Industry Outlook

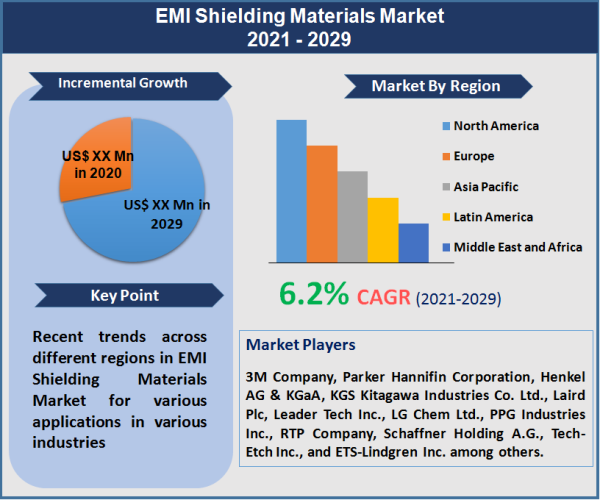

The global market for EMI Shielding Materials expanding at a CAGR of 6.2% during the forecast period. Asia Pacific was the largest region for EMI shielding materials in 2022 and expected to retain its position throughout the forecast period from 2026 to 2034. Further, the region is also expected to generate the fastest growth during the forecast period.

Electromagnetic interference (EMI) shielding is defined as the absorption or reflection of electromagnetic radiation with the help of materials that are positioned in the way of electromagnetic interference. EMI shielding is gaining traction in electronics industry, owing to increasing usage of electronics in different industries such as automotive, defense & aerospace, healthcare, telecom & IT, consumer electronics and so on. EMI shielding materials such as conductive coatings, metals, laminates and others are used to prevent malfunctioning of electronic devices by filtering the incoming and outgoing interferences. High demand of EMI shielding materials from 4G/LTE cellular infrastructure worldwide and compliance to EMI regulations are major factors fuelling the growth of the market. EMI shielding materials market is growing due to the rapid increase in sources generating electromagnetic fields and the reliability of these materials to protect the electronic devices from electromagnetic radiation.

Developments in the telecom and the IT industry is one of the key factors driving the demand for EMI shielding materials. The advancements in telecom technologies and swift penetration of the internet has collectively made it easier for consumers to access the internet and related services. According to a recent study, the internet access through smartphones has already crossed 50% of the overall internet usage worldwide. Ongoing advancements in telecom network technologies (such as 3G, 4G LTE and 5G) are one the rise, with consumer demanding improved internet connectivity.

Conductive Coatings & Paints Dominated the EMI Shielding Materials Market, and Expected to Display Similar Trend in the Coming Years

By component, conductive coatings and paints segment accounted for the largest share of more than 37% in 2022. Conductive paints and coatings is ideal for EMI shielding on non-metal surfaces. Materials such as silver, copper, gold, aluminum, nickel, silver-coated copper, and other materials are used as fillers in conductive coatings and paints. Different coating techniques used for metalizing the non-metal surfaces are foil laminates & tapes ion plating, and vacuum metallization amongst others.

Conductive shield created by the conductive coating and paints prevents electrical circuitry damage or hindrance to operations through EMI radiations. Laminates segment is anticipated to record high growth in the near future due to advantages such as light weight, cost effectiveness and ease of application. The most commonly used metals in EMI shielding include copper, aluminum, copper alloy 770 and pre-tin plated steel.

Automotive Segment, based on Application Expected to Continue Dominating the Global EMI Shielding Materials Market in the Coming Years

Based on application, the global market for EMI shielding materials was dominated by the automotive segment in 2022, and the segment is expected to continue dominating the market in the coming years as well. With the advancement in technology, the need to incorporate large number of electrical and electronic systems into automobiles has vividly increased. The most common electrical and electronic systems incorporated in automobiles include safety systems, Control Area Networks (CAN), communications systems, mobile media, controllers, DC motors and infotainment systems such as wireless headsets among others. Employing a large number of electrical and electronic systems into a limited and confined space poses the problem of eliminating the electromagnetic interference generated from these systems from interfering with each other.

However, the consumer electronics segment is expected to register high growth in the near future owing to increasing owing to increasing per capita disposable incomes as well as increasing demand for consumer electronics due to increased consumer spending across developing economies. Use of EMI shielding materials are anticipated to witness significant adoption among consumer electronics and telecom & IT applications due to rising demand for secured and error free transmission of data.

Factors such as rising per capita disposable incomes and changes in standards of living are driving the demand for automobiles across the globe, which in turn is anticipated to drive the demand for EMI shielding materials in the automotive segment. Furthermore, increasing focus of automakers on providing lightweight vehicles is expected to drive the demand for conductive plastics and laminates to achieve efficient EMI shielding.

Asia Pacific Expected to Continue Dominating the EMI Shielding Materials Market in the Coming Years

Asia Pacific dominated the global market for EMI shielding materials in 2022 and expected to retain it supremacy throughout the forecast period as well. China is the largest market for EMI shielding within Asia Pacific. It also projected to maintain its dominance over the forecast period. High growth potential for the development of EMI shielding materials is observed in economies such as India, China, Japan, Malaysia, South Korea and Indonesia. India is the second largest market for EMI shielding materials in the Asia Pacific region. Moreover, industries like automotive, electronics and defense & aerospace are growing at a higher rate in Asia Pacific as compared to global growth rate of respective industries. This is likely to increase the end-use applications and demand for EMI shielding materials in the region.

In North America and Europe region, due to rapid growth of defense & aerospace, consumer electronics and telecom & IT activities along with enforcement of stringent regulatory norms by the government authorities has boosted the demand for EMI shielding materials with higher efficiency. In the United States, Federal Communications Commission (FCC) is main authority body that has issued many guidelines for commercial equipment EMI shielding and RFI shielding. These guidelines are created to help research & development engineers to create new technology and materials in EMI shielding. The FCC has mandated the use of appropriate EMI shielding materials in all mass communication devices.

Product Launch is one of the Key Strategies of the Companies Operating in the EMI Shielding Materials Market

Notable players operating in the global EMI shielding materials market include 3M Company, Parker Hannifin Corporation, Henkel AG & KGaA, KGS Kitagawa Industries Co. Ltd., Laird Plc, Leader Tech Inc., LG Chem Ltd., PPG Industries Inc., RTP Company, Schaffner Holding A.G., Tech-Etch Inc., and ETS-Lindgren Inc. among others.

In March 2022, the Chomerics division of Parker Hannifin Corporation launched PREMIER PBT-225, EMI shielding conductive plastic pellets. It is specially formulated to improve long term aging performance when exposed to humid and typical heat conditions. Its single pellet, polybutylene terephthalate (PBT) based formula help to make metal to plastic housing conversions possible for the increasing electronics applications. These conversions eliminate the housing weight (as compared to aluminum) and also provide cost reduction up to 65% by eliminating secondary operations such as machining and assembly.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of EMI Shielding Materials market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Component

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report