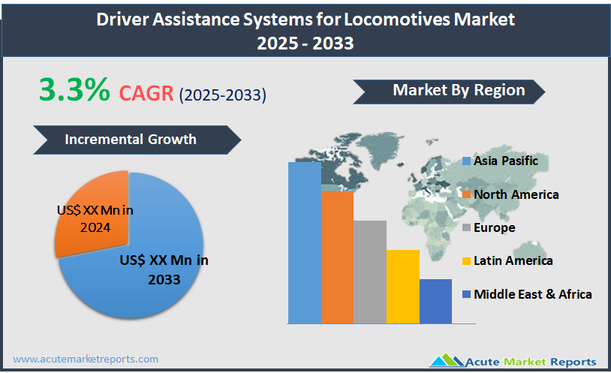

The driver assistance systems for locomotives market involves the development, installation, and use of advanced technological systems designed to enhance the operational efficiency and safety of railway transportation. These systems support locomotive drivers by providing critical information about the train's condition, track status, and external environment, aiding in decision-making processes. Key components include collision avoidance systems, automatic train operation, GPS navigation, and predictive maintenance tools. These systems are part of a broader push towards automation and digitalization in the rail industry, aiming to reduce human error, increase punctuality, and enhance overall service reliability. The global market for driver assistance systems for locomotives is projected to grow at a compound annual growth rate (CAGR) of 3.30%. This growth is driven by the increasing emphasis on rail transport safety and the rising demand for smart transportation solutions amid growing urbanization. Governments and transport authorities worldwide are investing in railway infrastructure and technology to improve service quality and meet environmental targets.

Increasing Focus on Railway Safety and Efficiency

A primary driver propelling the growth of the driver assistance systems for locomotives market is the global emphasis on railway safety and operational efficiency. Railways are under constant scrutiny to ensure safety and reliability while managing an increasing volume of freight and passenger traffic. Driver assistance systems play a crucial role by providing real-time data and analytics, facilitating better decision-making, and preventing accidents through features like collision avoidance and automatic braking. For example, in regions with complex rail networks such as Europe and North Asia, the integration of these systems has been instrumental in reducing human error and enhancing train handling capabilities, directly contributing to lower accident rates and improved punctuality of services.

Integration of AI and IoT in Rail Systems

A significant opportunity within the driver assistance systems for locomotives market lies in the integration of artificial intelligence (AI) and the Internet of Things (IoT). These technologies enable more advanced predictive maintenance and real-time monitoring, enhancing the ability to predict failures before they occur and optimize routes to improve efficiency. The continuous evolution of AI algorithms enhances system capabilities in anomaly detection and decision support, which can lead to more autonomous rail operations. As railways strive to accommodate growing traffic without compromising on service quality, AI and IoT applications in driver assistance systems present a strategic advantage, fostering more sustainable and scalable rail operations.

High Implementation Costs

One major restraint in the market is the high costs associated with implementing advanced driver assistance systems. Installing such systems involves significant upfront investment in both hardware and software, including sensors, cameras, and integrated data platforms. Additionally, retrofitting older locomotives with new technology can be particularly expensive, often requiring extensive modifications to existing systems. This financial burden can be prohibitive for rail operators, especially in developing countries where budget constraints are tighter and the return on investment may be uncertain over the short to medium term.

Complexity in System Integration and Standardization

A key challenge facing the driver assistance systems for locomotives market is the complexity associated with system integration and standardization across different types of railways. Rail systems vary widely in terms of track gauge, signal systems, and operational protocols. Developing and implementing driver assistance technologies that are compatible across these diverse systems while meeting all local regulatory requirements can be daunting. Moreover, ensuring that these technologies seamlessly interact with legacy systems and other digital infrastructure without disrupting existing operations demands a high level of technical expertise and careful planning. As rail operators upgrade their fleets to more digital and connected technologies, maintaining interoperability and standardization becomes increasingly critical, requiring ongoing innovation and collaboration within the industry.

Market Segmentation by Train Type

In the driver assistance systems for locomotives market, segmentation by train type includes Long Distance Trains, Suburban, Trams, Monorails, and Subway/Metro. The Subway/Metro segment accounts for the highest revenue within this market. This prominence is due to the high density of metro systems in major urban centers worldwide, where the safety and efficiency enhancements provided by driver assistance systems are crucial for managing frequent services and high passenger volumes. Additionally, the rapid expansion of metro systems in burgeoning metropolitan areas in Asia and the Middle East contributes significantly to revenue growth. However, the Tram segment is projected to exhibit the highest compound annual growth rate (CAGR) from 2026 to 2034. Trams are becoming increasingly popular in urban transport systems due to their environmental benefits and ability to integrate within cityscapes. The adoption of advanced driver assistance systems in trams is driven by the need to enhance safety in densely populated city centers and improve the integration with traffic systems, which is essential for minimizing accidents and disruptions.

Market Segmentation by Application

Segmentation by application in the driver assistance systems for locomotives market includes Emergency Braking, Automatic Door Open & Closure, Switch Detection, Rail Detection, Fog Pilot Assistance System, Rail Signal Detection, and Anti-collision System. The Anti-collision System segment generates the highest revenue as it is critical for preventing accidents, ensuring the safety of passengers and cargo, and reducing downtime and maintenance costs. These systems are particularly valued in congested rail networks and in regions with high-speed rail services. On the other hand, the Fog Pilot Assistance System is expected to grow at the highest CAGR. This growth is spurred by the increasing need to maintain operational efficiency and safety in adverse weather conditions, which are becoming more unpredictable due to climate change. Fog pilot systems use advanced sensors and navigation technologies to assist drivers when visibility is severely reduced, ensuring the continuity of services without compromising safety.

Geographic Segment

The driver assistance systems for locomotives market demonstrates distinct geographic trends, largely influenced by regional advancements in railway infrastructure and technology adoption. Europe has traditionally dominated the market in terms of revenue due to its extensive and modern rail networks, stringent safety regulations, and early adoption of advanced technologies in railway operations. The region's commitment to sustainability and public transport efficiency continues to drive investments in driver assistance technologies. However, Asia-Pacific is expected to experience the highest compound annual growth rate (CAGR) from 2026 to 2034. This growth is propelled by significant infrastructure developments in countries like China and India, where rapid urbanization and economic growth necessitate efficient and safe rail systems. The expansion of metro and high-speed train projects in these countries, coupled with increasing government initiatives to promote public transport systems as a solution to traffic congestion and pollution, underscores this trend.

Competitive Trends and Top Players

In 2025, the competitive landscape of the driver assistance systems for locomotives market was shaped by major players such as ABB, Alstom S.A., Beijing Traffic Control Technology Co., Ltd., Construcciones y Auxiliar de Ferrocarriles, S.A. (CAF), Hitachi Ltd, Kawasaki Heavy Industries, Ltd., Knorr-Bremse AG, Mitsubishi Electric, Robert Bosch GmbH, SIEMENS AG, Stadler Rail, Thales Group, and Wabtec Corporation. These companies concentrated on enhancing their product offerings through technological innovations, particularly in automation and connectivity solutions. They also focused on strategic partnerships and acquisitions to expand their geographic presence and deepen market penetration, especially in emerging markets. From 2026 to 2034, these companies are expected to increasingly leverage AI and IoT technologies to offer more integrated and smart solutions that enhance the safety and efficiency of rail operations. Investments in digital platforms that enable predictive maintenance, real-time monitoring, and automated control are anticipated to be key strategies. Additionally, as regulatory environments evolve, these players will likely focus on aligning their products with new standards and customer expectations in safety and environmental performance, ensuring their solutions not only enhance operational efficiency but also contribute to broader sustainability goals in the transportation sector.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Driver Assistance Systems for Locomotives market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Train Type

|

|

Application

|

|

Component

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report