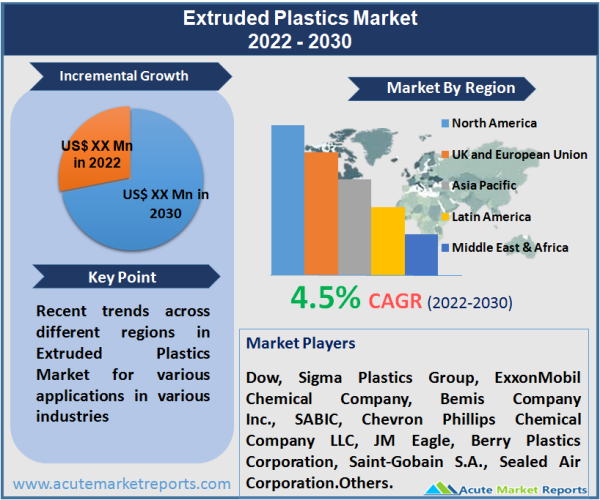

The value of the global extruded plastics market is expected to grow at a CAGR of 4.5% during the forecast period of 2026 to 2034. The process of extruding plastics involves heating the raw material, which might be a polymer for example, to a higher temperature so that it can be melted and then used to produce other goods. Tubing extrusion, blow film extrusion, sheet film extrusion, and over jacket extrusion are some of the possible extrusion techniques. Depending on the shape of the die, numerous products can be manufactured by employing one of these extrusion methods. The strong demand for extruded plastics in the consumer products business, particularly in the food sector, is a significant factor that has contributed significantly to the industry's meteoric rise in size. Extruded plastics are essential for the production of containers, bottles, and wrappers in the food and beverage industry, amongst many other goods.

Construction and the use of building materials are two other applications that are driving the rise of the extruded plastics industry. The expansion and improvement of countries' infrastructures in every region of the world are driving an increase in demand for plastic materials. In addition, the continuous need for electronics, computers, and home appliances can be credited with contributing to growth projections for the plastic parts industry. The average customer in today's market has more discretionary income, which drives up the demand for products made of plastic. The electronic industry's most prevalent use is for the insulation and packaging of wires, switches, cables, and enclosures. This is also the sector's most common application.

Increasing Population Has a Significant Impact on Market Growth

The rise in population has resulted in a higher demand for a variety of consumer goods, which has caused the packaging industry to see significant expansion. This growth has led to the widespread utilization of extruded plastics in the production of films and wraps. For example, a survey that was issued by the National Investment Promotion and Facilitation Agency found that the value of the packaging business exceeded $917 billion in 2019, and it is anticipated that it will reach $1.05 trillion by 2026, rising at a CAGR of 2.8%. During the time frame covered by the forecast, this is one of the primary factors that will contribute to the expansion of the extruded plastics market. In addition, the building and construction sector is expanding at a rapid rate in both developed nations and developing economies. This is due to the rising demand for commercial space across a variety of industries, including offices, hotels, shopping malls, industrial corridors, and others. In addition, growing investments in the construction of infrastructure in nations such as the United States of America, China, Japan, Mexico, and India, amongst others, have led to the building and construction sector experiencing tremendous growth. For instance, the Indian government has an investment budget of $1.4 trillion for infrastructure, according to a report that was published by Invest India. Of this sum, 16% is given towards the development of urban infrastructure. Extruded plastics provide limitless design possibilities and can be bent, molded, or extruded to create the desired shape. Because they are poor heat and electricity conductors, extruded plastics find widespread application as insulating materials, cladding panels, and pipes in commercial and residential buildings as well as other construction sites. These are the most important drivers driving growth in the extruded plastics industry.

Extruded Plastics Replacing Metals – Compelling the Market Growth

On the other hand, extruded plastics are increasingly used as a substitute for metals in a variety of applications, including the production of long pipes and tubes that are used for irrigation in agriculture, the production of fishing rods for use in sports and leisure activities, and a number of other applications. In addition to this, they have an extremely strong resistance to corrosion, which encourages customers to make more linear purchases of items that are based on extruded plastics. A growing concentration of manufacturers, the availability of feedstock at reduced rates, and the emergence of local companies are some of the other factors that have contributed to the manufacturers offering extruded plastics at low prices. It is a significant aspect that is projected to present new opportunities in the market for extruded plastic materials all over the world.

Regulations Restricting the Use of Products based on Extruded Plastics Limiting the Market Growth

A number of nations like Taiwan, Bangladesh, the United Kingdom, China, and others have taken steps to prohibit the utilization of a variety of items that are based on extruded plastic. Because of this, the leading manufacturers of extruded plastics have experienced a setback in their production. In addition, the production of extruded plastics entails the emission of a number of hazardous chemical compounds, which are known to have a negative impact on human immune systems. Extruded plastics can cause irritation in the eye, vision loss, respiratory problems, dizziness, genotoxic, cardiovascular, and gastrointestinal issues when exposed to them for extended periods of time. This can lead to a host of other health issues as well. The growth of the market is hampered by this factor.

For the purpose of determining the extent to which extruded plastic products pose a risk to consumers' health over the long term, stringent law has mandated that manufacturers provide data on the products in question. It is possible that the expansion of the market will be hampered by the fact that was just discussed as well as by legislation governing international single-use packaging that is more stringent. Customers of extruded plastic products in today's society, who are becoming increasingly environmentally conscious, are concerned about the poor recycling rate of products made of single-use plastic. The relevant shift will also have an effect on the market for extruded plastics, which may finally result in the extinction of these items designed for single use.

Packaging Segment Remained as the Most Dominant End User in 2022

In 2022, the packaging end-use category dominated the global market and the market is expected to grow at a CAGR of 4% during the forecast period of 2026 to 2034. This is because of increased global trade, which has resulted in reduced trade barriers and rationalized tariffs, leading to increased international trade in packaging machinery and materials, with extruded plastics-based films being widely used for packaging applications. This is due to the fact that increased global trade has led to increased global trade. Because of increased demand from both consumers and industrial users, the market for extruded plastic packaging is expanding across the globe. This demand is coming from both sectors. As a result of the increasing demand for products and solutions using extruded plastic packaging, metal and glass packaging is being gradually phased out in favor of extruded plastic packaging (especially for food products). Extruded plastic is by far the most popular material for use in flexible packaging because of its high degree of malleability and its ability to be molded into a wide variety of configurations. In addition, the industry has undergone a great deal of technical advancement, which has resulted in a growth in the number of first-rate items that suppliers are making available in order to cater to the various requirements of their clientele.

Options for packaging that are not only high-performing but also have the potential to reduce the costs of manufacturing are highly sought after by manufacturers. Packaging for foods, beverages, and personal care products needs to be competitive, cost-effective, and aesthetically pleasing. Because of the aforementioned requirements, vendors have been forced to make use of emerging technologies in order to innovate their product offerings. For instance, in recent years, the extruded multilayer plastic packaging solutions market in Asia-Pacific has seen a change among its customers away from using simple paper bags. This shift has been witnessed among its customers. In order to build these extruded multilayer packaging solutions, new materials are being utilized. Some examples of these new materials are self-venting films. These films are used to package frozen food items that can be cooked using steam within the pack itself. It is anticipated that the development of novel applications for flexible packaging solutions for food, beverages, and other consumer items will fuel the expansion of the market.

Polyethylene, Remained as the Most Dominant Material Type in 2022

polyethylene category generated the most revenue in 2022 among the material type segment and is projected to rise at a CAGR of 3.8% during the forecast period. When compared to other forms of extruded plastics, polyethylene extrusion has the characteristics of being durable, translucent, having a low coefficient of friction, and has good resistance to chemicals. The expansion of this sector in the international market is being helped along by this factor. High-density polyethylene (HDPE), medium polyethylene, and low-density polyethylene (LDPE) grades are the most common types of extruded plastics that are made from polyethylene. Polyethylene-based extruded plastics are versatile and inexpensive. In comparison to the other types of extruded plastics, polyethylene extrusions have superior chemical resistance, are translucent, are durable, have a low coefficient of friction, and have a low coefficient of friction. This element is contributing significantly to the rapid expansion of this sector in the international market.

The Films Applications Led the Market in 2022

The film application dominated the global market in 2022 and is projected to increase at a compound annual growth rate (CAGR) of 3.9% during the forecast period. This can be ascribed to the fact that films made from extruded plastics are utilized extensively for packaging applications in a variety of end-use industries, including food and beverage, pharmaceutical, agricultural, and others. In addition, the growing awareness of health and hygiene-related activities has led to an increase in the market for packaged consumer goods. Extruded plastic-based films are frequently utilized for packaging applications because they offer a number of advantages over other materials. The expansion of the segment of the film in the global market for extruded plastics is being aided by the aforementioned causes.

APAC Both the Largest and Fastest Growing Region

It is anticipated that the market will continue expanding in the Asia Pacific region, which was the region with the highest rate of expansion during the forecast period by registering a CAGR of 5%. The region was also the most dominant market with its contribution of 40% of the global revenue share. This expansion will be driven by urbanization and economic growth, which will benefit the automotive, packaging, and construction industries. It is anticipated that the largest contributions will come from Japan, India, Thailand, and South Korea respectively. according to a report that was published by the United Nations Statistics Division in 2019, China was responsible for approximately 28.7% of the total manufacturing output worldwide for consumer electronic products. In addition to this, nations like India and Australia are observing a rapid increase in the automotive sectors of their economies. Extruded plastics are widely used in sealing systems to improve the aerodynamics of vehicles in these nations. For example, a report that was issued by the India Brands Equity Foundation found that the number of passenger vehicles in March 2022 stood at 279,745 units, marking an increase of 28.39% when compared to the number of units that were sold in March 2021, which was 217,879 units.

The expansion of the extrusion business is being driven in part by several causes in Europe, including the desire for fuel-efficient automobiles and the presence of a strong medical base in the region. Germany, France, and the United Kingdom are the countries that have made the most significant contributions to this sector. The expansion that is brought on by industrialization will continue to bring about an increase in construction and the products that go along with it in Latin America. Brazil and Chile are the two countries that contribute the most to that area. It is anticipated that improvements to infrastructure in the Middle East, particularly in Saudi Arabia and the United Arab Emirates, will lead to expansions in the plastics industry.

Market to Remain Fragmented, and Combination of Strategies Enabling the Companies to Gain Market Position

The market for extruded plastics around the world is extremely fragmented with the presence of both global and domestic companies such as Dow, Sigma Plastics Group, ExxonMobil Chemical Company, Bemis Company Inc., SABIC, Chevron Phillips Chemical Company LLC, JM Eagle, Berry Plastics Corporation, Saint-Gobain S.A., and Sealed Air Corporation. Mergers, acquisitions, product launches, contributions, and collaborations among key market players are some of the strategies that key market players are adopting to gain competitive advantages and recognition in their respective markets. Companies are also increasing their production capabilities. For instance, On March 4, 2026, Sigma Stretch Film upgraded its production capabilities at its facilities in Tulsa, Oklahoma, and Belleville, Ontario, by purchasing two new cast film production lines each. SML Maschinengesellschaft of Redlham, Austria, is scheduled to deliver the lines in 2025, at which point the capacities at each location will have been significantly increased. The machinery in Tulsa will be installed in place of an existing line, and the new line in Ontario will be constructed within an entirely new wing of the complex there.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Extruded Plastics market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Applications

|

|

End-User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report