The epilepsy treatment drugs market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033, driven by the increasing global prevalence of epilepsy, continuous development of newer antiepileptic drugs (AEDs), and improvements in neurological diagnostics. Epilepsy affects over 50 million people globally, and treatment typically involves long-term use of AEDs. The rising demand for more effective and better-tolerated therapies has propelled research in both novel formulations and precision medicine approaches. Market dynamics are further influenced by government support for neurological disease awareness, rising generic drug penetration, and improved access to healthcare across developing nations.

Market Drivers

Growing Epilepsy Prevalence and Diagnosis Rates

The global burden of epilepsy continues to increase, with significant prevalence in low- and middle-income countries where infectious diseases, birth-related injuries, and lack of prenatal care are prevalent. With enhanced awareness, better access to neurological healthcare, and advancements in imaging and EEG technologies, early diagnosis and long-term management of epilepsy have improved. This has led to greater demand for maintenance medications and drug regimens that can manage seizures with fewer side effects and improved quality of life.

Therapeutic Advancements and Pipeline Expansion

The market is experiencing innovation through the launch of third-generation AEDs, which target novel mechanisms and offer enhanced safety and efficacy profiles. These drugs are better suited for refractory epilepsy and pediatric use. Companies are focusing on next-gen molecules, drug-device combinations, and extended-release formulations. Additionally, advancements in neuropharmacology, including precision targeting of sodium channels, AMPA receptors, and GABA modulation, are paving the way for disease-modifying treatments beyond symptomatic seizure control.

Rising Generic Availability and Cost-Effective Therapies

Cost pressure and patent expirations of several branded AEDs have led to increased generic penetration, particularly in emerging markets. Governments and public health systems are encouraging the adoption of generics to ensure affordability and continuous therapy adherence. Furthermore, partnerships between pharmaceutical companies and public health organizations are ensuring wider distribution of essential epilepsy medications in under-served regions.

Market Restraint

Adverse Effects and Drug Resistance

Despite therapeutic progress, long-term antiepileptic drug use is often associated with adverse side effects including cognitive impairment, sedation, mood changes, and hepatic toxicity. Furthermore, approximately 30% of patients exhibit drug-resistant epilepsy, where seizures persist despite treatment with two or more AEDs. This lack of universal efficacy across the patient population restricts overall treatment success rates and highlights the need for alternative and personalized approaches, which can be cost-intensive and less accessible.

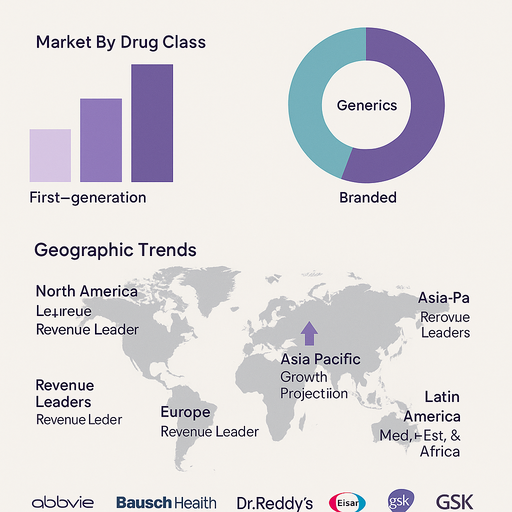

Market Segmentation by Drug Class

The Drug Class segment includes First-generation, Second-generation, and Third-generation antiepileptic drugs. In 2024, Second-generation AEDs accounted for the highest revenue share due to their improved safety, tolerability, and broader spectrum of activity compared to older medications like phenobarbital and phenytoin. Drugs such as levetiracetam, lamotrigine, and topiramate are widely prescribed due to their favorable side effect profiles and reduced drug-drug interactions. However, Third-generation drugs including perampanel, lacosamide, and cenobamate are expected to witness the fastest growth owing to better seizure control in refractory patients and fewer central nervous system side effects. First-generation drugs still hold relevance in specific clinical settings, especially in cost-sensitive regions and emergency use.

Market Segmentation by Type

The Type segment is categorized into Branded and Generics. Generic AEDs dominated the market in volume terms in 2024 due to widespread adoption in cost-conscious healthcare systems and greater availability following major patent expirations. These drugs are critical for managing epilepsy in public health programs and low-income countries. However, Branded drugs continue to command significant revenue share, particularly in high-income countries, owing to continued launches of novel third-generation treatments with differentiated value propositions. Additionally, branded drugs are often preferred in complex epilepsy syndromes where therapeutic consistency is critical.

Geographic Trends

Regionally, North America led the epilepsy treatment drugs market in 2024 in terms of revenue, driven by high diagnosis rates, robust healthcare infrastructure, and presence of major pharmaceutical players. The U.S. maintains a high treatment adherence rate due to access to both branded and generic therapies. Europe followed, supported by national epilepsy strategies, universal healthcare coverage, and strong focus on neurology research in countries like Germany, France, and the UK. The Asia Pacific region is expected to register the highest CAGR from 2025 to 2033, fueled by improving healthcare access, rising public awareness, and healthcare reforms in countries such as India, China, Indonesia, and Vietnam. Latin America and Middle East & Africa are emerging as opportunity zones, supported by increasing investment in neurological care, urban healthcare expansion, and public health initiatives aimed at reducing the treatment gap in epilepsy.

Competitive Trends

The epilepsy treatment drugs market is competitive with key players focusing on pipeline development, lifecycle management, and regional expansion. In 2024, Pfizer, UCB, GSK, and Sanofi maintained strong positions through their diverse AED portfolios, including both legacy and newer drugs. Jazz Pharmaceuticals, SK Biopharmaceuticals, and Neurelis introduced innovative third-generation products targeting refractory and acute seizure indications. AbbVie, Novartis, and Bausch Health Companies emphasized R&D in neurology and expanded their market through specialty divisions. Lupin, Sun Pharma, and Dr. Reddy’s Laboratories played key roles in the global generics space, supplying cost-effective options to both emerging and developed markets.

Smaller players like Eisai, Sumitomo Pharma, and Precision Neuroscience are contributing to targeted epilepsy segments such as pediatric epilepsy, Lennox-Gastaut syndrome, and seizure clusters. Strategic alliances, licensing deals, and co-marketing partnerships are expected to accelerate market consolidation, enhance drug accessibility, and foster global scale-up of novel therapies by 2033.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Epilepsy Treatment Drugs market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Drug Class

| |

Type

| |

Route of Administration

| |

Age Group

| |

Seizure Type

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report