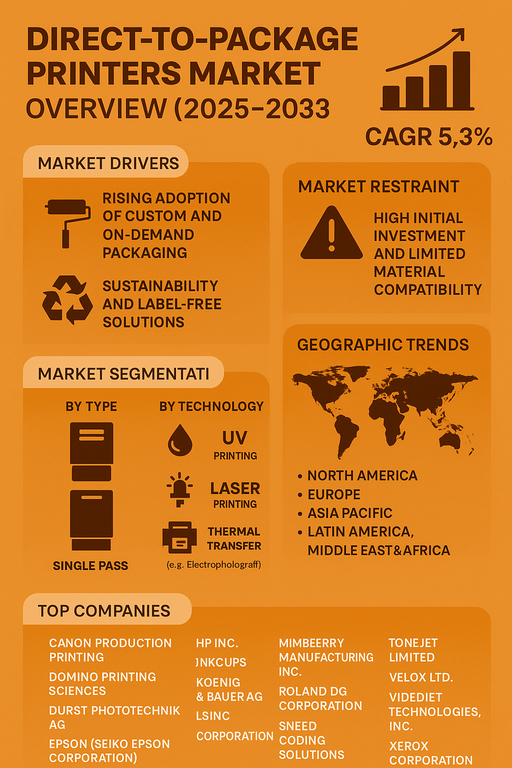

The global direct-to-package printers market is expected to grow at a CAGR of 5.3% from 2025 to 2033, driven by rising demand for cost-effective, short-run packaging, increasing customization needs, and sustainable printing solutions. Direct-to-package (DTP) printing enables printing directly onto containers or packaging surfaces without the need for labels, reducing waste and streamlining production. Brands in FMCG, cosmetics, food & beverage, and pharmaceutical sectors are embracing DTP printers to improve time-to-market, enhance packaging aesthetics, and support variable data printing for better consumer engagement and traceability.

Market Drivers

Rising Adoption of Custom and On-Demand Packaging

Brand owners are increasingly shifting toward personalized and on-demand packaging to meet customer preferences and boost brand loyalty. Direct-to-package printers enable variable data printing, QR code integration, and high-resolution graphics on curved, irregular, and rigid surfaces. This is especially beneficial for seasonal promotions, limited-edition runs, and multilingual compliance packaging. The ability to eliminate labels and streamline post-print workflows gives DTP printers a competitive edge in time-sensitive production cycles.

Sustainability and Label-Free Solutions

With increasing regulatory pressure and corporate sustainability goals, companies are minimizing packaging waste and eliminating secondary materials like adhesive labels. Direct-to-package printing technologies reduce material use and support eco-friendly inks, aligning with circular economy practices. Additionally, eliminating label application equipment leads to cost and energy savings while improving line efficiency.

Market Restraint

High Initial Investment and Limited Material Compatibility

Although DTP printers reduce long-term operational costs, their high upfront investment remains a barrier, especially for SMEs. These printers often require specialized inks and curing technologies, making them expensive to deploy across multiple SKUs or substrates. Limited compatibility with flexible packaging materials and certain curved surfaces restricts application diversity. Integration into legacy production lines also presents technical and training challenges, slowing adoption.

Market Segmentation by Type

The market is segmented into Single Pass and Multi Pass printers. In 2024, single pass printers led the market due to their high-speed printing capabilities suited for high-volume production environments. These systems are preferred by manufacturers in beverage, cosmetics, and pharmaceutical packaging where throughput is critical. Multi pass printers, while slower, offer greater precision and are ideal for applications requiring high-resolution imagery and color depth, including luxury goods and artisanal packaging. Over the forecast period, single pass printers are projected to maintain dominance due to their productivity and continuous improvements in image quality.

Market Segmentation by Technology

By technology, the market is segmented into Inkjet Printing, UV Printing, Laser Printing, Thermal Transfer Printing, and Others (including Electrophotography). In 2024, inkjet printing held the largest share due to its versatility, adaptability to diverse substrates, and minimal setup time. UV printing is rapidly gaining traction for its fast curing, durability, and environmental compatibility. Laser printing remains relevant for serialization and marking in regulatory-focused industries. Electrophotographic and thermal transfer technologies are niche but evolving, particularly in small-scale or specialty applications. Inkjet and UV printing are expected to lead growth during the forecast period.

Geographic Trends

North America held the largest market share in 2024 due to strong adoption in food & beverage, healthcare, and industrial sectors. The region benefits from advanced manufacturing ecosystems and early adoption of digital printing innovations. Europe followed closely, led by Germany, the UK, and Italy, where sustainable packaging regulations and premium brand demands are influencing technology uptake. Asia Pacific is forecasted to grow at the fastest CAGR from 2025 to 2033, with significant contributions from China, Japan, and India. Factors such as the booming e-commerce sector, flexible packaging demand, and rising consumer goods production are driving adoption. Latin America and Middle East & Africa are emerging markets supported by industrial digitization and growing investments in packaging automation.

Competitive Trends

The direct-to-package printers market in 2024 featured a combination of global printing technology leaders and niche DTP innovators. HP Inc., Canon Production Printing, and Epson dominated the inkjet segment with versatile solutions for industrial and commercial packaging. Fujifilm Holdings, Heidelberg (Gallus), and Koenig & Bauer AG offered advanced single-pass systems with automation-ready integration. Videojet, Domino Printing Sciences, and Markem-Imaje focused on coding and marking solutions for serialization and traceability. Mimaki Engineering, Roland DG, and Inkcups catered to high-resolution specialty and promotional packaging. Velox Ltd. and Tonejet Limited introduced proprietary technologies enabling direct digital printing on cans and rigid containers. Key competitive priorities include sustainability-focused ink innovations, line integration flexibility, high-speed color accuracy, and adoption of AI and machine vision for automated quality control.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Direct-to-Package Printers market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Type

| |

Technology

| |

Packaging Type

| |

Printing Process

| |

Automation level

| |

Ink Type

| |

Material/Substrate

| |

Application

| |

End Use Industry

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report