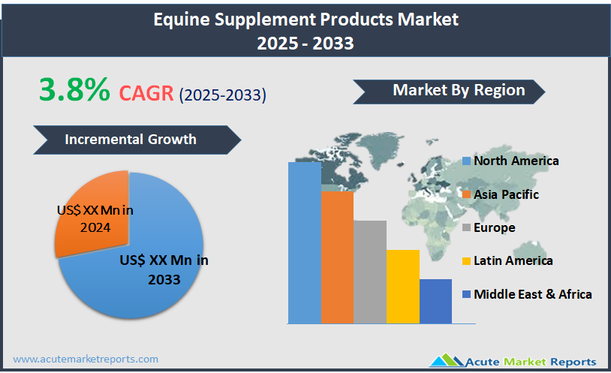

Equine supplement products are formulations designed to enhance the nutritional intake of horses. These supplements cater to various needs such as improving coat quality, joint health, digestive functioning, and overall performance. The products range from vitamins and minerals to specialty supplements targeting specific health issues like arthritis or energy deficiencies. These supplements are used by horse owners, trainers, and veterinarians to ensure that horses receive a balanced diet, especially when their nutritional needs cannot be met by regular feed alone. Projected to grow at a compound annual growth rate (CAGR) of 3.8% over the forecast period, the equine supplement products market is set to continue its growth trajectory. This moderate growth rate reflects the market's maturity in many regions but also highlights opportunities in emerging markets where horse sports and recreational riding are gaining popularity. Innovations in supplement formulations, driven by ongoing research into equine health and nutritional needs, are likely to attract new customers.

Increasing Participation in Equestrian Sports as a Driver

The increasing global participation in equestrian sports significantly drives the equine supplement products market. As horse racing, show jumping, and dressage gain popularity, the demand for specialized nutrition to enhance athletic performance and overall health in horses rises. Horse owners and trainers are more invested than ever in maintaining the peak physical condition of their animals to ensure competitive success. This heightened focus on health and performance correlates with a growing reliance on nutritional supplements, which are formulated to provide benefits such as improved joint mobility, muscle recovery, and energy management during training and competitions. These trends reflect a broader awareness of the critical role that nutrition plays in achieving top sporting performances and optimal animal welfare, thus pushing the demand for equine supplements upward.

Opportunity in Personalized Nutrition

An emerging opportunity within the equine supplement products market is the trend towards personalized nutrition, where supplements are tailored to meet the specific health needs of individual horses. This customization approach is based on factors such as age, activity level, health conditions, and performance requirements, which vary significantly among horses. As owners and veterinarians seek more targeted nutritional strategies, the demand for specialized supplements increases. This trend not only encourages product differentiation and innovation among manufacturers but also enhances customer loyalty and market growth as consumers look for products that can deliver visible and verifiable benefits to their horses.

Cost as a Restraint

The high cost of high-quality equine supplements poses a significant restraint to the market. Premium ingredients that are effective and safe for horses often come at a steep price, making them less accessible to average horse owners. The economic burden is compounded in competitive horse sports, where the highest standards for animal performance necessitate frequent and prolonged use of these products. Additionally, the global economic climate affects discretionary spending on pet and animal care, which can fluctuate with economic downturns, impacting the overall sales of non-essential goods such as some types of supplements. This price sensitivity can influence market dynamics by shifting consumer preferences towards cheaper, less effective alternatives or discouraging the use of supplements altogether.

Regulatory Compliance as a Challenge

Navigating the stringent regulatory landscape remains a challenge in the equine supplement products market. The industry faces rigorous scrutiny regarding the safety, efficacy, and quality of supplements, with regulations varying widely by region and country. Compliance with these regulations involves substantial costs related to product testing, certification, and adaptation of formulations to meet legal standards. Moreover, the lack of harmonization in regulations across different markets complicates the expansion efforts of manufacturers looking to enter new geographic areas. These regulatory hurdles can delay product launches, limit market access, and increase operational costs, challenging companies striving to innovate and expand within the global marketplace.

Market Segmentation by Supplement

The equine supplement products market is segmented into Proteins/Amino Acids, Vitamins, Enzymes, Electrolytes & Minerals, and Others. The segment generating the highest revenue is Electrolytes & Minerals, crucial for maintaining hydration, nerve function, and muscle performance in horses, especially those involved in high levels of physical activity. This category's prevalence is due to its essential role in preventing dehydration and electrolyte imbalances, which can significantly affect a horse's health and performance. Meanwhile, the Proteins/Amino Acids segment is anticipated to experience the highest CAGR over the forecast period. This growth is driven by increasing awareness of their benefits in muscle recovery and development, essential for performance horses. As the understanding deepens about the role of proteins and amino acids in enhancing muscle integrity and reducing recovery times, their demand is expected to surge, particularly among racehorses and sport horses where performance is paramount.

Market Segmentation by Application

In terms of application, the equine supplement products market is segmented into Performance Enhancement/Recovery, Joint Disorder Prevention, and Others. The Performance Enhancement/Recovery segment holds the highest revenue share, reflecting the high demand for supplements that support increased athletic performance and expedite recovery after rigorous activities. This segment benefits from the ongoing professionalization of equestrian sports and a growing understanding of animal physiology, which promotes the use of specific supplements to enhance performance and recovery rates. Conversely, Joint Disorder Prevention is expected to register the highest CAGR from 2025 to 2033. The growth in this segment is fueled by the rising prevalence of joint issues in horses due to intense training schedules and longer lifespans, which increases the need for preventative care through supplements that promote joint health and mobility, thus ensuring a longer and more productive life for performance horses.

Geographic Segment

The equine supplement products market is characterized by significant geographic trends. In 2024, North America accounted for the highest revenue percentage, driven by a well-established equestrian industry, high participation rates in horse sports, and substantial spending on horse healthcare and nutrition. The region's dominance is supported by advanced veterinary healthcare infrastructure and a strong presence of leading supplement manufacturers. Looking forward, Asia Pacific is expected to witness the highest CAGR from 2025 to 2033. This growth is anticipated due to increasing interest in equestrian sports, rising disposable incomes, and expanding awareness about horse health and nutrition in countries like China, Australia, and Japan.

Competitive Trends and Top Players

In 2024, the competitive landscape of the equine supplement products market was dominated by major players such as Zoetis, Boehringer Ingelheim International GmbH, Bayer AG, Equine Products UK LTD, Purina Animal Nutrition LLC, Vetoquinol S.A., Kentucky Equine Research, Plusvital Limited, Lallemand, Inc., and Virbac. These companies focused extensively on research and development to introduce innovative products that meet the specific nutritional requirements of horses, enhancing their health and performance. Strategic partnerships, acquisitions, and expanding into emerging markets were key strategies employed to strengthen market positions and expand customer bases. For instance, partnerships with equestrian events and sponsorships helped in increasing brand visibility and loyalty among horse owners and professionals.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Equine Supplement Products market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Supplement

| |

Application

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report