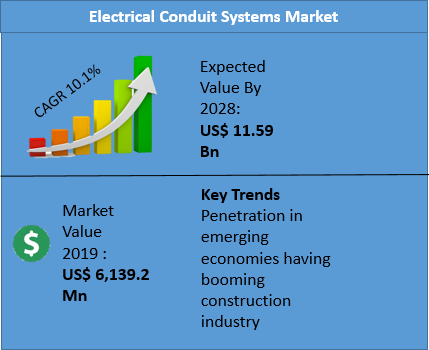

Electrical conduit systems refer to a subset of cable management systems used for protection and routing of electrical wires/cables. These are tubular structures designed to carry wires and cables and are available in rigid as well as flexible forms. Electrical conduit systems are available in both metallic as well as non-metallic materials. The most significant factor fueling the market growth is rising construction industry worldwide. The market is majorly supported by the residential and industrial sectors. Additionally, due to various competitive advantages over traditional wiring methods, conduit systems are increasingly being adopted for wiring installation. Nevertheless, high costs (especially metallic conduit systems) and availability fo substitutes such as cable trays, raceways and cable ladders is are major factors hindering the market growth. The electrical conduit systems market is expected to expand with a CAGR of 10.1% during the forecast period from 2025 to 2033.

As of 2021, the rigid conduit systems segment is dominant in the global market contributing to over two third of the total market revenue. Rigid conduit systems are the oldest types of conduit systems and hence are prominent in most of the electrical installation applications. These conduit systems offer excellent physical protection and can be fabricated using both metallic and non-metallic materials. Rigid conduit systems are largely used in residential and commercial construction applications. Since these end-use industry segments contribute substantial revenue share to the market, the rigid conduit systems segment is expected to retain its dominant position in the market throughout the forecast period.

The flexible conduit systems segment is however, expected to register the highest growth in the market. Flexible conduit systems are manufactured using non-metallic materials such as HDPE, PVC, nylon and PP. Amongst these, PVC and HDPE account for the largest share, in terms of revenue and adoption, in the global market. These conduit systems are majorly used in applications wherein frequent wiring alteration may be required. Flexible conduit systems offer easy installation and can be re-positioned as per the requirement. Thus, these conduit systems find application across almost all of the end-use industry segments. The segment is estimated to expand with a CAGR of 11.6% from 2025 to 2033.

As of 2021, the global electrical conduit systems market is dominated by the residential construction segment. The segment accounted for a market share, in terms of revenue, of over one fourth of the overall market in 2021. PVC conduit systems are the most popular types of conduit systems used in the residential segment. Due to ever-increasing population worldwide, the residential construction is expected to witness steady growth in the coming years. Thus, the segment is estimated to retain its dominant segment throughout the forecast period. The residential segment is followed, in terms of market share, by the industrial and public infrastructure segments.

The industrial manufacturing segment is estimated to witness the highest growth in the coming years. In order to ensure proper physical, as well as environmental protection, galvanized steel and PVC-coated metallic conduit systems, are popularly used in the industrial manufacturing segment. Since these are among the costliest conduit systems, the segment becomes highly profitable for conduit system manufacturers. The industrial manufacturing segment is expected to be majorly supported by the food & beverages, automotive and chemicals manufacturing sectors. Further, apart from industrial manufacturing, oil & gas and commercial segments are expected to register strong growth in the coming years.

Geography Segmentation Analysis

The global electrical conduit systems market is dominated by Asia Pacific region accounting for over one third of the total market revenue, as of 2021. The market in Asia Pacific is mainly governed by countries such as China, India and Japan having strong industrial as well as residential construction sectors. Due to increasing population coupled with the industrial development, the region is expected to retain its dominant position in the market throughout the forecast period. Additionally, due to ongoing public infrastructure in India and some of the Southeast Asia countries, the public infrastructure segment too is expected to witness strong growth.

As a result, Asia Pacific is expected to remain the highest growing market for electrical conduit systems in the coming years. Further, Asia Pacific market is followed by North America region due strong penetration of electrical conduit systems across all of the end-use applications. Conduit systems are costlier in North America as compared to Asia Pacific. Moreover, the market is well organized and consolidated in North America in comparison to Asia Pacific and Rest of the World regions.

Material Segmentation Analysis

The metallic conduit systems segment dominated the global electrical conduit systems market in 2021. The segmented contributed more than fifty percent of the total revenue. The metallic conduit systems segment comprises various materials such as galvanized steel, stainless steel and aluminum among others. Common types of metallic conduit systems include rigid metallic conduit systems (RMC), electrical metallic tubing (EMT), intermediate metallic conduit (IMC), PVC-coated metallic conduit systems and flexible metallic conduit systems. Galvanized steel and stainless steel are among the costliest materials used in conduit systems. These are largely used in the industrial manufacturing, oil & gas and energy & utilities segment to ensure optimum safety. Due to their high cost and superior protection advantages, the segment becomes highly profitable for conduit system manufacturers.

The non-metallic conduit systems segment includes materials such as polyvinyl chloride (PVC), nylon, high density polyethylene (HDPE), polypropylene (PP) and others. These conduit systems offer fairly high physical protection and are resistant to most of the environmental hazards such as chemical reactions, humidity and corrosion. These are among the cheapest and most convenient materials used in conduit systems. Due to their light weight, these conduit systems can be easily transported, handled and offer convenient installation. Hence, these conduit systems help reducing the overall installation cost. Due to these factors non-metallic conduit systems segment is expected to register the highest growth in the coming years.

Electrical conduit system refers to a tubular enclosure used for protecting and routing electrical cables. The entire system comprises tubing and fitting components required for wiring installation. Most of the electrical conduit systems used are rigid due to their high strength over flexible conduit systems. Electrical conduit systems offer excellent protection to the enclosed cables/wires from different external parameters such as moisture, impact and chemical reactions. Also, electrical conduits are capable of carrying large number of cables. Depending upon the number of cables to be routed, electrical conduits with wider diameter are available in market making these preferable over traditional types of wiring systems. The common types of electrical conduit systems are listed below:

The history of electrical conduit systems date back to the early 1900s. Traditionally, fluid pipes and gas pipes were used for wiring installation. Due better protection offered by these tubular enclosures, development of electrical conduits specifically for wiring installation became popular. Steel electrical conduit systems are among the first types of conduits used for wiring installation. With growing adoption of conduit systems in wiring installation, other materials such as galvanized steel, aluminium and coated steel. Due to their high strength and corrosion resistance, galvanized steel has become the most popular material for conduit systems in industrial environments. Further, with increasing penetration of conduit systems coupled with need for cost reduction, the polyvinyl chloride (PVC) became the most preferred material for conduit production. Over the course of time, PVC has become the dominant material, in terms of penetration, in the overall conduit systems market. This is majorly due to their low cost, good strength and resistance to corrosion and chemical reactions. Due to these properties, PVC conduit systems have become the largest used material in residential and commercial construction applications.

With advancement of conduit systems coupled with need for flexible wiring installation, flexible conduit systems were developed. Non-metallic materials such as PVC, nylon, high definition polyethylene (HDPE) are by far the most popular materials used in flexible conduit systems. Flexible conduit systems are used where there is frequent need for wiring alteration and in critical spaces. These conduit systems offer excellent strength and ease of installation especially in the case of underground wiring. Due to these factors, the flexible conduit systems have witnessed strong penetration over the period of time.

Electrical conduit systems are used in various end-use industries such as industrial manufacturing, commercial construction, public infrastructure, residential construction, oil & gas and others. Residential construction segment is by far the largest consumer, in terms of revenue, of the electrical conduit systems. Due to rising population worldwide coupled with the construction industry, the segment is expected to remain the dominant consumer in the coming years. Nevertheless, major concern for the market is availability of large number of substitutes. Major substitutes for electrical conduit systems are cable trays, cable ladders, raceways and others.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Electrical Conduit Systems market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product type

| |

End-use industry

| |

Material

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report