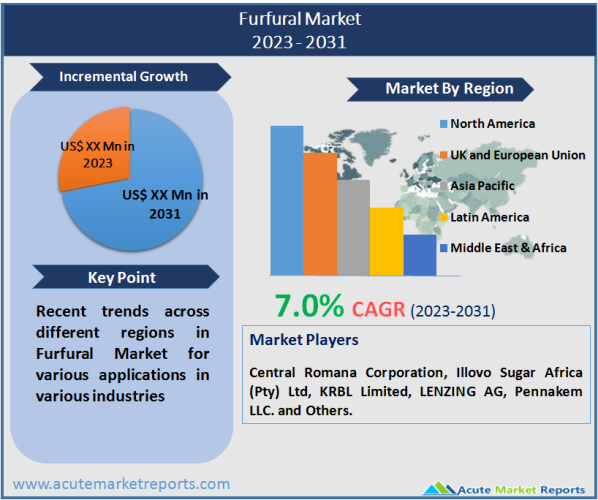

The global furfural market is projected to grow at a CAGR of 7.0% during the forecast period of 2026 and 2034. In the near future, the expansion of the market is anticipated to be fuelled by the increased demand for furfuryl alcohol due to rising concerns about renewable products. Furfural is largely employed as a solvent or intermediate in a variety of end-use sectors, including foundries, pharmaceuticals, paints & coatings, agriculture, chemicals, refineries, automotive, and construction, among others. Due to the expansion of the construction sector, the demand for furfural in refractory materials such as bricks, fiberglass, and ceramic composites is anticipated to rise throughout the forecast period. In addition, the market is anticipated to be driven by the rising demand for environmental products caused by the depletion of fossil fuel supplies.

Due to the widespread use of furfuryl alcohol in plastics and resins, the U.S. is anticipated to experience substantial expansion. Plastics are utilized in a variety of industries as a result of their lightweight, low cost, water resistance, and durability. Thus, the demand for furfural alcohol increases the demand for furfural on the market. In addition, increased research activities in the field of rocket fuel are anticipated to boost the need for furfuryl alcohol in the future years. Since 2021, the pandemic of COVID-19 has had a detrimental effect on the market, as evidenced by a price decline. China is a significant producer of furfural and furfuryl alcohol, accounting for over 80.0% of the global total. Until global conditions returned to normal, the epidemic of coronavirus had a negative impact on the worldwide market, causing producers to face challenges with supply availability. Nevertheless, significant end-use applications such as food & drinks and pharmaceuticals are anticipated to drive product demand in the foreseeable future, given the stability of these industries.

Increased Demand for Furfuryl Alcohol

The chemical furfuryl alcohol is produced from furfural. Due to its high reactivity, furfuryl alcohol plays a crucial role in the manufacturing of foundry sand binders. This alcohol has been widely used for decades to manufacture metal cores and molds. In addition, it is utilized in the synthesis of tetrahydrofurfuryl alcohol (THFA), which is widely employed in the pharmaceutical business. According to the World Foundry Organization, the foundry sector in India is predicted to increase by 13%-14% by 2026, making it the second-largest foundry market in the world after China. Consequently, the expanding foundry industry is driving up demand for furfuryl alcohol, thereby enhancing the furfural market.

The Emergence of Major End-Use Industries with Significant Applications for Furfural Products Is a Key Factor Driving the Global Market

Many end-use industries, including foundry, agriculture, paints and coatings, pharmaceuticals, refineries, chemicals, automobiles, and construction, employ furfural as a solvent or intermediary. The expanding construction industry is anticipated to enhance the need for Furfural in refractory materials such as ceramics, bricks, and fiberglass composites during the next few years. As fossil fuels run out, it is believed that the need for Furfural will be driven by the rising desire for sustainable products.

According to the China Petrochemical Corporation, China became the second-largest refining economy in 2019 due to its enormous output capacity. The United States continues to dominate the refining sector. China's rise can be attributed to a variety of significant causes, such as the country's increasing demand for oil as its people and economy expand. When merchandise corrodes due to excessive and frequent refining, it might result in financial losses. In petrochemical refining, furfural is used to produce anti-corrosion coatings and as a specialty solvent.

The U.S. refining business is competitive because, among other factors, crude oil prices are higher, refineries are more advanced and complicated, personnel is highly skilled and adaptable, and operational expenses are low because Furfural is a chemical feedstock used to manufacture other industrial chemicals. China, the EU-28, the United States, Japan, South Korea, India, Taiwan, Russia, Brazil, and Saudi Arabia are anticipated to produce more chemicals, which would raise the demand for Furfural in these economies.

The Growth of The Foundry Industry Will Drive the Global Furfural Market

The metal casting sector is essential to the safety and economic development of many nations. Both non-ferrous and ferrous alloys are melted at foundries and poured into molds so they can solidify into finished items. In the foundry industry, Furfural and its derivatives are utilized to create metal casting molds. It is believed that the increasing production of metal castings drives both the growth of the foundry industry and the demand for Furfural.

Over the past decade, the worldwide metal casting business has expanded substantially. This is due to the demand for lighter building materials, which has led to the proliferation of aluminum foundries. Good management techniques and new technology, such as automation, have also contributed to the expansion of the metal casting sector, particularly in Asia-Pacific, Europe, and North America.

Availability Of Alternatives Based on Crude Oil to Constrain Market Expansion

The availability of comparably less expensive alternatives derived from crude oil restrains the demand for furfural. In the foundry industry, furan resin is used to prepare binders. Nevertheless, phenolic resin, which is derived from crude oil, is less expensive than furan resin, according to a number of primary sources. Also, butanediol (BDO) is a component of polytetramethylene ether glycol (PTMEG), which is used in the textile industry to produce spandex. THF, which is a furfural derivative, can be utilized in the manufacturing of spandex, however, its higher price due to furfural processing makes it less desirable than BDO.

Fluctuating Raw Materials Prices to Hinder to The Market Expansion

Changes in the price of key raw materials, such as corn cob, can increase the cost of producing Furfural, which could inhibit the market's growth in the near future. Feedstocks are utilized to produce Furfural. Corncob, sugarcane bagasse, sunflower hull, and rice husk are among the examples. Corncob, commonly known as grain maize, is the primary raw material used to produce Furfural due to its high yield and higher pentosane content compared to other raw materials.

When there are fluctuations in the amount of available raw material, the price of that raw material, particularly corncob, can fluctuate. Due to climate change, the prices of raw materials have increased, resulting in a change in the Furfural market price. According to the 2018 EU-28 Report on Agricultural Commodities, the EU-28 produced 295,1 million tons of essential cereals. The mixture of grain maize and corn cobs comprised approximately 23.4% of the production share of other cereals.

At the end of 2018, the proportion of grain maize and corn cobs increased by 1.6%. The price of a blend of grain maize and corn cobs continued to fluctuate until 2017. However, this price increase could not compete with the largest in 2012. Changes in the price of corn cobs can increase the cost of producing furfural, which could restrict the market's growth in the near future.

Emerging Demand for Furfural Derivatives (Other Than Furfuryl Alcohol) In A Variety of Applications Presents an Opportunity

Due to its great strength and elasticity, the textile and garment sector is experiencing an increase in demand for spandex. In recent years, the growth of the spandex fibers market has been aided by the evolving textile industry and rising health consciousness. This is anticipated to stimulate the market for PTMEG, a THF application. THF is one of the furan derivatives that can be produced from furfural. Polyurethane (PU) is an additional chemical derived from PTMEG. Numerous industries, including apparel, appliances, automotive, construction, flooring, furnishings, marine, and medicine, employ PU extensively. Due to its energy efficiency, PU foam is often preferred for automobile interiors and thermal insulation in structures. China is the world's largest user and producer of polyurethane (PU), therefore a positive market condition in APAC is anticipated to stimulate demand for PU throughout the projected period, offering possibilities for furfural manufacturers.

Development Of Green Chemicals Creating Diverse Market Opportunities

The chemical industry is evolving toward the sustainable manufacturing of bio-based/green chemicals that adhere to the 12 green chemistry principles. By changing how green chemicals are manufactured, biotechnological processes such as fermentation, biocatalysis, and enzymatic processes, among others, have become feasible. The growth of the green chemicals industry has been aided by the aforementioned factors. To fulfill the rising demand for their products, green chemical manufacturers are expanding their production capacity and constructing new plants. They have merged their production and distribution channels to facilitate the dissemination of their products. Strategic alliances and mergers and acquisitions are essential components of this sector and assist businesses in enhancing their market position. End-user business activities have a significant impact on the finances and operations of both raw material suppliers and manufacturers. Green chemistry industry growth, business sustainability programs, and the emergence of new bio-based value chains are a few of the factors contributing to the expansion of the furfural market.

Low Furfural Yield with Conventional Methods to Challenge the Market Growth

Furfural is a chemical that is derived from biomass and converted into various chemical compounds and fuels utilizing the most well-known technique, the Quaker Oats technique. Numerous technologies to valorize agricultural feedstocks or wood residues for furfural production have been developed. In pilot-scale experiments, the Supra Yield technology produced a yield of approximately 70.0%. However, the commercial application of this technique did not generate the same returns as the pilot tests. In addition, numerous investigations have been conducted to comprehend the chemical mechanisms involved in the production of furfural from agricultural/wood residues. The present emphasis is on expanding these investigations to improve the commercial yield of furfural.

Chinese Batch Process Dominating the Market by Process

In 2025, the Chinese batch process dominated the market with the biggest revenue share of 80.0%. This is due to the widespread usage of the Chinese batch process in numerous small-scale manufacturing facilities, the majority of which are located in China, which accounts for a significant portion of the market. China produces a substantial amount of furfural, and the Chinese batch process is believed to create furfural on a greater scale. Typically, corncob is used as a feedstock in this process. In contrast to the Quaker batch technique, the digesters in this method rotate. The digesters consist of enormous cylinders in which steam is delivered at five bars over an 8-m-tall, 1.5-m-diameter static bed. In China, the technique generates a furfural yield of approximately 30% to 40% on a commercial scale.

The Quaker batch procedure is one of the earliest techniques for producing furfural. In its U.S. manufacturing facility in Cedar Rapids, the Quaker Oats Company developed the initial production method. Except for established and leading manufacturing facilities such as Central Romana Corporation, the method is not widely employed nowadays. Central Romana Corporation was founded by a Dominican sugar mill and Quaker Oats in order to commercialize the Quaker batch technique for producing furfural. The Rosenlew continuous method is the most effective and takes the least amount of upkeep. Due to its high steam consumption, limited manufacturing yield, and high production expenses, however, this technology is rarely preferred by medium and small-sized businesses. Since the Chinese batch method is less expensive, the majority of businesses prefer it.

Corn Cob Dominated the Market by Raw Material

In 2025, corn cobs led the global market with a revenue share of 70%. This is because corncobs have a pentosane concentration of around 31.0% and are used as a raw material in the production of furfural. In addition, the corncob's high yield makes it a suitable raw material, and it is utilized in around 70.0% of the world's furfural manufacturing. Hydrolysis, pre-treatment, purification, and separation are involved in the synthesis of furfural from corncob. Therefore, corncob is the most desirable raw material for the manufacturing of furfural.

Bagasse from sugarcane is a widely utilized agricultural byproduct. Several sugarcane-processing industrial facilities, such as sugar mills and individual distilleries, may acquire vast quantities of sugarcane bagasse at a reduced price. Significant quantities of sugarcane are cultivated in Brazil, China, India, and Thailand, making bagasse widely available in their respective economies. Using a gas-fired boiler, sugar mills can also improve the amount of bagasse accessible for use as a raw material by increasing bagasse production. Because bagasse storage is costly and difficult, a furfural factory must be located near a sugar mill.

Refineries Remain as the Dominant End User

In 2025, the refinery end-use category dominated the market with a 50% revenue share. This is due to the widespread use of furfural as a solvent in petroleum refining, specialty adhesives, and lubricants. Hydrogenation can turn it into 2-methyl tetrahydrofuran and 2-methyl furan, both of which are utilized as gasoline additives. In addition, the rising demand for lubricants in the industrial and automotive sectors is anticipated to increase petroleum refining activities and substantially increase demand for furfural in the petroleum refining industry.

Furfural is widely used in the agrochemical industry as a nematicide, pesticide, and fungicide. It is an active ingredient in numerous nematicides, including crop protectors and guards. The chemical is also used as a weed killer in horticulture. Furfural is a contact nematicide that is transferred or mechanically incorporated into the soil during irrigation in relatively low amounts. As an agrochemical, it is relatively safe and simple to use.

As a substantial number of stone oil products, such as dimethylbenzene and benzene, are utilized in the synthesis of paints, the paints and coatings industry faces environmental contamination concerns. Petroleum solvent poses a significant threat to both the environment and the operator. Bio-based furfural solvents are preferred by manufacturers in the paints and coatings industry as a substitute for petroleum-based solvents. The expansion of the paints and coatings industries, coupled with tight regulations and restrictions on the use of synthetic chemicals, is anticipated to increase product demand in the paints and coatings industries.

Ascorbic acid (vitamin C) is a major component in fruit juices and wines, while furfural is a product of ascorbic acid. It is also employed as a flavoring agent in a wide variety of non-alcoholic and alcoholic foods and beverages. To lengthen the shelf life of wine, excessive amounts of furfural are added during production. Food and beverage evolved as one of Europe's most important manufacturing industries. This occurs as a result of the rising intake of alcohol, beverages, and convenience foods.

Furfuryl Alcohol Led the Applications Segment

In 2025, the furfuryl alcohol segment led the market with an 85% revenue share. This is because furfuryl alcohol is commonly employed as a binder in the industry because of the prevalence of foundries. Furfuryl alcohol is used extensively in the synthesis of furan resin, a significant chemical feedstock utilized in the manufacture of paints, cement, adhesives, thermoset polymer matrix composites, and casting resins. As a solvent, furfuryl alcohol is utilized by the petroleum and refining sectors.

Furfural has been utilized for the formulation of Nylon 6,6 and Nylon 6 for a number of years. Additionally, furfural is employed as a chemical intermediary in the production of tetrahydrofuran and furan. It is primarily employed as an intermediary in the synthesis of various furan derivatives, such as furoic acid and insecticides.

The growing utilization of furfural as a selective solvent in the refining of lubricating oils and rosin is predicted to raise demand for the solvent. In addition, it is used as a wetting agent in the production of brake linings, refractory materials, and abrasive wheels as well as a solvent in the extraction of mineral oils. Additionally, it removes dienes from a variety of other hydrocarbons found in plastic and nylon. In the near future, rising product demand for solvent-based processes, such as lubricating oil and butadiene extractions, is predicted to drive solvent expansion.

Furfural has been utilized as a chemical raw ingredient in the production of Nylon 6, 6, and Nylon 6 for many years. Additionally, furfural is employed as a chemical intermediary in the production of tetrahydrofuran and furan. It is primarily employed as an intermediary in the synthesis of various furan derivatives, such as furoic acid and insecticides.

APAC Remains as the Global Leader

In 2025, Asia-Pacific dominated the global market with a revenue share of 75%. This is owing to the enormous furfural output, particularly in China, as well as the expansion of various end-use industries, including agriculture, food & beverages, medicines, and refineries, in the economies of China, India, and Japan. The Asia-Pacific market is also anticipated to have substantial growth due to the increased consumption of furfural from agriculture; according to the India Brand Equity Foundation, about 58.0% of India's population relies mostly on agriculture for their livelihood (IBEF). A huge population and increasing rural and urban incomes are driving the demand for agricultural products.

Emerging nations such as China, India, and Japan are anticipated to propel Asia-Pacific to the top of the global furfural market over the forecast period. China is a center for chemical processing, producing a significant portion of the world's chemicals. The nation's contribution to global chemical sales exceeds 35%. China is home to the chemical factories of numerous market-leading firms. The demand for furfural from this industry is predicted to increase throughout the forecast period due to the growing need for bio-based chemicals worldwide. The increased demand for chemicals and agrochemicals is anticipated to fuel India's chemical industry's anticipated robust expansion. The government forecasts that the chemical sector would reach USD 304 billion by 2026, with prospects presented by the predicted annual demand growth of approximately 9% over the following five years. The chemical industry offers investment opportunities worth around $701.97 million, with over 168 investment opportunities and 29 projects in development. Due to rising urbanization, industrial expansion, and increased investments in emerging economies such as Japan, China, and India, the foundry goods market in Asia-Pacific is expanding significantly. The foundry sector in India is anticipated to expand by over 13% to reach 14-15 million metric tons by 2022 and 20 million metric tons by 2026.

As a result of the aforementioned factors, the furfural market in the region is anticipated to rise steadily over the forecast period.

Due to the existence of well-established chemical and fertilizer manufacturers in the region, the North American industry has experienced significant expansion over the past decade. Pennakem LLC now produces furfural in the United States. The commodity is predominantly imported from China, the Dominican Republic, and South Africa. In addition, North America is anticipated to have substantial growth in the near future due to the expanding pharmaceutical industry and the increasing use of this product in drug synthesis.

The Competition Among Key Players to Intensify During the Forecast Period

Competition is heavily dependent on product quality, the number of manufacturers and distributors, and their regional presence. In addition to focusing on bio-based oil formulation and various strategic activities, such as acquisitions and mergers, the leading manufacturers are increasing their R&D efforts aimed at developing unique and imaginative products and services. A number of worldwide industry stakeholders and participants are also working on boosting their manufacturing capacities. The furfural market is naturally largely consolidated. Central Romana Corporation, Illovo Sugar Africa (Pty) Ltd, KRBL Limited, LENZING AG, and Pennakém LLC are among the market's leading participants.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Furfural market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Process

|

|

Raw Material

|

|

Application

|

|

End-use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report