"Electrophysiology Devices Market to Exhibit Healthy Growth during the Forecast Period between 2022 & 2030"

The global electrophysiology devices market accounted for a value of US$ 8,643.1 Mn in 2021 and expected to attain US$ 22,200.9 Mn by 2030. Variables of the market are globally growing older population base coupled with rising prevalence of atrial fibrillation (AF) & cardiovascular diseases (CVDs), technological advancements in electrophysiology devices, and the presence of favorable government initiatives. The elderly population is more prone to develop AF and cardiovascular diseases. The World Health Organization (WHO) reported that global elder population has surged from 841.0 Mn in 2013 to 962.3 Mn in 2021, and will surpass 2.0 Bn by the end of 2050. Currently, the number of individuals suffering from atrial fibrillation across the world are more than 33.5 Mn. AtriCure, Inc., an atrial fibrillation (Afib) treatment devices firm stated that the U.S. has 6.0 million AF patients who incurred a total cost of US$ 26.0 BN for the disease in 2021 and currently, the country holds more than US$ 1.0 Bn market for atrial fibrillation. According to the American College of Cardiology (ACC) Foundation, about 422.7 Mn patients were living with the cardiovascular disease in 2015, and around 17.9 Mn patients died from CVDs in 2019, accounting 31.0% of all worldwide deaths.

"The Electrophysiology Laboratory Devices Segment to Command the Market from 2022 to 2030"

The electrophysiology laboratory devices segment is anticipated to hold the lion’s share of the market between 2022 & 2030 owing to a surge in the number of electrophysiology labs in developed and developing countries along with increased focus on new product launches with technological advances in devices including EP X-ray systems, EP imaging, 3D mapping & recording systems, intracardiac echocardiography (ICE) systems, radiofrequency (RF) ablation generators, and electrophysiology remote steering systems. Electrophysiology ablation catheters includes catheters for cryoablation & RF ablation, laser ablation systems, and microwave ablation (MWA) systems.

"The Atrial Fibrillation Segment is expected to Continue the Dominance During the Forecast Period"

Rising prevalence of atrial fibrillation (Afib), technological developments in atrial fibrillation devices such as novel 3D mapping technology, convergent procedure, WATCHMAN left atrial appendage closure (LAAC) procedure, and focal impulse and rotor modulation (FIRM) ablation are supporting the governance of this segment in terms of value. Moreover, increasing adoption of radiofrequency and microwave catheter ablation procedures and the advent of implantable cardiac monitors (ICMs) are likely to support the market growth throughout the forecast period.

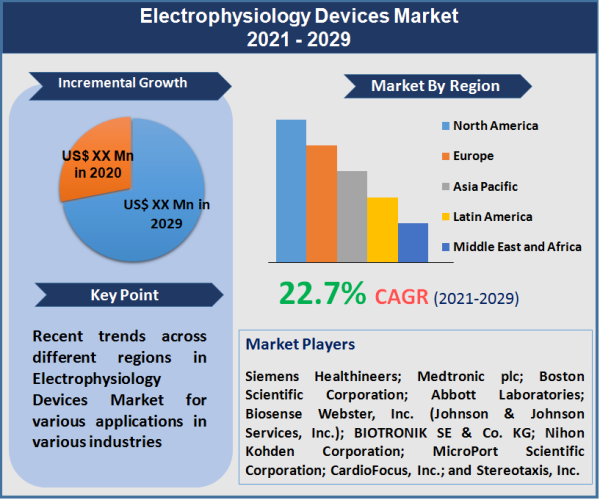

"North America to Led the Market in 2021 due to the Presence of Supportive Healthcare Infrastructure and Key Market Players Based"

North America would continue to hold supremacy throughout the forecast period owing to the presence of major market participants & well-established healthcare infrastructure, surging number of EP labs along with supportive reimbursement & coverage for electrophysiology procedures in the U.S. and Canada. Asia Pacific is envisaged to display comparatively higher CAGR during the forecast period attributed to increasing incidence rates of targeted diseases, growing awareness about EP procedures, and rising spending on healthcare in India, China, and Japan.

"The Presence of International Market Players Creates Market Penetration Challenging for New Entrants"

Key participants in this space are Siemens Healthineers; Medtronic plc; Boston Scientific Corporation; Abbott Laboratories; Biosense Webster, Inc. (Johnson & Johnson Services, Inc.); BIOTRONIK SE & Co. KG; Nihon Kohden Corporation; MicroPort Scientific Corporation; CardioFocus, Inc.; and Stereotaxis, Inc. In December 2021, Abbott Laboratories, a global healthcare company launched world's first and only smartphone compatible insertable cardiac monitor namely Confirm Rx insertable cardiac monitor (ICM) in the U.S. This device will assist physicians/cardiologists to remotely identify cardiac arrhythmias. Manufacturers have adopted growth strategies such as new product launches, collaborations & partnerships, divestitures, mergers & acquisitions, and operational & geographical expansion. In July 2021, BIOTRONIK SE & Co. KG launched Intica DX and Intica cardiac resynchronization therapy (CRT)-DX implantable cardioverter defibrillator (ICD) systems for atrial diagnostics (without an atrial lead) in the U.S. In May 2015, GE Healthcare and Abbott Laboratories collaborated to provide heart's electrical activity data to cardiac electrophysiology labs wherein GE's CardioLab sends electrogram signal data to Abbott's RhythmView mapping software which assists cardiologists in quickly diagnosing the sources of atrial fibrillation and other heart rhythm disorders.

The current report also covers qualitative & quantitative analysis of market variables such as key market drivers, restraints, opportunities, and trends which convey comprehensive market information of the overall electrophysiology devices. In addition, the report also embraces a graphical illustration of the competitive landscape based on their market initiatives & strategies, product portfolio, financial information, and key developments. Major market players profiled in this study report are Siemens Healthineers; Medtronic plc; Boston Scientific Corporation; Abbott Laboratories; Biosense Webster, Inc. (Johnson & Johnson Services, Inc.); BIOTRONIK SE & Co. KG; Nihon Kohden Corporation; MicroPort Scientific Corporation; CardioFocus, Inc.; and Stereotaxis, Inc.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Electrophysiology Devices market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Indication

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report