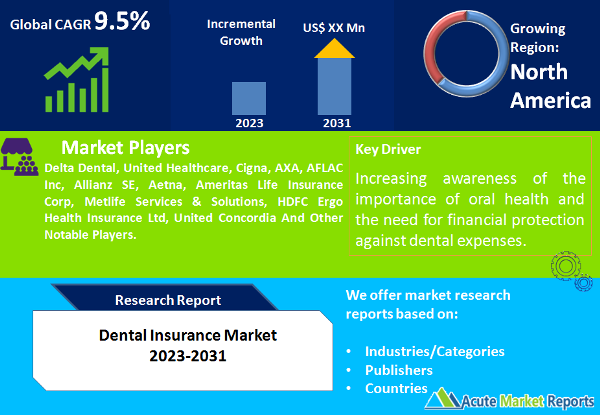

The dental insurance market plays a crucial role in ensuring access to dental care for individuals and families. The dental insurance market is expected to grow at a CAGR of 9.5% during the forecast period of 2026 to 2034, driven by the increasing awareness of the importance of oral health and the need for financial protection against dental expenses. In summary, the Dental Insurance Market is poised for continued growth, driven by growing awareness of oral health, expanding coverage options, and the increasing dental care needs of the aging population. Limited coverage in certain regions remains a restraint. Market segmentation by coverage and type, along with geographic trends, further shape the industry's dynamics. Key players are expected to maintain their competitive edge through innovation and customer-centric strategies, with revenues projected to rise from 2026 to 2034. Looking ahead to the period from 2026 to 2034, the market is expected to continue evolving with changes in coverage options and geographic expansion.

Growing Awareness of Oral Health

In 2025, the Dental Insurance Market experienced significant growth due to the growing awareness of the importance of oral health. More individuals and families recognized the need for regular dental check-ups and treatments. Dental insurance provided a cost-effective way to access these services, contributing to the market's expansion. This trend is expected to continue from 2026 to 2034 as dental health remains a priority for many.

Expanding Coverage Options

The market was also driven by expanding coverage options and flexibility in dental insurance plans. Insurers introduced innovative plans, including Dental Preferred Provider Organizations (DPPO), Dental Health Maintenance Organizations (DHMO), Dental Indemnity Plans, and others. These options allowed individuals to choose plans that best suited their needs and budget, leading to increased enrollments. The demand for diverse coverage options is expected to contribute to a high CAGR during the forecast period.

Aging Population and Dental Care Needs

Another significant driver was the aging population and their increasing dental care needs. As people age, the demand for dental services, such as dentures, implants, and complex procedures, tends to rise. Dental insurance plans that cater to these specific needs gained popularity in 2025 and are anticipated to exhibit a high CAGR from 2026 to 2034.

Restraint in the Dental Insurance Market

Despite its growth, the Dental Insurance Market faces a restraint related to limited coverage in certain regions. In 2025, some areas struggled to provide comprehensive dental insurance coverage to their populations due to regulatory constraints or limited availability of dental care providers. It is expected that addressing these coverage limitations will continue to be a restraint from 2026 to 2034, necessitating efforts to expand access to dental insurance.

Market Segmentation by Coverage: DHMO Plans Dominate the Market

The Dental Insurance Market can be segmented by coverage into several categories, including Dental Preferred Provider Organizations (DPPO), Dental Health Maintenance Organizations (DHMO), Dental Indemnity Plans, and others. In 2025, the highest revenue was attributed to DHMO plans, which are known for their cost-effective coverage. However, during the forecast period from 2026 to 2034, Dental Indemnity Plans are expected to exhibit the highest CAGR. These plans offer greater flexibility and coverage for various dental procedures, making them an attractive choice for many consumers.

Market Segmentation by Type: Major Dental Services Dominate the Market

Another crucial segmentation factor is the type of dental services covered by insurance, which can be divided into Major, Basic, and Preventive. In 2025, the highest revenue came from Major dental services, as they encompass complex and costly procedures. However, during the forecast period from 2026 to 2034, Preventive dental services are expected to exhibit the highest CAGR. The focus on preventive care has increased as people recognize the benefits of early intervention and maintenance.

North America Remains the Global Leder

Geographically, the Dental Insurance Market exhibits diverse trends. North America recorded the highest revenue percentage in 2025 due to its well-established dental insurance industry and aging population. However, the Asia-Pacific region is expected to have the highest CAGR from 2026 to 2034, as dental awareness and access to insurance coverage continue to grow in emerging markets.

Market Competition to Intensify during the Forecast Period

The Dental Insurance Market is characterized by competition among key players, such as Delta Dental, United Healthcare, Cigna, AXA, AFLAC Inc, Allianz SE, Aetna, Ameritas Life Insurance Corp, Metlife Services & Solutions, HDFC Ergo Health Insurance Ltd and United Concordia. These companies have consistently invested in expanding their coverage options, enhancing customer service, and improving their network of dental care providers. In 2025, they recorded substantial revenues, and it is expected that their strategic investments will continue to yield high returns from 2026 to 2034. Key strategies include tailoring coverage options, improving customer experience, and forming partnerships with dental care providers to ensure a comprehensive network.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Dental Insurance market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Coverage

|

|

Type

|

|

Demographic

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report