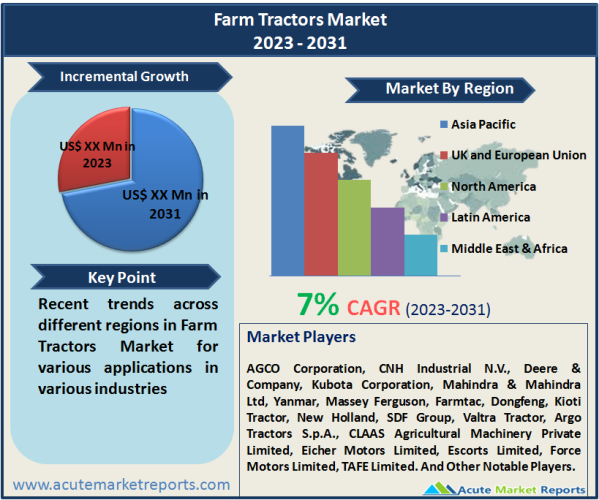

The farm tractors market is expected to grow at a CAGR of 7% during the forecast period of 2026 to 2034. The farm tractor market is a vital segment of the agriculture industry, providing essential machinery for various farming activities. Farm tractors are versatile vehicles used for pulling or pushing agricultural implements, performing tasks such as plowing, tilling, planting, and harvesting. The market revenue of the farm tractors industry has experienced steady growth over the years, driven by the increasing mechanization of agriculture, rising global food demand, and the need for enhanced operational efficiency. The growth of the farm tractors market can be attributed to several factors. Firstly, the increasing adoption of mechanized farming practices and the shift from manual labor to machine-assisted operations have fueled the demand for farm tractors. Farm tractors enable farmers to accomplish tasks more efficiently, reduce manual labor requirements, and increase productivity. This has become particularly crucial in regions facing labor shortages and the need for improved agricultural output. Secondly, the growing population and rising food consumption have increased the demand for agricultural products. Farm tractors play a pivotal role in increasing agricultural productivity by facilitating timely and efficient farming operations. They enable farmers to cultivate larger areas of land, increase crop yields, and meet the demand for food, feed, and other agricultural products. Additionally, technological advancements have significantly contributed to the growth of the farm tractors market. Manufacturers are incorporating advanced features such as GPS navigation, precision farming technologies, telematics, and automation, which enhance operational efficiency, improve accuracy, and optimize resource utilization. These technological innovations are enabling farmers to achieve better crop management, reduce input costs, and minimize environmental impact. Moreover, government initiatives and subsidies promoting agricultural mechanization have positively influenced the farm tractors market. Many governments around the world are offering financial incentives, subsidies, and favorable policies to encourage farmers to adopt modern farming equipment, including farm tractors. These initiatives aim to support agricultural development, improve farm productivity, and ensure food security.

Increasing Farm Mechanization

One of the key drivers of the farm tractor market is the increasing trend of farm mechanization. Farmers worldwide are adopting mechanized farming practices to improve productivity, efficiency, and profitability. Farm tractors play a crucial role in mechanized agriculture by enabling farmers to perform a wide range of tasks such as plowing, tilling, planting, and harvesting. The shift from traditional manual labor to machine-assisted operations offers numerous benefits, including increased productivity, reduced labor costs, and faster completion of farming activities. According to a report by the Food and Agriculture Organization (FAO), farm mechanization is rapidly increasing in developing countries, driven by the need to improve agricultural productivity and address labor shortages. A study conducted by researchers at Purdue University found that farm mechanization significantly increased crop production and farm income in smallholder farming systems in Sub-Saharan Africa.

Rising Global Food Demand

The growing global population and increasing food demand are driving the demand for farm tractors. As the world population continues to expand, there is a greater need for agricultural products to feed the population. Farm tractors enable farmers to cultivate larger areas of land, increase crop yields, and meet the rising demand for food, feed, and other agricultural products. The efficiency and productivity gains provided by farm tractors contribute to meeting the growing global food demand. The United Nations projects that the global population will reach 9.7 billion by 2050, necessitating a substantial increase in agricultural production. The Food and Agriculture Organization (FAO) estimates that global food production needs to increase by 70% by 2050 to meet the demands of the growing population.

Technological Advancements

Technological advancements play a significant role in driving the farm tractors market. Manufacturers are continuously investing in research and development to introduce innovative technologies and features in farm tractors. Advanced features such as GPS navigation, precision farming technologies, telematics, and automation are improving the efficiency and effectiveness of farming operations. These technologies enable farmers to optimize resource utilization, improve crop management practices, and enhance overall farm productivity. Precision farming technologies, such as variable-rate application systems, help optimize the use of fertilizers, pesticides, and irrigation, resulting in cost savings and improved environmental sustainability. GPS-based guidance systems integrated into farm tractors enable precise and efficient field operations, reducing overlap and minimizing input wastage.

High Initial Investment and Cost of Ownership

One significant restraint in the farm tractors market is the high initial investment and cost of ownership associated with purchasing and maintaining farm tractors. Farm tractors are capital-intensive equipment, and their purchase requires a substantial upfront investment. Additionally, the cost of ownership includes expenses related to fuel, maintenance, repairs, and spare parts. Farmers, especially small and medium-sized ones with limited financial resources, may face challenges in affording the initial purchase and ongoing maintenance costs of farm tractors. The high cost of ownership can act as a barrier to entry and limit the adoption of farm tractors, particularly in regions with lower agricultural incomes or where farmers rely heavily on traditional manual labor or smaller-scale farming practices. A study conducted by the University of Tennessee found that high equipment costs were a major barrier to the adoption of mechanized agriculture among small-scale farmers in the U.S. Farmers' experiences shared on online farming forums frequently highlight the concern over the high initial investment and ongoing expenses of farm tractors, emphasizing the need for careful financial planning and consideration of alternative options. Addressing the restraint of high initial investment and cost of ownership requires various approaches. Government support programs, subsidies, and financing options tailored for the agricultural sector can help alleviate the financial burden on farmers and incentivize the adoption of farm tractors. Manufacturers can also explore innovative business models, such as leasing or rental programs, to make farm tractors more accessible and affordable. Furthermore, advancements in technology that improve fuel efficiency and reduce maintenance requirements can help lower the overall cost of ownership for farmers. By addressing these challenges, the farm tractors market can overcome the restraint of high initial investment and cost of ownership, allowing more farmers to benefit from the advantages of mechanized agriculture.

More than 100 HP Segment Led the Market by Engine Power

The farm tractors market can be segmented based on engine power, including three segments: Less than 40 HP, 41 to 100 HP, and More than 100 HP. Among these segments, the Less than 40 HP segment is expected to witness the highest CAGR during the forecast period of 2026 to 2034. This can be attributed to the increasing demand for small and compact tractors for small-scale farming operations, gardening, and landscaping purposes. These tractors are often preferred by smallholder farmers, hobby farmers, and operators with limited land areas or specific niche requirements. While the Less than 40 HP segment demonstrates the highest CAGR, the More than 100 HP segment held the highest revenue share in the farm tractors market in 2025. This is primarily due to the extensive use of high-powered tractors in large-scale commercial farming, where higher horsepower is required for heavy-duty tasks such as plowing, harvesting, and operating larger implements and machinery. The More than 100 HP tractors offer superior performance, enhanced productivity, and greater versatility for large farms and specialized agricultural operations. The 41 to 100 HP segment holds a significant share in both CAGR and revenue, catering to a wide range of farming applications, including medium-sized farms and a variety of crop types.

The 2WD segment Led the Market by Driveline Type

The farm tractors market can be segmented based on the driveline type, including two segments: 2WD (2-wheel drive) and 4WD (4-wheel drive). Among these segments, the 4WD segment is expected to witness the highest CAGR during the forecast period of 2026 to 2034. This can be attributed to the increasing demand for enhanced traction, maneuverability, and performance in various farming conditions. 4WD tractors offer superior traction and power distribution to all four wheels, allowing farmers to operate efficiently on challenging terrains, such as hilly or uneven fields. The 4WD segment is particularly popular among large-scale and commercial farmers who require tractors capable of handling heavy-duty tasks and operating with larger implements. While the 4WD segment demonstrates the highest CAGR, the 2WD segment held the highest revenue share in the farm tractors market in 2025. This is primarily due to its widespread adoption among small and medium-scale farmers, as well as for specific farming applications where maneuverability and cost-effectiveness are key factors. 2WD tractors are more budget-friendly, lighter, and easier to operate and maintain compared to their 4WD counterparts. They are commonly used in flat or level terrain, where enhanced traction and maneuverability are not critical requirements. The 2WD segment caters to a diverse range of farming operations, including horticulture, small-scale farming, and certain specialty crops.

APAC to Promise Significant Opportunities during the Forecast Period

The Asia Pacific region is projected to experience the highest CAGR during the forecast period of 2026 to 2034. This growth can be attributed to several factors, including the increasing population, rising disposable incomes, and the need for improved agricultural productivity in countries like India and China. These countries are witnessing a shift from manual labor to mechanized farming practices, resulting in increased demand for farm tractors. Europe held the highest revenue percentage in the farm tractors market in 2025. The market trends indicate a shift towards developing regions with growing populations, rising incomes, and increasing agricultural mechanization, offering opportunities for market players to expand their presence and cater to the evolving needs of farmers in these regions. The region is expected to hold a substantial revenue percentage in the market, driven by the presence of technologically advanced agricultural economies such as Germany, France, and the Netherlands. These countries have a strong agricultural sector and are known for their adoption of precision farming techniques. North America has traditionally been a prominent market for farm tractors, driven by the presence of large-scale commercial farming operations, advanced farming techniques, and high mechanization levels. However, the market in North America is expected to witness a moderate growth rate in terms of CAGR due to market maturity. Latin America, particularly countries like Brazil and Argentina, also contributes significantly to the farm tractors market. These countries have a large agricultural base and are major exporters of agricultural commodities. They are increasingly adopting mechanized farming practices to improve efficiency and meet the growing demand for agricultural products.

The Market Competition to Intensify during the Forecast Period

The farm tractors market is highly competitive, with several key players vying for market share and striving to strengthen their positions. Some of the top players in the industry include AGCO Corporation, CNH Industrial N.V., Deere & Company, Kubota Corporation, Mahindra & Mahindra Ltd, Yanmar, Massey Ferguson, Farmtac, Dongfeng, Kioti Tractor, New Holland, SDF Group, Valtra Tractor, Argo Tractors S.p.A., CLAAS Agricultural Machinery Private Limited, Eicher Motors Limited, Escorts Limited, Force Motors Limited, TAFE Limited. These companies have established themselves as leaders in the farm tractors market through their extensive product portfolios, strong distribution networks, and focus on innovation. The competitive landscape of the farm tractors market is characterized by various key trends. One notable trend is the emphasis on technological advancements and innovation. Major players are investing in research and development to introduce new features, improved efficiency, and advanced technologies in their tractor models. This includes the integration of precision farming technologies, telematics, automation, and connectivity solutions to enhance tractor performance, optimize farming operations, and improve productivity. Another trend is the expansion of product offerings to cater to diverse customer needs. Leading companies are developing a wide range of tractor models, offering varying power ranges, driveline types, and specialized features to address the requirements of different farming applications and customer segments. This allows them to capture a larger market share and cater to a broad customer base, ranging from small-scale farmers to large commercial operations. Strategic partnerships and collaborations are also prevalent in the farm tractors market. Companies are entering into alliances with technology providers, component suppliers, and agricultural organizations to leverage synergies, access new markets, and enhance their product offerings. These collaborations often focus on developing integrated solutions, such as precision farming packages, aftermarket services, and digital platforms, which provide comprehensive solutions to farmers. Market players are also adopting strategies to strengthen their distribution networks and expand their geographical presence. This involves establishing regional offices, dealership networks, and service centers to ensure widespread availability and customer support. The focus is on reaching out to farmers in both established and emerging markets, where agricultural mechanization is gaining momentum. Furthermore, companies are placing increasing importance on sustainability and environmental considerations. They are developing tractors with improved fuel efficiency, lower emissions, and reduced environmental impact. This aligns with the growing demand for environmentally friendly farming practices and the need to meet stringent emission standards and regulations.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Farm Tractors market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Billion |

| Segmentation | |

Engine Power

|

|

Driveline Type

|

|

System

|

|

Design

|

|

|

Region Segment (2024-2034; US$ Billion)

|

Key questions answered in this report