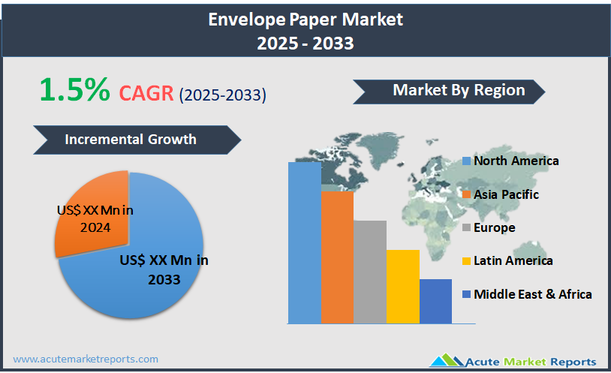

The envelope paper market encompasses the production and sale of paper specifically designed for manufacturing envelopes. This type of paper is typically characterized by its durability, printability, and ability to be folded without tearing, making it ideal for both commercial and personal correspondence. Envelope papers vary in weight, color, texture, and finish to cater to a wide range of mailing needs, from business communications to invitations and greeting cards. The envelope paper market is projected to grow at a modest Compound Annual Growth Rate (CAGR) of 1.5%. This growth is relatively slow due to the increasing digitization of communication which reduces the need for traditional mailing methods. However, specific niches within the market, such as luxury and specialty envelopes, offer potential growth opportunities. These niches cater to premium business communications and special occasions, which continue to rely on physical mail for a personal touch. Moreover, as environmental concerns become more prominent, the demand for envelope papers made from recycled and sustainable sources is expected to rise, providing new directions for growth and innovation in this mature market.

Persistence of Traditional Business Communications

A primary driver for the envelope paper market is the ongoing requirement for traditional business communications. Despite the digital shift, many sectors such as legal, finance, and government continue to rely on physical documents for official transactions, contracts, and notices. These documents often need to be delivered in envelopes to ensure privacy and compliance with legal standards. For instance, legal documents like court notices or confidential agreements are typically required to be sent in physical form to ensure the recipient's acknowledgment of receipt. Furthermore, direct mail marketing remains an effective strategy for many businesses, particularly in targeting older demographics or regions with limited internet connectivity. These uses demonstrate the enduring need for envelope papers in professional settings, supporting sustained demand within the market.

Growth in Specialty and Custom Envelopes

An opportunity within the envelope paper market lies in the growing demand for specialty and custom envelopes. With the rise of e-commerce and online shopping, businesses are increasingly looking for ways to enhance the customer experience. Customized or branded envelopes can add a touch of personalization and professionalism to business communications, making them more memorable. Additionally, the market for luxury invitation envelopes for events such as weddings, galas, and corporate functions is expanding. These high-end envelopes often use premium papers and unique designs, which could drive higher profit margins and diversify revenue streams for producers focused on this niche segment.

Rise of Digital Communication Platforms

A significant restraint impacting the envelope paper market is the rise of digital communication platforms. Emails, instant messaging, and electronic documents have drastically reduced the need for traditional mail services in both personal and professional contexts. Many businesses and individuals opt for digital communications because they offer faster, more cost-effective, and environmentally friendly alternatives to physical mail. This shift has particularly affected routine communications like billing and everyday business correspondence, which previously formed a substantial portion of the envelope paper market. As digital literacy and access improve globally, the preference for electronic communication is expected to further diminish the demand for traditional envelope paper.

Environmental Concerns and Sustainability Challenges

A critical challenge facing the envelope paper market is addressing environmental concerns related to paper production and waste. As global awareness of sustainability issues grows, consumers and businesses are increasingly seeking products that minimize environmental impact. The production of paper, including that for envelopes, typically involves significant water and energy consumption, contributing to deforestation and pollution unless managed sustainably. Manufacturers are thus under pressure to adopt greener practices, such as using recycled materials or sustainable forestry products. However, transitioning to these methods can be costly and complex, particularly for smaller producers. Balancing environmental responsibilities with maintaining profitability remains a significant challenge for the envelope paper industry.

Market Segmentation by Material

In the envelope paper market, segmentation by material includes Bright White Paper, Kraft Paper, Colored Paper, and Specialty Paper. Bright White Paper is the leader in terms of revenue generation due to its widespread use in business communications and direct mail marketing, where a clean and professional appearance is essential. Its high opacity and excellent print quality make it a preferred choice for both corporate and personal correspondence. Conversely, Specialty Paper is expected to register the highest Compound Annual Growth Rate (CAGR). This growth is fueled by the increasing demand for unique textured and premium-quality papers in the luxury invitations and bespoke stationery markets. Specialty papers, which include options like linen, cotton, and recycled papers, cater to niche markets that value distinctiveness and tactile qualities in their envelope choices.

Market Segmentation by Basis Weight

Regarding basis weight, the envelope paper market is segmented into Less than 80 GSM, 80 to 120 GSM, 121 to 180 GSM, and More than 180 GSM. The segment of 80 to 120 GSM dominates in terms of revenue, as papers within this weight range offer an ideal balance of durability and cost-effectiveness, making them suitable for a wide range of applications from standard business correspondence to direct mail. This weight class is particularly favored for its ability to withstand the rigors of postal handling without being too bulky, which can increase mailing costs. Meanwhile, the More than 180 GSM segment is projected to experience the highest CAGR. Papers heavier than 180 GSM are typically used for premium and luxury envelopes, appealing to high-end markets where the quality and feel of the envelope are paramount. This segment's growth is driven by rising demand for exclusive, high-quality mailing products in sectors like event management and luxury branding, where the presentation is crucial.

Geographic Segment

The envelope paper market showcases varied geographic trends, with North America leading in terms of revenue generation in 2024, driven by the region's robust direct marketing activities and the persistence of traditional business practices requiring formal communication through postal services. This region benefits from the presence of major corporations and a well-established commercial sector that relies on postal services for direct consumer engagement and transactional mail. Meanwhile, Asia Pacific is projected to experience the highest Compound Annual Growth Rate (CAGR) from 2025 to 2033. Rapid industrialization, urbanization, and the expansion of the corporate sector in countries like China and India are major contributors to this growth. The increasing middle-class population and the rise in consumer spending also boost the demand for consumer goods, including stationery and mailing products, further fueling the envelope paper market in the region.

Competitive Trends

In 2024, the envelope paper market was highly competitive, with key players such as International Paper Company, Mondi Group, Domtar Corporation, UPM Technologies, Inc., Stora Enso Oyj, Neenah, Inc., Lintec Corporation, JK Paper, Moorim Paper Co. Ltd., Mohawk Paper Company, Koehler Paper, Packman Packaging Private Limited, Cosmo papers, Sangal Papers Ltd., TOMPLA, Kuvert Polska Group, and Mayer-Kuvert-network GmbH actively expanding their market footprint. These companies focused on diversifying their product portfolios to include a range of sustainable and specialty papers to meet the evolving preferences of consumers looking for high-quality, environmentally friendly products. Innovations in paper production, such as the development of papers with improved recycling capabilities and reduced environmental impact, were a common strategy among these firms. Additionally, several players emphasized strengthening their global distribution networks and entering new markets, particularly in Asia Pacific and the Middle East, to capitalize on the growing demand in these regions. From 2025 to 2033, these companies are expected to continue their focus on innovation and sustainability.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Envelope Paper market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Material

| |

Basis Weight

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report