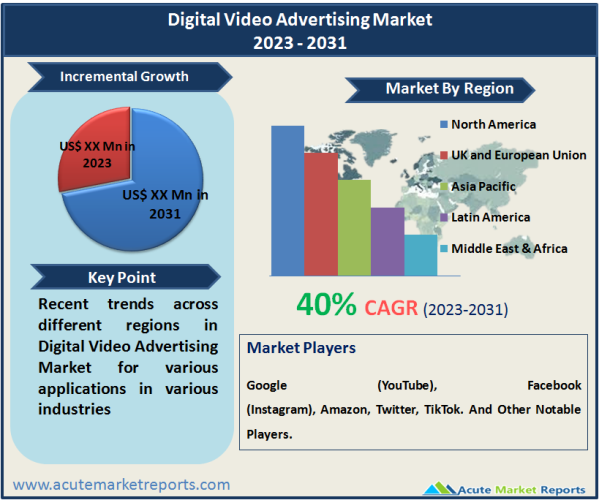

The digital video advertising market is expected to experience a CAGR of 40% during the forecast period of 2026 to 2034, driven by the increasing adoption of digital platforms and the shift in consumer behavior towards online video consumption. Digital video advertising refers to the promotion of products and services through video content delivered via digital channels, including social media platforms, websites, and mobile apps. As people spend more time online, advertisers have recognized the immense potential of digital video advertising in reaching their target audiences effectively. Digital video advertising offers several advantages over traditional advertising methods, including higher engagement rates, better targeting capabilities, and real-time performance tracking. Advertisers can precisely target their desired audience based on demographics, interests, and online behavior, maximizing the impact of their campaigns. Moreover, the ability to measure key performance indicators (KPIs) such as click-through rates, viewability, and conversion rates allows advertisers to optimize their strategies for better results.

Increasing Internet Penetration and Mobile Device Usage

The increasing internet penetration and widespread adoption of mobile devices are significant drivers of the digital video advertising market. With the advent of high-speed internet connectivity, more people have access to digital content, leading to a surge in online video consumption. According to a report by DataReportal, as of January 2022, there were over 4.66 billion internet users globally, with 92% of them accessing the internet via mobile devices. The growing popularity of smartphones and tablets has made digital video content easily accessible to a vast audience, creating a favorable environment for advertisers to leverage video advertising to reach their target customers. The convenience of accessing video content on the go has resulted in increased engagement and viewing time, making digital video advertising an attractive option for brands seeking to capture consumers' attention effectively.

Proliferation of Over-The-Top (OTT) Streaming Services

The proliferation of Over-The-Top (OTT) streaming services is another key driver of the digital video advertising market. OTT platforms, such as Netflix, Amazon Prime Video, and Disney+, have gained immense popularity, offering a vast library of on-demand video content to subscribers. According to a report by Conviva, global streaming time on OTT platforms increased by 44% year-over-year in 2021. Advertisers recognize the massive audience reach of these platforms and are increasingly incorporating digital video advertising into their marketing strategies to tap into this engaged user base. OTT platforms offer ad-supported models, where advertisers can showcase their video ads to viewers during content playback. This provides an opportunity for brands to target a captive audience and deliver their messages effectively, driving the demand for digital video advertising on OTT platforms.

Targeted Advertising and Real-time Analytics

The ability to deliver targeted advertising and access real-time analytics is a significant driver of the digital video advertising market. Digital video platforms and social media channels provide advanced targeting capabilities, allowing advertisers to deliver personalized ads to specific audience segments based on demographics, interests, and online behavior. This targeted approach enhances the relevance of video ads and increases the likelihood of capturing viewers' attention. Additionally, digital video advertising offers real-time analytics, enabling advertisers to track ad performance metrics and make data-driven decisions to optimize their campaigns. According to a survey by eMarketer, 76% of advertisers reported using real-time data to optimize their digital video ad campaigns in 2021. The availability of detailed performance metrics, such as click-through rates and viewability, empowers advertisers to measure the effectiveness of their video ads accurately and make necessary adjustments to improve campaign performance, making digital video advertising an attractive and results-driven advertising option for brands.

Ad-blocking and Ad Avoidance

One significant restraint in the digital video advertising market is the increasing prevalence of ad blocking and ad avoidance among internet users. Ad-blocking refers to the use of software or browser extensions to prevent digital ads from displaying on websites and video platforms, while ad avoidance pertains to users actively skipping or ignoring video ads when given the option. According to a report by GlobalWebIndex, as of Q3 2021, 47% of internet users worldwide were using ad-blockers on their devices. The rising ad-blocking adoption can significantly impact the effectiveness of digital video advertising campaigns, as a considerable portion of the target audience is effectively shielded from viewing ads. Ad-blocking is often driven by factors such as intrusive and disruptive ad formats, concerns about data privacy, and a desire for a smoother and uninterrupted online experience. Moreover, ad avoidance is common among users who find video ads interruptive and irrelevant to their interests, leading them to skip or scroll past the ads. As ad blocking and ad avoidance continue to increase, advertisers face challenges in reaching their target audience effectively, which may impact the overall efficacy and ROI of digital video advertising campaigns. To address this restraint, advertisers are adopting less intrusive and more personalized ad formats, leveraging contextual targeting, and focusing on creating engaging and relevant video content to enhance the viewer's ad experience and encourage better ad receptivity.

Mobile Segment to Lead the Growth during the Forecast Period

The type segment of the digital video advertising market comprises two primary categories: Desktop and Mobile. Among these, the mobile segment is expected to demonstrate the highest CAGR during the forecast period of 2026 to 2034. The rapid proliferation of smartphones and mobile devices has significantly increased mobile internet usage and video consumption. As of 2022, there were approximately 4.32 billion mobile internet users globally, and mobile devices accounted for over half of all internet traffic. Advertisers recognize the immense potential of mobile video advertising in reaching a vast and engaged audience, driving the adoption of video ads on mobile platforms. The Mobile segment benefits from the convenience and portability of mobile devices, enabling users to access video content on the go, thus increasing engagement and ad views. On the other hand, the Desktop segment holds the highest revenue percentage in the Digital Video Advertising market. Desktop devices, including laptops and personal computers, have been a traditional platform for digital video consumption, especially in office and home settings. While mobile usage is on the rise, desktops still attract a significant audience, particularly during working hours and leisure time. Advertisers often allocate higher budgets to desktop video advertising due to the larger screen size and potentially longer viewing times. Additionally, desktop platforms offer advanced targeting capabilities and deliver a more immersive ad experience, contributing to higher conversion rates and ad revenues.

Automotive Sector to Lead the Growth of the Market by Vertical Segment

The industry vertical segment of the digital video advertising market encompasses various sectors, including Retail, Automotive, Financial Services, Telecom, Consumer Goods & Electronics, Media & Entertainment, and Others. Among these, the highest CAGR during the forecast period of 2026 to 2034, is expected to be from the Automotive sector. The Automotive industry has embraced digital video advertising as an effective means to showcase new car models, promote special offers, and create brand awareness. As consumers increasingly turn to digital platforms for research and decision-making during their car-buying journey, advertisers have recognized the potential of video ads in influencing purchase decisions and engaging with the audience. The use of immersive and interactive video formats allows automotive brands to present their products in a visually appealing and informative manner, driving interest and consideration among potential buyers. In terms of highest revenue, the Retail sector dominates the Digital Video Advertising market. Retailers leverage video advertising to promote their products, launch sales campaigns, and enhance their online presence. According to eMarketer, the retail industry accounted for the largest share of digital video ad spending in 2021, indicating the industry's heavy investment in video ads. The Retail sector benefits from a diverse audience and a wide range of product categories, creating opportunities for advertisers to tailor video ads to specific consumer segments and preferences. Moreover, the rise of e-commerce and mobile shopping has further boosted the demand for video advertising in the Retail sector, as retailers seek to capture the attention of online shoppers and drive website traffic.

North America remains as the Global Leader

North America and Asia-Pacific are two key regions that play a significant role in the digital video advertising landscape. North America has held the highest revenue percentage in the market in 2025, primarily driven by the United States' robust digital advertising industry. The region benefits from advanced digital infrastructure, high internet penetration, and a large population of digital-savvy consumers. According to eMarketer, the United States accounted for the largest share of digital ad spending worldwide, with video ads being a significant component of this spending. On the other hand, the Asia-Pacific region demonstrates the highest CAGR in the Digital Video Advertising market during the forecast period of 2026 to 2034. The region's rapid economic growth, coupled with increasing internet adoption and mobile device usage, has led to a surge in online video consumption. Countries such as China, India, and Japan are among the key contributors to the region's digital video ad growth. According to a report by Statista, China is one of the largest markets for digital video advertising in the Asia-Pacific region, driven by a massive online population and the popularity of video-sharing platforms like Douyin (TikTok). Additionally, India's growing internet user base and the rise of regional content on digital platforms contribute to the increasing demand for video advertising in the country.

Market Competition to Intensify during the Forecast Period

The Digital Video Advertising market is highly competitive, with several top players vying for dominance in the industry. Some of the key players in the market include Google (YouTube), Facebook (Instagram), Amazon, Twitter, and TikTok. These tech giants have established themselves as leading platforms for digital video advertising, leveraging their vast user bases and advanced targeting capabilities to attract advertisers and drive revenue. In the competitive landscape, key players are constantly innovating and enhancing their platforms to offer advertisers more engaging and effective video advertising solutions. They are investing in research and development to improve ad formats, targeting algorithms, and analytics tools to provide advertisers with better insights into campaign performance. For instance, Google's YouTube offers TrueView ads, which allow users to skip ads after five seconds, ensuring that advertisers only pay for engaged views. Facebook's Instagram offers Stories ads, which appear in users' Stories feed, providing an immersive and interactive ad experience. Strategic partnerships and acquisitions are also prevalent among top players in the Digital Video Advertising market. By collaborating with content creators, media companies, and other advertising technology firms, key players enhance their content offerings and reach a broader audience. For example, Amazon's acquisition of Twitch, a live-streaming platform popular among gamers, has expanded its video advertising inventory and allowed advertisers to tap into the gaming community's engaged audience.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Digital Video Advertising market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

|

Digital Video Advertising Market By Type (Desktop, Mobile), By Industry Vertical (Retail, Automotive, Financial Services, Telecom, Consumer Goods & Electronics, Media & Entertainment, Others) - Growth, Share, Opportunities & Competitive Analysis, 2023 - 2031

digital-video-advertising-market |

|

Type

|

|

Industry Vertical

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report