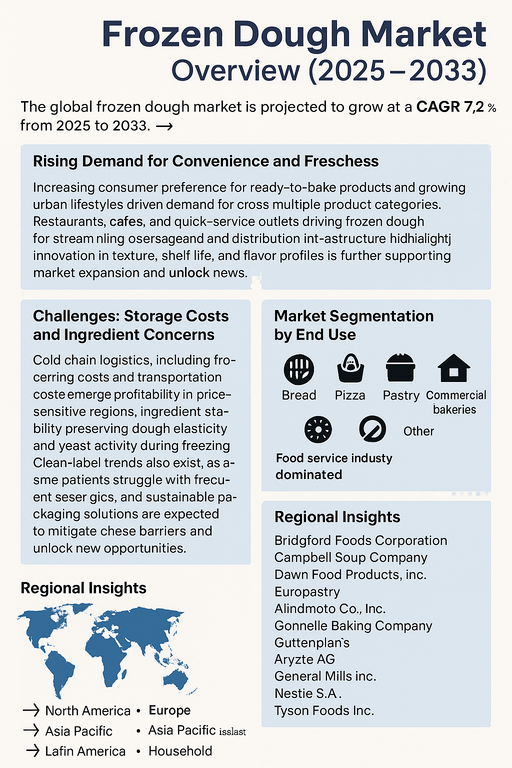

The global frozen dough market is projected to grow at a CAGR of 7.2% from 2025 to 2033, supported by rising demand for convenient food products, growing penetration of Western-style bakery consumption worldwide, and advancements in cold storage and distribution infrastructure. Frozen dough offers a time-saving and flexible solution for bakeries, food service providers, and households by eliminating the need for from-scratch preparation while maintaining consistent quality. Its ability to reduce labor costs and enable fresh, on-demand baking is fueling strong adoption across both developed and emerging economies.

Rising Demand for Convenience and Freshness

Increasing consumer preference for ready-to-bake products and growing urban lifestyles are driving demand for frozen dough across multiple product categories. Restaurants, cafes, and quick-service outlets are increasingly turning to frozen dough to streamline operations and ensure product consistency. Retail consumers also value the convenience of frozen dough for home use, allowing easy preparation of bread, pizza, pastries, and cookies without specialized baking skills. Continuous innovation in texture, shelf life, and flavor profiles is further supporting market expansion.

Challenges: Storage Costs and Ingredient Concerns

The frozen dough market faces challenges related to cold chain logistics, including high storage and transportation costs that limit profitability in price-sensitive regions. Ingredient stability, particularly in preserving dough elasticity and yeast activity during freezing, poses technical limitations. Clean-label trends are also shaping consumer expectations, as some buyers are wary of preservatives and additives used to extend frozen dough shelf life. Despite these barriers, ongoing R&D in natural stabilizers, improved freezing technologies, and sustainable packaging solutions are expected to mitigate challenges and unlock new opportunities.

Market Segmentation by Type

By type, the market is divided into bread, pizza, pastry, biscuits & cookies, bagels, and others. In 2024, bread dough held the largest share, driven by global consumption of bread as a staple product. Pizza dough is also a rapidly expanding category, supported by the rising popularity of frozen pizzas and home-baking trends. Pastries, biscuits, cookies, and bagels represent attractive segments, particularly in developed markets where indulgent bakery products are in strong demand.

Market Segmentation by End Use

By end use, the market is segmented into food service industry, retail, commercial bakeries, and household. The food service industry dominates, supported by demand from restaurants, cafes, and quick-service chains. Commercial bakeries are leveraging frozen dough to optimize production efficiency and ensure large-scale consistency. Retail distribution is growing with the rise of supermarkets and convenience stores offering frozen bakery sections. Household adoption is also increasing, fueled by consumer interest in baking-at-home trends.

Regional Insights

In 2024, North America led the frozen dough market, with strong bakery culture, established cold chain infrastructure, and consumer preference for convenience foods. Europe followed closely, with high consumption of artisanal bread, pastries, and frozen pizza, particularly in Germany, France, and the UK. Asia Pacific is the fastest-growing region, driven by urbanization, rising disposable incomes, and growing adoption of Western bakery products in China, India, and Southeast Asia. Latin America and the Middle East & Africa (MEA) are emerging regions where the expansion of modern retail and increasing demand for affordable bakery products are creating new growth avenues.

Competitive Landscape

The 2024 frozen dough market was characterized by competition among multinational food companies and regional bakery specialists. General Mills Inc. and Nestlé S.A. remain prominent players, leveraging broad product portfolios and global distribution networks. Aryzta AG and Europastry are leaders in supplying frozen bakery solutions to commercial clients and food service providers. Tyson Foods Inc. and Campbell Soup Company are expanding their portfolios with frozen bakery offerings to complement core businesses. Dawn Food Products, Bridgford Foods Corporation, and Gonnella Baking Company maintain strong regional presence with innovative bakery solutions. Ajinomoto Co., Inc. and Guttenplan’s are also strengthening their positions by focusing on quality and expanding into new consumer markets. Competitive differentiation is increasingly being driven by innovation in clean-label dough, extended shelf life, and premium bakery experiences.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Frozen Dough market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Type

| |

End Use

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report