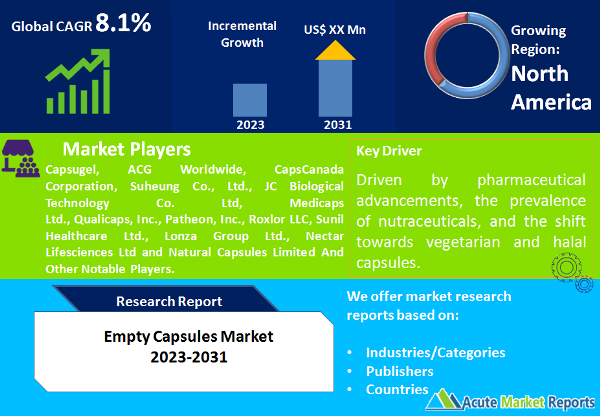

Empty capsules, commonly known as gelatin or vegetarian capsules, are widely used in the pharmaceutical and nutraceutical industries to encapsulate various drugs, vitamins, and dietary supplements. The empty capsules market is expected to grow at a CAGR of 8.1% during the forecast period of 2026 to 2034, driven by pharmaceutical advancements, the prevalence of nutraceuticals, and the shift towards vegetarian and halal capsules. However, stringent regulatory compliance poses a significant challenge for manufacturers. As the market evolves, natural and vegetarian capsules are expected to gain prominence, offering a broader range of options to consumers. Additionally, sustained-release capsules are anticipated to witness increased demand due to their benefits in drug delivery. Geographically, Asia-Pacific is projected to exhibit the highest growth rate, driven by the expansion of the pharmaceutical and nutraceutical sectors.

Pharmaceutical Advancements

The pharmaceutical industry's constant drive for innovation and drug development serves as a significant driver for the empty capsules market. Pharmaceutical companies use empty capsules for the encapsulation of both prescription and over-the-counter drugs. The demand for empty capsules is poised to grow as the pharmaceutical sector continues to expand globally. According to a report by the Pharmaceutical Research and Manufacturers of America (PhRMA), the global pharmaceutical market is expected to reach $1.5 trillion by 2026, indicating substantial growth potential for empty capsules.

Prevalence of Nutraceuticals

The increasing awareness of health and wellness, coupled with a growing aging population, has led to a surge in the consumption of nutraceuticals and dietary supplements. Empty capsules provide an ideal dosage form for these products, allowing precise formulation and easy administration. The global nutraceutical market size is expected to reach $725 billion by 2028, with dietary supplements playing a significant role in this growth.

Shift Towards Vegetarian and Halal Capsules

A rising preference for vegetarian and halal products has driven the demand for plant-based or non-gelatin empty capsules. As consumers become more health-conscious and ethically aware, manufacturers are responding by offering vegetarian and halal-certified capsules, which cater to a broader consumer

Stringent Regulatory Compliance

The empty capsules market faces challenges due to strict regulatory requirements imposed by various health authorities worldwide. Compliance with these regulations can be time-consuming and costly for manufacturers. Ensuring quality and safety standards throughout the production process is essential to meet regulatory criteria. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have stringent guidelines governing the manufacturing, labeling, and distribution of empty capsules. These regulations aim to guarantee the safety and efficacy of pharmaceutical products encapsulated within them.

Market by Source: Porcine-Based Empty Capsules Dominate the Market

The empty capsules market can be segmented based on the source of the capsules, including:

In 2025, porcine-based empty capsules dominated the market due to their widespread use in pharmaceuticals. However, during the forecast period from 2026 to 2034, natural and vegetarian capsules are expected to demonstrate both the highest revenue and the highest compound annual growth rate (CAGR). This growth is driven by increased consumer preference for plant-based and halal-certified products.

Market by Functionality: Immediate-Release Capsules Dominate the Market

Empty capsules serve different functionalities in drug delivery systems, including:

In 2025, immediate-release capsules accounted for the highest revenue within the empty capsules market, reflecting their widespread use in pharmaceutical applications. However, during the forecast period from 2026 to 2034, sustained-release capsules are expected to exhibit both the highest revenue and the highest CAGR. This growth is driven by the advantages of sustained release in enhancing patient compliance and treatment outcomes.

North America Remains as the Global Leader

Geographically, North America held the highest revenue percentage in the empty capsules market in 2025, driven by a robust pharmaceutical industry and a growing nutraceutical sector. However, Asia-Pacific is expected to demonstrate the highest CAGR during the forecast period. This growth is fueled by the expansion of pharmaceutical manufacturing capabilities, increased investments in healthcare infrastructure, and the rising adoption of dietary supplements in the region.

Focus on Innovation to Enhance Market Share during the Forecast Period

Key players in the empty capsules market include Capsugel, ACG Worldwide, CapsCanada Corporation, Suheung Co., Ltd., JC Biological Technology Co. Ltd, Medicaps Ltd., Qualicaps, Inc., Patheon, Inc., Roxlor LLC, Sunil Healthcare Ltd., Lonza Group Ltd., Nectar Lifesciences Ltd and Natural Capsules Limited, and others. These companies focus on expanding their product portfolios, developing innovative formulations, and strategic collaborations to maintain their market positions. In the highly competitive empty capsules market, key players are engaged in several strategic initiatives to gain a competitive edge and expand their market presence. Leading companies are heavily investing in research and development to introduce innovative capsule technologies. This includes improvements in capsule shell materials, coatings, and manufacturing processes. For instance, the development of enteric coatings that enhance drug stability and targeted release has gained attention. Such innovations enable pharmaceutical and nutraceutical manufacturers to offer differentiated products with improved performance. Customization of empty capsules to meet specific requirements is becoming a key trend. Manufacturers are offering a wide range of sizes, colors, and materials to cater to the diverse needs of their clients. Additionally, many companies provide contract manufacturing services, allowing pharmaceutical and nutraceutical brands to outsource capsule production. This trend simplifies the supply chain and reduces production costs for brand owners.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Empty Capsules market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Source

|

|

Type

|

|

Functionality

|

|

Application

|

|

End-User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report