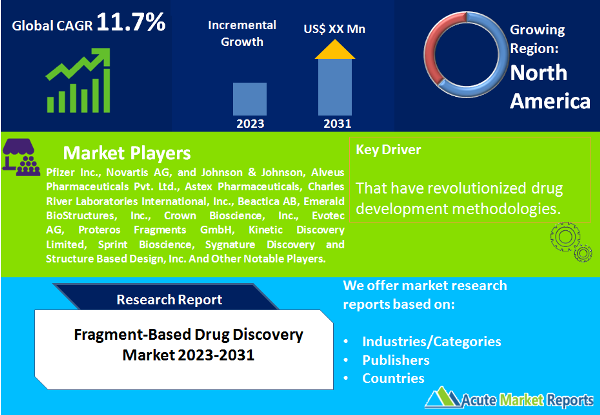

The fragment-based drug discovery (FBDD) market is expected to experience a CAGR of 11.7% during the forecast period of 2026 to 2034, driven by several key drivers that have revolutionized drug development methodologies. FBDD is a robust and innovative approach that has gained prominence in the pharmaceutical industry due to its ability to identify highly potent lead compounds with lower molecular weight, ultimately simplifying the chemical synthesis and optimization process. This analysis provides a brief overview of the fragment-based drug discovery market and delves into the three main drivers, along with an exploration of one significant restraint impacting the market. Additionally, we will examine the market's segmentation by component and end-user, highlighting segments with the highest revenue and Compound Annual Growth Rate (CAGR), as well as geographic trends, regions with the highest CAGR, and regions with the highest revenue percentage. Furthermore, we will explore the competitive landscape, including top players and key strategies for the forecast period from 2026 to 2034.

Enhanced Drug Discovery Efficiency

The remarkable efficiency of fragment-based drug discovery is a key driver behind its adoption in the pharmaceutical industry. Traditional high-throughput screening methods often involve screening large compound libraries, which can be time-consuming and resource-intensive. In contrast, FBDD focuses on the initial screening of small chemical fragments, which simplifies the process by targeting critical interactions with the drug target. This targeted approach significantly increases the probability of identifying lead compounds with high affinity, potency, and specificity, thus accelerating the drug discovery timeline. FBDD also enables the exploration of chemical space more effectively by screening smaller fragments, allowing for a broader coverage of potential lead structures. The efficient identification of promising lead compounds early in the drug development process reduces the risk of costly failures at later stages, enhancing overall drug discovery efficiency.

Rising Demand for Targeted Therapies

The increasing demand for targeted therapies has been a significant driver propelling the adoption of fragment-based drug discovery. Targeted therapies focus on specific molecular targets involved in disease processes, which offers the potential for more precise and personalized treatment options. FBDD allows researchers to design drugs that specifically interact with the desired target, minimizing off-target effects and reducing the risk of adverse reactions. As personalized medicine gains traction, fragment-based drug discovery provides a valuable tool to identify lead compounds tailored to individual patient needs. This demand for targeted therapies has also been driven by the growing prevalence of complex diseases, such as cancer and autoimmune disorders, which require treatments that can selectively act on specific disease pathways.

Advancements in Structural Biology and Computational Techniques

Advancements in structural biology and computational techniques have been instrumental in driving the success of fragment-based drug discovery. Structural biology techniques, such as X-ray crystallography and nuclear magnetic resonance (NMR) spectroscopy, provide detailed insights into the three-dimensional structures of drug targets. This valuable information aids in the identification of potential binding sites for small fragments, guiding the design of more effective lead compounds. Computational techniques, including molecular docking and virtual screening, complement experimental methods by predicting the binding affinities and interactions between fragments and target proteins. These techniques significantly accelerate the screening process, allowing researchers to efficiently explore a vast chemical space and identify promising fragment hits.

Limited Fragment Chemical Diversity

Despite its many advantages, the fragment-based drug discovery market faces a significant restraint related to the limited chemical diversity of fragments. FBDD relies on screening relatively small fragments, and this can restrict the variety of chemical functionalities represented in the initial fragment libraries. As a result, certain chemical interactions and binding sites may not be adequately explored during the early stages of the drug discovery process. Limited chemical diversity can potentially lead to overlooking essential chemical interactions or target classes that could result in the identification of highly potent lead compounds. Addressing this restraint requires continuous efforts to expand and diversify fragment libraries, either through internal research or collaborations with other research institutions.

Market Segmentation by Component

In 2025, Fragment Optimization held a prominent position in the FBDD market. The elaboration and optimization of initial fragment hits to develop lead compounds involve extensive research and expertise. Pharmaceutical companies are willing to invest significantly in Fragment Optimization services as it is a critical stage in the drug discovery process. Moreover, the growing understanding of structure-activity relationships and advancements in medicinal chemistry techniques contribute to the higher revenue potential of Fragment Optimization services.

Market Segmentation by End-User

In 2025, Pharmaceutical companies represent the highest revenue-generating end-user segment in the fragment-based drug discovery market. These companies actively utilize FBDD to identify potential lead compounds for various therapeutic targets.Pharmaceutical companies often have extensive drug discovery pipelines and research budgets, allowing them to invest in innovative approaches like FBDD. As the need for novel drug candidates continues to rise, pharmaceutical companies leverage FBDD's efficiency and ability to identify highly potent lead compounds, driving the segment's significant revenue share.

Geographic Segment

As of 2026, North America led the market in terms of revenue, driven by its advanced healthcare infrastructure, well-established pharmaceutical industry, and significant research and development investments. However, the Asia Pacific region is expected to witness the highest CAGR during the forecast period from 2026 to 2034. The Asia Pacific region's projected high CAGR can be attributed to several factors, including the increasing prevalence of chronic diseases, the growing focus on drug development, and the rising investments in research and development activities. Additionally, the region's vast patient population offers substantial opportunities for targeted therapies, driving the demand for fragment-based drug discovery services.

Competitive Trends and Key Strategies

The fragment-based drug discovery market is competitive, with key players vying for market share through strategic initiatives. Some of the top players in the market include Pfizer Inc., Novartis AG, and Johnson & Johnson, Alveus Pharmaceuticals Pvt. Ltd., Astex Pharmaceuticals, Charles River Laboratories International, Inc., Beactica AB, Emerald BioStructures, Inc., Crown Bioscience, Inc., Evotec AG, Proteros Fragments GmbH, Kinetic Discovery Limited, Sprint Bioscience, Sygnature Discovery and Structure Based Design, Inc. And Other Notable Players. These companies employ various strategies to strengthen their market position and gain a competitive edge in the industry. Many key players engage in collaborations and partnerships with academic institutions, research organizations, and other pharmaceutical companies to access novel technologies, expand their research capabilities, and share expertise. Collaborations allow companies to combine resources and expertise, facilitating the efficient identification of lead compounds.Leading players continuously invest in research and development activities to expand their drug discovery pipelines and explore innovative therapeutic targets. The commitment to ongoing research enables these companies to stay at the forefront of FBDD advancements and identify new opportunities for drug development.To maintain a strong market presence, top players often focus on expanding their product portfolios by introducing novel fragment libraries, specialized services, and integrated drug discovery solutions. The diversification of offerings caters to the specific needs of various pharmaceutical and biotechnology companies.Key players also emphasize geographical expansion to tap into emerging markets with a high demand for drug discovery services. Expanding their presence in regions with favorable regulatory environments and growing research and development activities opens up new growth opportunities.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Fragment-Based Drug Discovery market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Component

|

|

Application

|

|

End-User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report