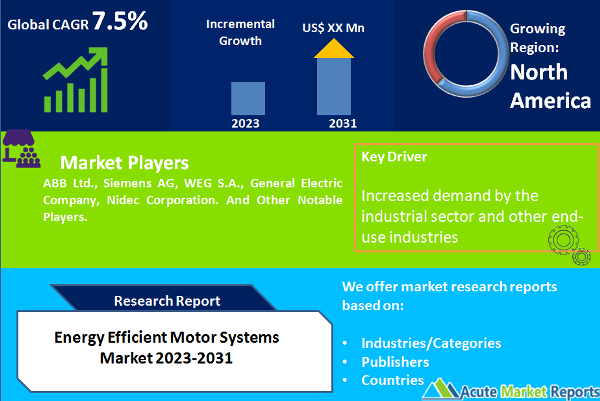

The global energy-efficient motor systems market has been experiencing substantial growth in recent years, driven by various factors such as increasing demand for energy-efficient systems, rising awareness about the benefits of energy efficiency, and stringent government regulations. The market is projected to grow at a CAGR of 7.5% during the forecast period (2026-2034). The market overview suggests that the increasing need to reduce carbon emissions and energy consumption across industries is one of the primary drivers of the energy-efficient motor systems market. This is especially true for industries such as HVAC, industrial machinery, and automotive, which are the major end-users of energy-efficient motor systems. The adoption of energy-efficient motor systems is expected to significantly reduce energy consumption, which, in turn, will result in a reduction of greenhouse gas emissions. Another significant driver of the energy-efficient motor systems market is the growing focus on the Internet of Things (IoT) and Industrial Internet of Things (IIoT). The integration of these technologies with energy-efficient motor systems enables real-time monitoring and control of motor systems, providing greater energy efficiency, predictive maintenance, and cost savings. With the increasing adoption of these technologies across various industries, the demand for energy-efficient motor systems is expected to grow significantly. Moreover, the rising demand for electric vehicles (EVs) is expected to create new opportunities for the energy-efficient motor systems market. As EVs require efficient and reliable motors, the adoption of energy-efficient motor systems in the automotive industry is expected to grow significantly in the coming years.

Government Regulations and Initiatives

Government regulations and initiatives promoting energy efficiency are one of the key drivers of the energy-efficient motor systems market. Governments around the world are implementing policies and regulations to reduce energy consumption and greenhouse gas emissions, driving demand for more energy-efficient motors. For instance, the European Union has established the Eco-Design Directive, which sets minimum energy efficiency standards for various products, including motors. In the US, the Energy Policy Act of 2005 mandates the use of energy-efficient motors in federal buildings, while several states have also implemented similar regulations. These initiatives are expected to continue driving the growth of the energy-efficient motor systems market.

Rising Energy Costs

With the rising costs of energy, businesses are seeking ways to reduce their energy consumption and costs, which is driving the demand for energy-efficient motor systems. Energy-efficient motors can help businesses reduce their energy consumption by up to 30%, resulting in significant cost savings. Additionally, the increasing adoption of renewable energy sources is also contributing to the demand for energy-efficient motor systems.

Growing Industrialization

The growing industrialization across the globe is driving the demand for energy-efficient motor systems. The increasing number of manufacturing facilities, particularly in emerging economies, is driving the demand for energy-efficient motors. For instance, the manufacturing sector in India is growing at a rapid pace, with the government's "Make in India" initiative promoting manufacturing in the country. This has resulted in increased demand for energy-efficient motor systems, as manufacturers look to reduce their energy consumption and costs.

High Initial Cost to Restrain the Market Growth

One of the key restraints in the energy-efficient motor systems market is the high initial cost of implementing these systems. While energy-efficient motors can save energy and operating costs in the long run, the initial investment required can be a deterrent for some companies. According to a report by the U.S. Department of Energy, the initial cost of energy-efficient motors is typically 15-40% higher than standard motors. This can be a significant expense for companies, especially small and medium-sized enterprises that may have limited budgets. Additionally, the installation and retrofitting of these systems can be complex and require specialized knowledge and expertise, which can further increase costs. The high upfront costs can make it difficult for some companies to justify the investment, especially if they do not have a clear understanding of the potential long-term savings. As a result, some companies may opt to stick with less efficient motors, which can have negative impacts on both their energy consumption and operating costs in the long run.

IE3 Dominating the Market by Efficiency Levels

Energy-efficient motor systems market can be segmented by the efficiency level of motors used in the system, including IE1, IE2, IE3, IE4, and IE5 motors. The IE3 segment is expected to have the highest CAGR during the forecast period of 2026 to 2034, owing to its higher efficiency level compared to IE1 and IE2 motors. According to a report by the International Energy Agency, the adoption of high-efficiency IE3 motors in the industrial sector can result in energy savings of up to 4.5% globally. Furthermore, government initiatives such as the Minimum Energy Performance Standards (MEPS) in various countries mandating the use of IE3 motors in certain applications are expected to drive the market for IE3 motors in the coming years. In terms of revenue, the IE3 segment held the highest revenue share in 2025 due to the increasing focus on energy-efficient systems in various industries such as manufacturing, automotive, and construction. The IE4 and IE5 segments are expected to witness significant growth in the coming years due to the growing demand for higher efficiency levels in motor systems.

Fans Led the revenues, HVAC to Lead the Growth in the Market by Applications

The application segment of the energy-efficient motor systems market can be broadly divided into HVAC, fans, pumps, and compressors. The HVAC application segment is expected to exhibit a high CAGR during the forecast period of 2026 to 2034 owing to the rising demand for energy-efficient HVAC systems in both residential and commercial buildings. According to a report by the International Energy Agency (IEA), buildings account for around 40% of global energy consumption and contribute significantly to greenhouse gas emissions. This has led to the adoption of energy-efficient HVAC systems that not only reduce energy consumption but also help in reducing carbon emissions. The fans application segment is expected to have the highest revenue share during the forecast period due to the increasing demand for energy-efficient fans in industries such as HVAC, automotive, and manufacturing. In terms of revenue, the fans application segment held the highest revenue share in 2025, owing to the wide range of applications of energy-efficient fans in various industries.

North America Leading Revenues, While APAC to Lead the Growth

In terms of revenue, North America held the highest revenue share in the market in 2025, owing to the increasing demand for energy-efficient solutions and the presence of major market players. In North America, the U.S. is expected to lead the market, owing to the increasing investments in energy-efficient infrastructure and the presence of several market players. Europe is also expected to hold a significant share in the market, owing to the increasing government regulations to reduce carbon emissions and the growing demand for energy-efficient solutions in the region. The Asia Pacific is expected to witness the highest revenue growth during the forecast period, owing to the rapid industrialization and increasing demand for energy-efficient solutions in emerging economies such as China and India. The Middle East and Africa and Latin America are also expected to witness significant revenue growth during the forecast period, owing to the increasing adoption of energy-efficient solutions and government initiatives to reduce carbon emissions.

Market Competition to Intensify During the Forecast Period

The global energy-efficient motor systems market is highly competitive, with several players competing for market share. Some of the major players in the market are ABB Ltd., Siemens AG, WEG S.A., General Electric Company, and Nidec Corporation. These companies are focusing on product innovation, strategic collaborations, and mergers and acquisitions to gain a competitive edge in the market. One of the key strategies adopted by market players is the launch of new products with improved energy efficiency. For instance, in October 2021, ABB Ltd. introduced the IE5 SynRM motor that offers high energy efficiency and is suitable for various industrial applications. Similarly, in 2022, Siemens AG introduced the Simotics SD Pro motor which is designed for use in pump, fan, and compressor applications and provides high energy efficiency. Another important strategy adopted by market players is strategic collaborations and partnerships. For example, in June 2021, WEG S.A. signed a partnership agreement with Renault to supply energy-efficient electric motors for Renault's electric vehicle production line. This collaboration is expected to help both companies expand their market reach and increase revenue. Overall, with increasing demand for energy-efficient motor systems and the growing emphasis on sustainable practices, market players are expected to continue investing in research and development to introduce new products and expand their market reach through strategic collaborations and mergers, and acquisitions.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Energy Efficient Motor Systems market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Power Output Rating

|

|

Efficiency Level

|

|

Application

|

|

End User

|

|

Installation Type

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report