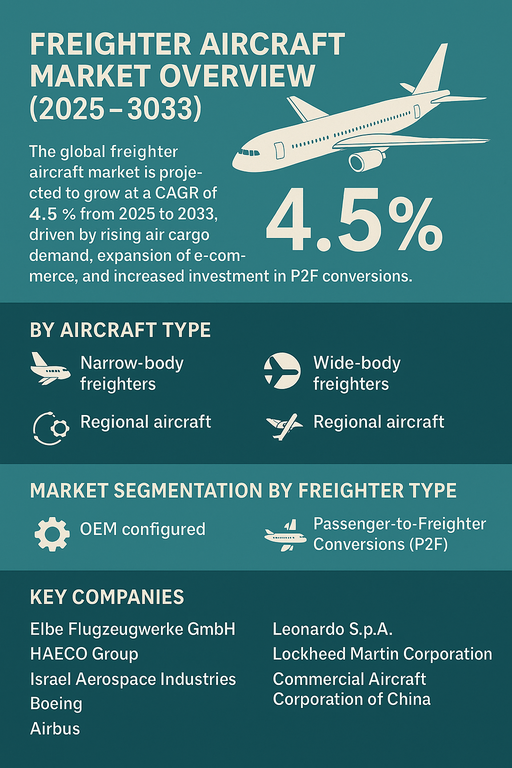

The global freighter aircraft market is projected to grow at a CAGR of 4.5% from 2026 to 2034, supported by the rising demand for air cargo, expansion of global e-commerce, and increased reliance on fast, reliable logistics. Freighter aircraft play a crucial role in transporting goods across long distances, offering unmatched speed compared to sea or land transport. With globalization and supply chain integration, airlines and logistics companies are investing in dedicated cargo fleets to meet rising volumes, while passenger-to-freighter (P2F) conversions are further fueling capacity expansion.

Growth Driven by E-commerce and Global Trade

The rapid rise of e-commerce platforms, coupled with consumer expectations for faster deliveries, is pushing demand for dedicated cargo aircraft. Freighters provide reliable transportation for high-value, time-sensitive, and perishable goods, reinforcing their importance within global trade. The COVID-19 pandemic highlighted the strategic role of air cargo, and since then, investments in air freight capacity have remained strong. Emerging markets in Asia Pacific and the Middle East are witnessing accelerated freighter adoption, supported by growing logistics hubs, trade corridors, and infrastructure development.

Challenges: High Costs and Environmental Pressures

Despite strong demand, the freighter aircraft market faces significant challenges. New freighter aircraft carry high capital costs, making passenger-to-freighter conversions a more attractive solution for many operators. Rising fuel costs and the aviation industry’s growing focus on sustainability add pressure to reduce emissions and improve efficiency. Additionally, air cargo demand can be cyclical, closely linked to global trade patterns and economic fluctuations, creating revenue volatility. Regulatory pressure to adopt greener technologies and limited availability of conversion slots also create constraints for market players. However, technological innovation, fuel-efficient aircraft, and the adoption of sustainable aviation fuels are expected to address these challenges in the long term.

Market Segmentation by Aircraft Type

By aircraft type, narrow-body freighters remain widely used for regional and short-haul cargo operations, offering flexibility and cost efficiency for domestic and regional trade. Wide-body freighters dominate the international cargo segment due to their large payload capacity and ability to serve long-haul routes, making them the backbone of global logistics. Regional aircraft freighters occupy a niche segment, catering to specialized routes and remote areas where smaller cargo volumes need efficient transport solutions.

Market Segmentation by Freighter Type

In terms of freighter type, OEM-configured freighters are designed from the outset for cargo operations, offering optimized payload, fuel efficiency, and advanced cargo handling features. These are typically preferred by large logistics operators and global carriers. Passenger-to-freighter (P2F) conversions, however, represent the fastest-growing segment due to their cost advantages. With a steady stream of retired passenger aircraft available, conversion programs offer operators a more economical route to expand fleets, especially in the wake of rising demand for dedicated cargo capacity.

Regional Insights

North America currently leads the freighter aircraft market, supported by strong logistics infrastructure, large e-commerce platforms, and the dominance of major cargo operators. Europe follows, driven by high-value exports and investments in dedicated air cargo fleets. Asia Pacific is the fastest-growing region, fueled by the expansion of e-commerce in China and India, rising cross-border trade, and increasing investment in logistics hubs. The Middle East is strengthening its role as a global transit hub, with major carriers positioning the region as a strategic cargo gateway between Asia, Europe, and Africa. Latin America and Africa represent emerging opportunities, where demand for air cargo is growing due to increasing trade flows, urbanization, and infrastructure development.

Competitive Landscape

The freighter aircraft market in 2025 was led by a mix of original equipment manufacturers (OEMs), aerospace engineering firms, and conversion specialists. Boeing dominates the wide-body freighter market with models such as the 777F and 767F, while Airbus continues to expand its footprint with the A330-200F and A350 freighter. Elbe Flugzeugwerke GmbH, a joint venture between Airbus and ST Engineering, remains a leader in passenger-to-freighter conversions, alongside Israel Aerospace Industries (IAI) and HAECO Group, which specialize in conversion programs for narrow- and wide-body aircraft. ST Engineering continues to strengthen its presence with advanced P2F solutions and global maintenance networks. Leonardo S.p.A. and Lockheed Martin Corporation contribute to the regional and defense-related freighter segments, while Commercial Aircraft Corporation of China (COMAC) is emerging as a regional player with growing ambitions in the cargo segment. Competitive differentiation is being shaped by fuel efficiency, conversion capabilities, cost competitiveness, and global aftersales support, ensuring that the market continues to evolve rapidly in line with shifting cargo dynamics.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Freighter Aircraft market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Aircraft Type

|

|

Freighter Type

|

|

Payload

|

|

End Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report