geriatric population and increasing awareness of dental aesthetics.

Fixed Braces Dominates the Market by Components

The orthodontics segment is a significant component of the dental consumables market, comprising clear aligners/removable braces and fixed braces. Fixed braces held the highest revenue share in the orthodontics segment in 2025. Their widespread usage, established treatment efficacy, and relatively lower cost compared to clear aligners contribute to their high revenue generation. Fixed braces are commonly used in orthodontic practices and cater to a broad patient base, including children, adolescents, and adults. Clear aligners/removable braces are expected to exhibit the highest CAGR in the orthodontics segment during the forecast period of 2026 to 2034. The growing demand for aesthetic orthodontic treatments and the increasing adoption of digital dentistry technologies contribute to the market's growth. Clear aligners offer improved patient comfort, reduced treatment duration, and enhanced aesthetics compared to traditional braces.

North America Remains as the Global Leader

North America held a significant revenue share in 2025, due to the well-established dental infrastructure, high awareness about oral health, and favorable reimbursement policies. However, emerging markets in Asia-Pacific, such as China and India, are experiencing rapid growth in dental consumables due to improving healthcare infrastructure, rising disposable incomes, and increasing dental tourism. Asia-Pacific is expected to exhibit the highest CAGR during the forecast period of 2026 to 2034 in the dental consumables market. The region's large population, increasing dental awareness, and rising disposable incomes are key factors driving market growth. Moreover, the dental tourism industry in countries like India and Thailand is attracting patients from other regions seeking cost-effective dental treatments, further contributing to the market's expansion.

Market Competition to Intensify during the Forecast Period

The dental consumables market is highly competitive, with several key players vying for market share. These companies employ various strategies to maintain their competitive edge and drive growth in the market. Some of the top players in the dental consumables market includeDentsply Sirona, Danaher Corporation, GlaxoSmithkline Plc., Henry Schein, Inc., Hu-Friedy MFG Co., Ivoclar Vivadent AG., 3M Company, Nakanishi, Inc., Straumann Group, Patterson Companies, Inc., Ultradent Products, Inc., Young Innovations, Inc., among others. These companies focus on product innovation and development to meet the evolving needs of dental professionals and patients. They invest heavily in research and development activities to introduce advanced dental consumables that offer improved performance, durability, and aesthetics. Additionally, strategic collaborations and partnerships with dental institutions and research organizations help them gain access to advanced technologies and expand their product portfolio. Market players also emphasize expanding their geographic presence by establishing distribution networks in emerging markets. They leverage opportunities in regions with a growing dental industry, such as Asia-Pacific and Latin America, to increase their customer base and revenue. Furthermore, mergers and acquisitions are common strategies adopted by these companies to enhance their market position and expand their product offerings. Such strategic alliances allow companies to combine their expertise and resources, accelerate product development, and leverage their brand reputation.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Dental Consumables market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Orthodontics

|

|

Periodontics

|

|

Infection Control

|

|

Whitening Products

|

|

Finishing & Polishing Products

|

|

Other Dental Consumables

|

|

End User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report