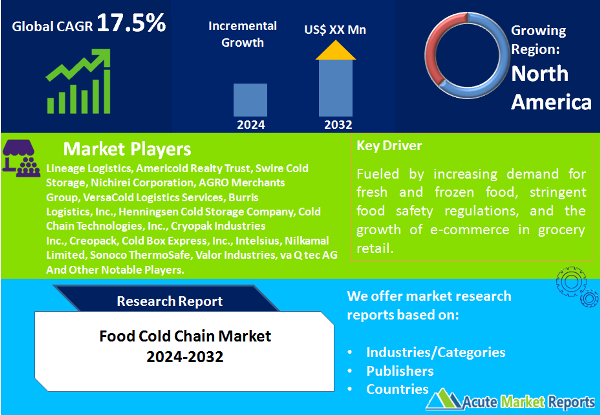

The food cold chain market is a critical component of the global supply chain, ensuring the safe and efficient transportation and storage of perishable goods. The food cold chain market is expected to grow at a CAGR of 17.5% during the forecast period of 2026 to 2034, fueled by increasing demand for fresh and frozen food, stringent food safety regulations, and the growth of e-commerce in grocery retail. However, the high initial investment and operational costs pose a significant restraint, requiring companies to balance expansion with cost management strategies. Market segmentation reflects the industry's adaptability, with storage dominating revenue in 2025, while monitoring components exhibit the highest anticipated CAGR. Geographic trends showcase the potential for growth in Asia-Pacific and the established market in North America. Competitive trends highlight the dynamic strategies adopted by major players, including Lineage Logistics, Americold Realty Trust, and others. These companies leverage technology, expansion, and partnerships to maintain a competitive edge. As the food cold chain market progresses from 2026 to the forecast period of 2034, strategic positioning, innovation, and adaptability will be critical for sustained success in this essential industry.

Increasing Demand for Fresh and Frozen Food

The growing consumer preference for fresh and frozen food products is a significant driver for the food cold chain market. With a rising awareness of health and nutrition, consumers seek access to a variety of perishable items, including fruits, vegetables, dairy, and frozen meals. Companies like Lineage Logistics and Americold Realty Trust have capitalized on this trend by expanding their cold storage capacities to accommodate the increasing demand for a diverse range of fresh and frozen products. The evidence lies in the substantial investments made by these companies in building new cold storage facilities and upgrading existing ones to meet the evolving market needs.

Stringent Food Safety Regulations

Stringent food safety regulations imposed by governments and international bodies have become a driving force for the food cold chain market. Compliance with these regulations is crucial for maintaining the quality and safety of perishable products throughout the supply chain. Companies such as Swire Cold Storage and Nichirei Corporation have implemented advanced monitoring and control systems to ensure temperature integrity and adherence to regulatory standards. The evidence lies in their commitment to certifications like Hazard Analysis and Critical Control Points (HACCP) and International Organization for Standardization (ISO) standards, providing a framework for safe food handling and distribution.

E-commerce Growth in Grocery Retail

The rapid growth of e-commerce in the grocery retail sector has emerged as a key driver for the food cold chain market. Online platforms like Amazon Fresh and Instacart have witnessed a surge in demand for fresh and frozen food items delivered directly to consumers' doorsteps. This trend has prompted cold chain logistics providers to enhance their transportation and last-mile delivery capabilities. Companies such as Preferred Freezer Services and AGRO Merchants Group have strategically positioned themselves to cater to the evolving needs of e-commerce grocery retail, investing in advanced refrigerated transportation fleets and distribution centers. The evidence lies in the expansion of their infrastructure and the adoption of technologies like real-time tracking for temperature-sensitive shipments.

High Initial Investment and Operational Costs

While the food cold chain market experiences growth, high initial investment and operational costs present a notable restraint. Establishing and maintaining cold storage facilities, refrigerated transportation, and monitoring systems require substantial capital. Companies face ongoing operational expenses for energy consumption and maintenance. Despite the potential returns, the evidence of this restraint lies in the cautious approach of companies like AGRO Merchants Group and VersaCold Logistics Services, which carefully balance expansion with cost management strategies to ensure long-term sustainability in a capital-intensive industry.

Market Analysis by Type of Food Cold Chain: Storage Segment Dominates the Market

In 2025, the highest revenue in the food cold chain market was generated from the storage segment, as companies invested significantly in expanding their cold storage capacities. However, the highest Compound Annual Growth Rate (CAGR) during the forecast period (2026-2034) is expected from the monitoring components segment. The emphasis on real-time monitoring and advanced technologies, such as Internet of Things (IoT) sensors, reflects the industry's commitment to ensuring the integrity of the cold chain, thereby fostering future growth.

Market Analysis by Construction Type: Grocery Stores Dominate the Market

Grocery stores led the market in revenue in 2025, driven by the increasing demand for fresh produce and perishable items from consumers. However, the highest CAGR during the forecast period is anticipated from the "Others" category, encompassing specialized storage and distribution facilities catering to specific industries. This dual segmentation approach reflects the market's responsiveness to varied demands, with grocery stores meeting immediate consumer needs and specialized facilities catering to niche markets, driving overall market growth.

North America Remains the Global Leader

Geographically, the Asia-Pacific region is poised to exhibit the highest CAGR, driven by population growth, urbanization, and changing consumer preferences. North America is expected to contribute the highest revenue percentage, emphasizing the established cold chain infrastructure in the region. These geographic trends highlight the need for companies to tailor their strategies to diverse market conditions, recognizing the unique challenges and opportunities presented by different regions.

Market Expansion Strategies to Enhance Market Share

In 2025, major players in the food cold chain market included Lineage Logistics, Americold Realty Trust, Swire Cold Storage, Nichirei Corporation, Preferred Freezer Services, AGRO Merchants Group, VersaCold Logistics Services, Burris Logistics, Inc., Henningsen Cold Storage Company, Nordic Logistics, Wabash National, Cold Chain Technologies, Inc., Cryopak Industries Inc., Creopack, Cold Box Express, Inc., Intelsius, Nilkamal Limited, Sofrigam, Softbox Systems Ltd., Sonoco ThermoSafe, Valor Industries, va Q tec AG, and others. These companies adopted diverse strategies, including facility expansions, technology integration, and strategic partnerships, to strengthen their market positions. The evidence lies in Lineage Logistics' acquisition of Emergent Cold, expanding its global footprint, and AGRO Merchants Group's investment in automated storage and retrieval systems. As of 2026, the competitive landscape indicates a dynamic market with companies strategically positioning themselves to capitalize on emerging trends. Revenues for 2026 and the expected landscape for the forecast period (2026-2034) reveal a competitive environment where innovation, market awareness, and geographic strategies play crucial roles in determining success.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Food Cold Chain market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Construction Type

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report