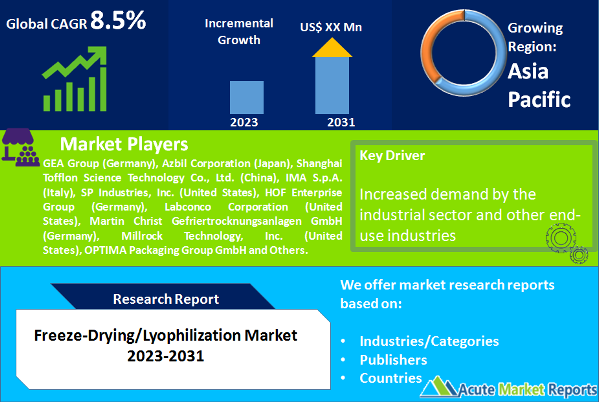

The global freeze-drying market is predicted to grow at a CAGR of 8.5% during the forecast period of 2026 to 2034. Increasing demand for food preservation, rapid growth in contract manufacturing and lyophilization services across the globe, rising demand for lyophilized products (particularly for the production of new biologic drugs and injectable formulations), and technological advancements in lyophilization methods are the major factors driving the growth of this market. On the other hand, the increasing use of alternative drying techniques in the pharmaceutical and biotechnology industries and failure to meet cGMP regulatory guidelines set by regulatory bodies (resulting in recalls of lyophilized products) are anticipated to restrain the growth of this market over the forecast period.

Rising Demand for Food Preservation

Equipment for lyophilization is used to preserve a variety of food items, including fruits and vegetables, meat, fish, herbs and culinary flavorings, ice creams, and coffee. By adding water, freeze-dried meals can be reconstituted quickly and easily without refrigeration or chemical preservation. Another significant benefit of freeze-drying food is its capacity to produce clean, complete, and nutrient-rich food ingredients with a very extended shelf life (making food products versatile and accessible).

Astronauts and military personnel are increasingly utilizing freeze-dried foods, as conventional drying processes have significant limitations. For example, high temperatures can lead to chemical or physical changes in food goods, and their overall quality is inferior to that of freeze-dried foods. In light of these benefits, the usage of freeze-drying as a food preservation method is rising globally.

Increased Use of Alternate Drying Processes in The Pharmaceutical and Biotechnology Sectors Is Constrained by Certain Factors.

Lyophilization is a costly procedure with high operational expenses, high energy usage, high capital expenditure, and a longer processing time. Due to the capital-intensive nature of lyophilization systems, companies in the food, pharmaceutical, and biotechnology industries are focused on alternate drying methods to reduce the overall cost of their products without sacrificing quality. Spray drying has been regarded as the leading substitute for freeze-drying. It is a one-step procedure to dry chemicals with improved scalability and decreased equipment, facility, and utility expenses. Moreover, spray drying's drying cycle time is substantially shorter than lyophilization's, which decreases operational expenses for producers. Other methods to lyophilization include precipitation, vacuum-microwave dehydration, vacuum foam drying, usage of glycerol, and atmospheric freeze-drying. The emergence of these low-cost alternative methods is inhibiting market expansion. However, lyophilization is the only technique capable of delivering stable, physiologically active goods with a lengthy shelf life.

Loss of Patent Protection for Numerous Biopharmaceuticals to Widen Market Potential

The market for biologics is one of the largest contributors to the expansion of the freeze-drying market in the healthcare sector. In the coming decade, biosimilars are anticipated to boost the expansion of the biotechnology industry. Several important biologics are anticipated to lose their patent protection in the future years.

As a cost-effective alternative to biological drugs for chronic illnesses, a growing number of biosimilars are being developed and introduced to the market. The market for lyophilization of biologics and biopharmaceutical products will be driven by expanding R&D and the development of biosimilars. In recent years, more than 30% of FDA-approved parenteral medicines were lyophilized. Soon, more than half of all injectable medications will require lyophilization, which will increase the pharmaceutical industry's demand for lyophilization solutions.

Difficulties In Reaching the Correct Levels of Moisture and Sustaining Product Quality

Often, the appropriate level of moisture removal is not accomplished during the lyophilization process; products are contaminated due to the presence of excess moisture, which might pose significant risks to patients who are administered these products. In addition, the removal of excess moisture can cause product instability, leading to the loss of structural integrity and biological activity. In order to prevent contamination of food and pharmaceutical items, it is essential to achieve the necessary moisture level precisely. Manufacturers have a substantial obstacle in obtaining these target moisture levels due to the difficulty of achieving them.

In 2025, The Sector of Tray-Style Freeze Dryers Held the Largest Revenue Share

The lyophilization equipment market is segmented into tray-style freeze dryers, manifold freeze dryers, and shell (rotary) freeze dryers, based on the kind of product. In 2025, the segment of tray-style freeze dryers held the biggest market share at 70%. This segment is likewise expected to increase at the fastest rate during the projection period, 8.5% annually. This market's growth is primarily driven by the expanding demand for contract manufacturing and contract lyophilization services in the pharmaceutical industry, the growing commercialization of labile pharmaceuticals, and the rising demand for freeze-dried food products. Additionally, tray-style freeze dryers are larger than manifold and rotary freeze dryers, allowing them to dry items in huge quantities.

Industrial Freeze Dryers Segment Dominated the Product Market

In 2025, the industrial freeze dryers product segment dominated the market and represented 35% of the worldwide revenue share. Due to industrial freeze dryers, the food processing and dairy industries can preserve goods that are exceedingly delicate and cannot be dried via evaporation. These colossal systems are capable of storing massive quantities of food for the purpose of drying it to a consistent quality.

Freeze drying is essential for preserving, storing, and extending the shelf life of fragile biological materials in the laboratory. Laboratory freeze drying is applied to remove water from delicate biological products without altering their chemical structure. This allows for simple storage and subsequent reconstitution with water or solvents. Freeze drying is a low-temperature dehydration method. During the majority of procedures, materials are kept at a negative temperature. Consequently, freeze-drying has less of an effect on the original characteristics of the food, retaining its biological activity, vitamins, flavor, taste, and appearance. They can be reconstituted quickly and simply by adding water or other solvents.

Due to their mobility, versatility, and convenience of use, the mobile freeze dryer’s product segment is anticipated to grow at a CAGR of 11.0% throughout the forecast period. Freeze-drying is a technique for extending the shelf life of perishable goods by eliminating their water content. Freeze-drying is necessary for the frozen water in a substance to directly turn into vapor.

In 2025, The Sector of Industrial-Scale Lyophilization Equipment Held the Biggest Market Share.

The freeze-drying market is divided into industrial-scale lyophilization equipment, pilot-scale lyophilization equipment, and laboratory-scale lyophilization equipment, based on the scale of operation. The industrial-scale lyophilization equipment segment held the biggest market share in 2025 at 65%. Due to the high quality given by industrial-scale lyophilization equipment, this market segment accounts for a substantial share. Additionally, industrial-scale lyophilization equipment can be modified to meet specific process needs.

In 2025, The Food Processing and Packaging Segment Held the Biggest Market Share.

In 2025, the application of food processing led the market and accounted for 35.0% of the worldwide revenue share. The food can preserve its original size and shape with minimal cell damage during the freeze-drying process. As a result, shrinkage is minimized or avoided entirely, allowing the food to be kept in nearly pristine condition for a longer period of time, which will increase demand for the product in food processing applications.

The majority of the expansion in surgical procedures is driven by the aging of the population, the prevalence of cancer, and the frequency of chronic disorders. Due to the usage of freeze-dried platelet-rich plasma (PRP) in surgical procedures, which preserves PRP's efficacy and bioactivity for a longer period of time, the number of surgical procedures will rise, hence increasing demand for freeze-drying equipment. Due to the extensive use of freeze-drying equipment to preserve biologicals such as enzymes, proteins, viruses & bacteria, and penicillin, demand for freeze-drying equipment in the pharmaceuticals industry is anticipated to increase at a CAGR of 11.0% throughout the forecast period. Freeze drying can be used to dry fragile, unstable, or heat-sensitive pharmaceuticals and biologics without causing structural damage. In the case of emergency vaccinations and prompt administration of antibodies, freeze-dried products are easily and rapidly carried out, generating market demand.

According to the Alliance for Regenerative Medicine, companies specializing in cell and gene therapies raised over USD 23.1 billion in funding worldwide in 2022, a nearly 16% increase over the previous year's total of USD 19.8 billion. In addition, the government is actively assisting the biotechnology industry by modernizing the regulatory environment, improving approval and reimbursement processes, and standardizing clinical trials. The removal of aqueous and solvent solutions from biologics during freeze drying minimizes degradation and preserves the proteins necessary for their drug delivery mechanism, hence boosting market expansion.

In 2025, The Loading & Unloading Category Held the Greatest Revenue Share Among the Accessories Segment

The lyophilization equipment market is categorized on the basis of accessories into vacuum systems, loading & unloading systems, clean-in-place (CIP) systems, drying chambers, controlling & monitoring systems, freeze-drying trays & shelves, manifolds, and other accessories. In 2025, loading & unloading systems held the largest market share of 26.6%; this segment is also anticipated to grow at the fastest CAGR of 10.0% over the forecast period. This segment's rapid expansion can be attributable to technological advances in lyophilization equipment, shorter cycle times, increased productivity, and aseptic settings that comply with cGMP rules.

APAC Remains as the Global Leader

Asia-Pacific dominated the market in 2025 with a 35% share and is anticipated to grow at the highest CAGR of 10.5% during the forecast period. A substantial proportion of the Asia-Pacific regional segment can be ascribed to the increasing number of investments in this region, the increase in R&D spending, and the geographical expansion of lyophilization equipment firms in this region. In addition, the presence of significant players in the lyophilization market in the APAC region and the expansion of the manufacturing facilities of leading pharmaceutical firms in this region are anticipated to support market growth in this region over the forecast period.

Market Consolidation to Hinder the Entry of Potential Players

The global market is extremely concentrated and competitive, dominated by significant firms. In addition, they are investing heavily in R&D to develop novel solutions and acquire a competitive advantage. In February 2026, for example, food manufacturer Pol's awarded GEA its third contract to install and source RAY freeze-drying equipment at the company's 4,000 m2 vegetable & fruit freeze-drying business in Ermenek, Karaman, Turkey. This will allow the annual production of freeze-dried products to expand from 200 to 300 tonnes.

GEA Group (Germany), Azbil Corporation (Japan), Shanghai Tofflon Science Technology Co., Ltd. (China), IMA S.p.A. (Italy), SP Industries, Inc. (United States), HOF Enterprise Group (Germany), Labconco Corporation (United States), Martin Christ Gefriertrocknungsanlagen GmbH (Germany), Millrock Technology, Inc. (United States), and OPTIMA Packaging Group GmbH are some of the key market players.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Freeze-Drying/Lyophilization market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Product

|

|

Scale of Operation

|

|

Application

|

|

Accessories

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report