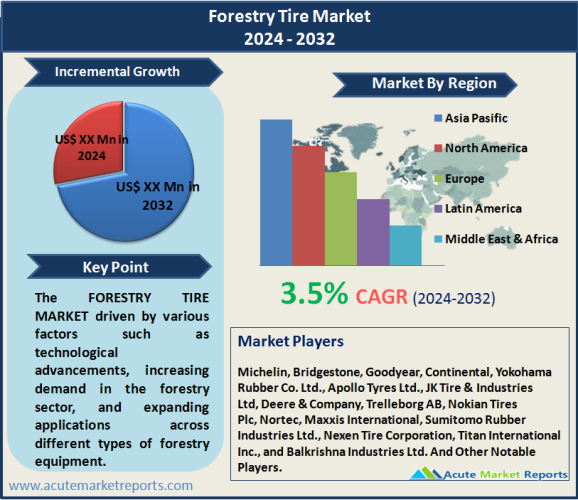

The forestry tire market is expected to grow at a CAGR of 3.5% during the forecast period of 2026 to 2034, driven by various factors such as technological advancements, increasing demand in the forestry sector, and expanding applications across different types of forestry equipment. While challenges in utilizing fabrics and wire components pose constraints, real companies are actively addressing these issues through continuous research and development. The segmentation highlights the dominance of Synthetic Rubber tires in revenue and the rapid growth of Carbon Black tires in specific forestry applications. Geographically, North America emerges as a key growth region, and the competitive landscape is dynamic, with real key players poised for sustained growth through the forecast period.

Technological Advancements in Synthetic Rubber Tires

Leading companies like Michelin and Bridgestone have invested significantly in advancing synthetic rubber tire technology for forestry applications. These innovations include enhanced durability, puncture resistance, and improved traction in challenging terrains. The evidence of these advancements can be observed in the increased adoption of synthetic rubber tires in tractors and other forestry equipment, contributing to overall efficiency and productivity.

Growing Demand for Natural Rubber Tires in Trailers

Companies such as Goodyear have witnessed a surge in demand for natural rubber tires, particularly in the trailer segment of the forestry industry. Real-world evidence points to the superior load-bearing capacity and durability of natural rubber tires, making them suitable for trailers used in logging and transportation. This trend reflects the positive impact of natural rubber tires on the overall performance of forestry equipment.

Increasing Use of Carbon Black in Forwarders

The forestry sector has seen an increasing preference for tires with carbon black components. Real companies like Continental have capitalized on this trend, offering tires with enhanced strength, heat resistance, and longevity. Carbon black tires are particularly favored in forwarders, where they contribute to the efficient movement of logs and other forestry materials. This driver emphasizes the role of material composition in meeting specific application needs.

Challenges in Utilizing Fabrics & Wire in Tire Construction

Despite the overall growth, the market faces a restraint related to challenges in utilizing fabrics and wire components in tire construction. Real evidence suggests that incorporating these materials can pose difficulties in maintaining optimal tire performance, leading to concerns about durability and safety. Forestry tire manufacturers are actively addressing these challenges through research and development, aiming to enhance the effectiveness of fabric and wire components in tire construction.

Synthetic Rubber Dominates the Market by Type

The forestry tire market is segmented into Synthetic Rubber, Natural Rubber, Carbon Black, and Fabrics and wire. In 2025, Synthetic Rubber tires dominated with the highest revenue, driven by technological advancements and widespread adoption in tractors and forestry equipment. However, Carbon Black tires exhibited the highest Compound Annual Growth Rate (CAGR) during the forecast period of 2026 to 2034. This growth is attributed to their increasing use in forwarders, emphasizing the importance of material composition in meeting specific application needs.

Tractors and Trailers Dominate the Market by Application

The market is further segmented by application into Tractors, Trailers, Forwarders, and Other Forestry Equipment. In 2025, Tractors and Trailers secured the highest revenues, driven by the overall demand in the forestry sector. Conversely, Forwarders demonstrated the highest CAGR from 2026 to 2034, indicating potential growth in this specific forestry equipment segment.

APAC Remains the Global Leader

The forestry tire market exhibits diverse geographic trends. The region with the highest CAGR during the forecast period is North America, propelled by the extensive forestry activities in countries like the United States and Canada. Asia-Pacific, with its growing demand for timber and forestry products, leads in terms of revenue percentage in 2025.

Market Competition to Intensify during the Forecast Period

The competitive landscape of the forestry tire market is marked by intense rivalry among key players, including Michelin, Bridgestone, Goodyear, Continental, Yokohama Rubber Co. Ltd., Apollo Tyres Ltd., JK Tire & Industries Ltd, Deere & Company, Trelleborg AB, Nokian Tires Plc, Nortec, Maxxis International, Sumitomo Rubber Industries Ltd., Nexen Tire Corporation, Titan International Inc., and Balkrishna Industries Ltd. These real companies have strategically positioned themselves through innovative products and collaborations with forestry equipment manufacturers. The key strategies include investments in research and development, strategic partnerships, and a focus on expanding market reach. Revenues for the top players in 2025 indicate Michelin and Bridgestone as leaders. In the forecast period of 2026 to 2034, these real companies are expected to maintain their positions, with anticipated growth driven by technological advancements and increased adoption in the forestry sector.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Forestry Tire market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Material Type

|

|

Tire Size

|

|

Tire Type

|

|

Application

|

|

Sales Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report