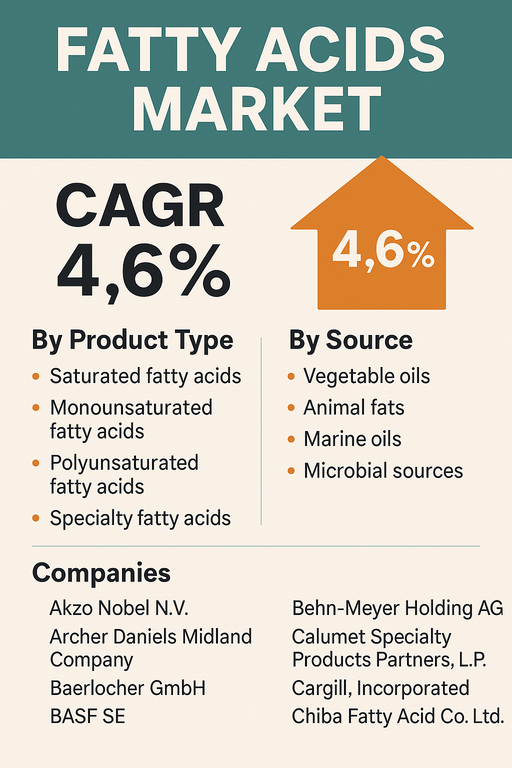

The global fatty acids market is projected to grow at a CAGR of 4.6% from 2025 to 2033, driven by increasing demand for functional ingredients in food, personal care, pharmaceuticals, and industrial applications. Fatty acids are critical components in nutritional products, cosmetic formulations, biodiesel production, and chemical intermediates. The market is experiencing steady growth due to rising health awareness, growing consumption of processed and fortified foods, and expanding usage of bio-based chemicals in various manufacturing sectors. Sustainable sourcing, technological innovation, and regulatory compliance are central to future growth strategies.

Market Drivers

Growing Use in Nutritional and Functional Food Applications

Fatty acids especially omega-3 and omega-6 polyunsaturated variants are widely used in dietary supplements and fortified food products for their cardiovascular and anti-inflammatory benefits. Increasing consumer focus on preventive healthcare and rising awareness of essential fatty acids (EFAs) are fueling demand for high-purity polyunsaturated fatty acids (PUFAs), particularly in developed markets. Additionally, saturated and monounsaturated fatty acids continue to find use in baked goods, dairy products, and processed foods, reinforcing their steady market consumption.

Rising Demand in Industrial and Oleochemical Applications

Fatty acids serve as base materials for the production of soaps, lubricants, surfactants, plasticizers, and coatings. As the chemical industry shifts toward bio-based alternatives, fatty acids derived from vegetable oils and animal fats are replacing petroleum-based ingredients in several applications. Sectors such as paints & coatings, agrochemicals, rubber processing, and textiles are increasing their reliance on fatty acids due to their biodegradability, low toxicity, and compatibility with green chemistry trends.

Market Restraint

Price Volatility in Raw Materials and Supply Chain Disruptions

The fatty acids market is vulnerable to fluctuations in the availability and pricing of key raw materials such as palm oil, coconut oil, and fish oil. Geopolitical tensions, adverse weather conditions, and environmental restrictions on deforestation and animal harvesting impact supply stability. Additionally, inconsistent quality control in raw material procurement and transportation challenges in emerging markets can disrupt manufacturing timelines and affect profit margins.

Market Segmentation by Product Type

The market is segmented into Saturated Fatty Acids, Monounsaturated Fatty Acids, Polyunsaturated Fatty Acids, and Specialty Fatty Acids. In 2024, Saturated Fatty Acids accounted for the largest share, widely used in soaps, detergents, and lubricants due to their stable chemical properties. Polyunsaturated Fatty Acids (PUFAs) are expected to grow at the highest CAGR due to increasing inclusion in nutraceuticals, pharmaceuticals, and infant nutrition. Monounsaturated Fatty Acids are gaining attention for their cardiovascular benefits, while Specialty Fatty Acids serve niche functions in cosmetics, drug delivery, and specialty coatings.

Market Segmentation by Source

By source, the market is categorized into Vegetable Oils, Animal Fats, Marine Oils, and Microbial Sources. Vegetable Oils dominated the market in 2024, particularly palm, soybean, and canola oil, due to their abundant availability and ease of processing. Animal Fats continue to be used in traditional industrial processes, although their share is gradually declining due to sustainability and ethical sourcing concerns. Marine Oils (e.g., fish oil, krill oil) are key sources of omega-3 PUFAs. Microbial Sources are emerging as a sustainable and scalable option for producing high-purity specialty fatty acids, with ongoing R&D in fermentation and synthetic biology.

Geographic Trends

Asia Pacific led the global fatty acids market in 2024, driven by strong production of vegetable oils in Malaysia, Indonesia, and India, coupled with growing downstream demand in food, personal care, and industrial sectors. North America and Europe followed, with significant adoption in health supplements, biodiesel production, and cosmetics. Latin America and the Middle East & Africa are witnessing rising demand, especially in oleochemicals and agro-processing industries, fueled by increasing industrialization and local sourcing capabilities.

Competitive Trends

The fatty acids market is competitive, with companies focusing on feedstock diversification, cost optimization, and product innovation. BASF SE, Croda International Plc, and Evonik Industries AG lead in specialty and high-purity applications, leveraging strong R&D and global distribution. Cargill, Archer Daniels Midland Company, and Godrej Industries Limited operate integrated supply chains in vegetable-based fatty acid production. Emery Oleochemicals and Baerlocher GmbH specialize in industrial and polymer-grade fatty acids. Companies like Eastman Chemical, Akzo Nobel N.V., and Behn-Meyer Holding AG are investing in downstream product customization. Sustainability certifications, traceability of raw materials, and strategic regional expansions remain key growth enablers.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Fatty Acids market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Source

| |

Manufacturing Process

| |

Application

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report