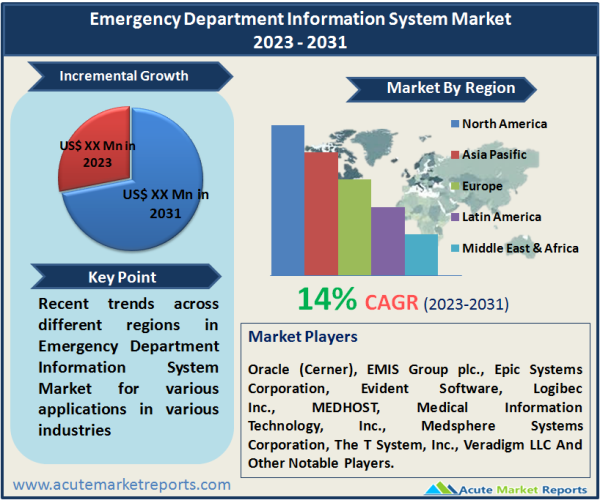

The emergency department information system (EDIS) market is a crucial part of modern healthcare, revolutionizing the way medical facilities manage and deliver emergency care. The EDIS market is expected to grow at a CAGR of 14% during the forecast period of 2026 to 2034. The EDIS market plays a pivotal role in enhancing the efficiency and quality of care provided in emergency departments across the healthcare industry. As healthcare providers continue to embrace digital transformation, the EDIS sector is witnessing significant developments. Key drivers fuel its growth, including digitalization, workflow optimization, and interoperability. However, the challenge of high implementation costs and resistance to change must be addressed. The market segmentation highlights the evolving preferences for applications and deployment methods. Geographic trends show the shift in dynamics, with the Asia-Pacific region poised for substantial growth. The competitive strategies of established players ensure ongoing innovation and leadership in the EDIS market.

Digitalization of Healthcare

The ongoing digital transformation in healthcare is a primary driver of the EDIS market. As the healthcare industry embraces electronic health records (EHRs), telemedicine, and data analytics, the need for advanced information systems in emergency departments becomes paramount. EDIS solutions facilitate seamless data sharing, enhance decision-making, and streamline patient care processes.

Efficiency and Workflow Optimization

Hospitals and emergency departments are under constant pressure to improve efficiency and reduce patient wait times. EDIS solutions offer features like computerized physician order entry (CPOE), clinical documentation, and patient tracking and triage, which contribute to smoother workflows and enhanced patient management. These tools help in prioritizing patients, reducing bottlenecks, and ensuring timely care.

Interoperability and Data Integration

In today's healthcare landscape, interoperability is critical. EDIS solutions are designed to integrate seamlessly with other healthcare systems, such as EHRs and laboratory information systems. This interoperability allows for the exchange of vital patient information across various platforms, ensuring that clinicians have access to a patient's complete medical history and relevant data.

High Implementation Costs and Resistance to Change

The implementation of EDIS solutions can be a significant financial burden for healthcare organizations. Upgrading existing systems, staff training, and change management efforts are often necessary. Moreover, healthcare professionals may resist transitioning from traditional paper-based methods to digital systems, leading to a certain degree of reluctance in adopting EDIS technology.

By Application (Computerized Physician Order Entry, Clinical Documentation, Patient Tracking and triage, E-Prescribing, Others): The EDIS Market Dominates the Market

E-prescribing within EDIS enables healthcare professionals to electronically send prescriptions to pharmacies, enhancing the speed and accuracy of medication dispensing. In 2025, this application segment showed significant revenue, and its CAGR is projected to remain robust in the years ahead. EDIS supports efficient patient tracking and triage in emergency departments. It allows healthcare providers to prioritize patients based on the severity of their condition, ensuring that those in critical need receive immediate attention. This application segment had a substantial market share in 2025 and is anticipated to maintain a strong CAGR through the forecast period.

By Deployment (On-Premises, Software-As-A-Service (SaaS)): on-premises deployment Dominates the Market: On-Premises Deployment Dominates the Market

On-premises EDIS solutions involve the installation and maintenance of the system within the healthcare facility's infrastructure. This deployment type allows for greater control and customization but requires substantial investment. In 2025, on-premises deployment contributed significantly to the market's revenue, and it is expected to maintain a substantial market share and CAGR from 2026 to 2034. SaaS-based EDIS solutions are hosted in the cloud, providing flexibility and scalability for healthcare providers. This deployment option gained traction due to its cost-effectiveness and ease of implementation. SaaS-based EDIS solutions are projected to experience a high CAGR during the forecast period, driven by their accessibility and reduced maintenance requirements.

North America remains the Global Leader

In 2025, North America led the EDIS market, attributed to its early adoption of healthcare technology and digitalization. Nevertheless, during the forecast period from 2026 to 2034, the Asia-Pacific region is projected to witness the highest CAGR. The region's burgeoning healthcare infrastructure and the need for efficient emergency care systems contribute to this anticipated growth.

Market Competition to Intensify during the Forecast Period

The EDIS market is characterized by intense competition, with various players striving to provide innovative solutions to meet the evolving needs of healthcare providers. Prominent companies in the EDIS sector include Oracle (Cerner), EMIS Group plc., Epic Systems Corporation, Evident Software, Logibec Inc., MEDHOST, Medical Information Technology, Inc., Medsphere Systems Corporation, The T System, Inc., and Veradigm LLC These market leaders employ strategies such as product innovation, partnerships, and acquisitions to maintain their market presence. In 2025, these companies held substantial market shares, and their strategies are expected to persist during the forecast period from 2026 to 2034, with a focus on offering advanced EDIS solutions tailored to the diverse requirements of healthcare facilities.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Emergency Department Information System market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Application

|

|

Deployment

|

|

Software Type

|

|

End-User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report