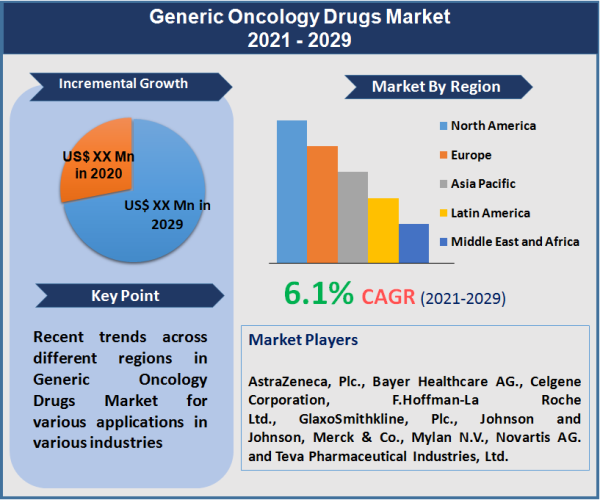

The generic oncology drugs market is set to growth at a compounded annual growth rate (CAGR) of 6.1% during the forecast period from 2025 to 2033. According to the statistics provided by World Health Organization (WHO) in 2024, 9.6 million people worldwide have been estimated to be dead due to cancer. It is considered as the second leading cause of death, researchers are of the opinion that approximately 30% cancer deaths can be prevented by avoiding risk factors such as alcohol consumption, tobacco smoking, early diagnosis etc. Generic oncology drugs drastically reduce the healthcare cost burden associated with cancer treatment, but still there is ambiguity among healthcare professionals regarding its effectiveness and bioequivalence when compared to branded drugs. Healthcare agencies have made it imperative for pharmaceutical companies to follow ICH and cGMP guidelines while manufacturing generic oncology drugs.

"Excellent pharmacokinetic and pharmacodynamic drug profile is related to the positive inclination among oncologist worldwide"

Small molecule are currently dominating the oncology generic drugs market. They apparently constitute for 90% of the medicines currently available in the market. The chief parameters responsible for its popularity among oncologist throughout the globe are its excellent drug pharmacokinetic and pharmacodynamic profile. Large molecules comprises of biologics which are gaining huge traction in the current scenario as they resemble biomolecules present in the human body and specifically binds to those cell receptors which are associated with disease process resulting in high drug efficacy, safety and minimal side effects. Expiry of process patent of biologics employed in cancer treatment will create opportunity for its generic version to enter into market, thereby reducing cost burden associated with cancer.

"Significant rise in cancer patients and increasing trend of generic substitution over branded drugs drive the market growth in North America"

North America with a market share of 42% is the largest regional market for generic oncology drugs market. According to the research findings of Center for Disease Control and Prevention (CDC), the percent of adults diagnosed with cancer in the United States is 9.4%. The drivers associated with its dominance are rising prevalence of cancer and increasing trend of generic substitution over branded drugs, it is state specific in U.S. and province specific in Canada. Europe holds 30% market share on account of supportive regulatory scenario provided by European Medical Agency (EMA) for generic oncology drugs. Domicile of chief players such as Teva Pharmaceutical Industries, Ltd., Mylan N.V., Merck & Co., and Novartis A.G. further bolster the market growth in Europe. Asia Pacific represents 20% share owing to the significant rise in the number of patients diagnosed with cancer and booming oncology generic market receiving business leverage from government healthcare authorities to reduce the cost burden associated with cancer treatment.

Pharmaceutical giants having a strong foothold in the generic oncology drugs market are AstraZeneca, Plc., Bayer Healthcare AG., Celgene Corporation, F.Hoffman-La Roche Ltd., GlaxoSmithkline, Plc., Johnson and Johnson, Merck & Co., Mylan N.V., Novartis AG. and Teva Pharmaceutical Industries, Ltd.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Generic Oncology Drugs market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Molecule

| |

Route of Administration

| |

Distribution Channel

| |

Cancer Type

| |

Drug Class

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report