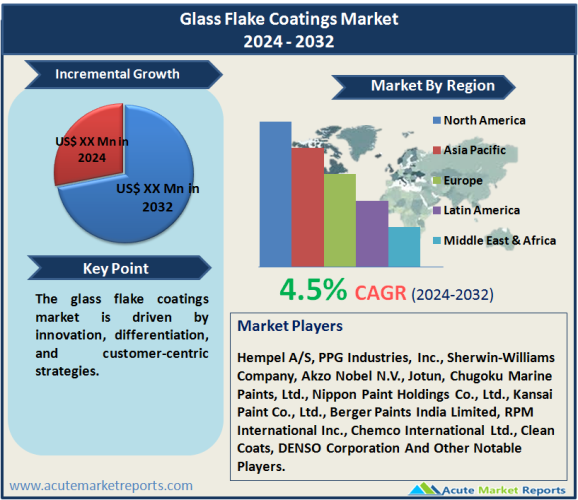

The glass flake coatings market is expected to grow at a CAGR of 4.5% from 2026 to 2034, driven by innovation, differentiation, and customer-centric strategies. Key players such as Hempel A/S, PPG Industries, Inc., Sherwin-Williams Company, and Akzo Nobel N.V. invest in research and development, market expansion, and operational excellence to maintain market leadership and drive long-term growth. With increasing demand for corrosion protection solutions, infrastructure development, and environmental sustainability, the glass flake coatings market offers opportunities for companies to innovate, collaborate, and capitalize on emerging trends and market dynamics.

Drivers

Increasing Demand for Corrosion Protection

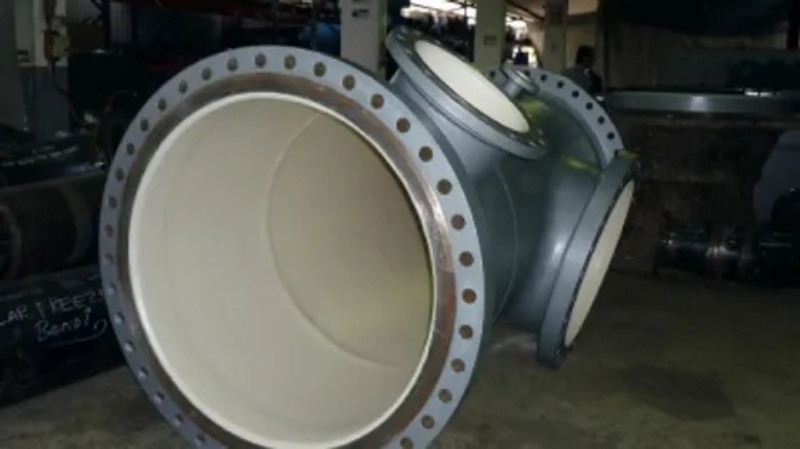

The increasing demand for corrosion protection across various industries has been a primary driver of the glass flake coatings market. Glass flake coatings offer exceptional resistance to corrosion, chemicals, and abrasion, making them ideal for protecting steel and concrete substrates in harsh environments. Industries such as oil & gas, marine, chemical & petrochemical, and infrastructure rely on glass flake coatings to extend the service life of assets, reduce maintenance costs, and ensure operational reliability. Companies like Hempel A/S and PPG Industries, Inc. offer a wide range of glass flake coatings with advanced corrosion protection properties, meeting the stringent requirements of industrial applications. With growing investments in infrastructure development, industrial expansion, and asset maintenance, the demand for glass flake coatings is expected to continue rising in the foreseeable future.

Advancements in Coating Formulations

Advancements in coating formulations and technologies have contributed to the growth of the glass flake coatings market. Manufacturers continuously innovate to enhance the performance, durability, and sustainability of glass flake coatings, addressing evolving industry requirements and regulatory standards. New formulations incorporating hybrid resins, nano-additives, and self-healing mechanisms have emerged to offer superior protection against corrosion, UV degradation, and mechanical damage. Companies like Sherwin-Williams Company and Akzo Nobel N.V. invest heavily in research and development to develop next-generation glass flake coatings that meet the specific needs of end-users. Moreover, the development of low-VOC (volatile organic compound) formulations and eco-friendly coatings aligns with sustainability initiatives and regulatory compliance efforts, driving market adoption and growth.

Rising Demand from Emerging Economies

The rising demand for glass flake coatings from emerging economies has contributed to market expansion and geographic diversification. Countries in Asia Pacific, Latin America, and the Middle East are experiencing rapid industrialization, urbanization, and infrastructure development, driving demand for corrosion protection solutions. Glass flake coatings play a crucial role in protecting assets such as pipelines, storage tanks, bridges, and offshore structures from corrosion and environmental degradation. Companies like Jotun A/S and Nippon Paint Holdings Co., Ltd. have established a strong presence in emerging markets by offering tailored solutions and localized services to meet the specific needs of customers. With ongoing investments in industrial projects, energy infrastructure, and maritime facilities, emerging economies are expected to remain key growth drivers for the glass flake coatings market.

Restraint

High Initial Cost and Application Complexity

One of the primary restraints hindering market growth is the high initial cost and application complexity associated with glass flake coatings. While glass flake coatings offer superior performance and long-term protection, they often require specialized surface preparation, application equipment, and skilled labor, leading to higher upfront expenses compared to conventional coatings. Additionally, the complex application process, including multiple coating layers, curing times, and quality control measures, can result in longer project timelines and increased labor costs. This aspect poses challenges for end-users, particularly in cost-sensitive industries and projects with tight deadlines. Despite the long-term benefits of corrosion protection and asset longevity, the perceived high cost and complexity of glass flake coatings may deter some customers from adoption, impacting market growth in certain segments and regions.

Market Segmentation by Resin Type

Epoxy

Epoxy-based glass flake coatings dominated the market in 2025, accounting for the highest revenue percentage, driven by their excellent adhesion, chemical resistance, and mechanical properties. Epoxy coatings are widely used in industries such as oil & gas, marine, and infrastructure for protecting steel and concrete substrates against corrosion and chemical attack. Companies like PPG Industries, Inc. and Hempel A/S offer a diverse portfolio of epoxy-based glass flake coatings tailored to different application requirements and environmental conditions. Moreover, epoxy coatings are expected to maintain the highest CAGR during the forecast period, supported by advancements in formulation technology, increased demand from emerging economies, and regulatory mandates for environmental protection.

Vinyl Ester

Vinyl ester-based glass flake coatings represented a significant share of the market in 2025, driven by their superior chemical resistance, UV stability, and thermal performance. Vinyl ester coatings are widely used in aggressive environments such as chemical processing plants, wastewater treatment facilities, and offshore platforms, where corrosion protection is critical for asset integrity and safety. Companies like Sherwin-Williams Company and Akzo Nobel N.V. offer vinyl ester-based glass flake coatings with high build capabilities, rapid curing times, and excellent adhesion to various substrates. However, the segment is expected to experience moderate growth in CAGR during the forecast period, attributed to market maturity and competition from alternative coating technologies.

Polyester

Polyester-based glass flake coatings accounted for a smaller share of the market in 2025, primarily used in less demanding applications and budget-sensitive projects. Polyester coatings offer good chemical resistance, weatherability, and cost-effectiveness, making them suitable for applications such as architectural coatings, transportation, and general maintenance. Companies like Jotun A/S and Nippon Paint Holdings Co., Ltd. offer polyester-based glass flake coatings with customizable colors, gloss levels, and performance additives to meet specific customer requirements. While polyester coatings offer advantages in terms of affordability and ease of application, they are expected to exhibit the lowest CAGR during the forecast period, reflecting limited growth opportunities in high-performance applications and niche markets.

Steel

Glass flake coatings applied on steel substrates accounted for the highest revenue in 2025, driven by the extensive use of steel in industrial infrastructure, marine vessels, and offshore structures. Steel substrates are susceptible to corrosion in harsh environments, making corrosion protection essential to ensure structural integrity and longevity. Glass flake coatings provide an effective barrier against corrosion, chemical attack, and abrasion, prolonging the service life of steel assets and reducing maintenance costs. Industries such as oil & gas, chemical & petrochemical, and power generation rely on steel structures and equipment for critical operations, creating significant demand for corrosion protection solutions. Companies like Hempel A/S and PPG Industries, Inc. offer a range of glass flake coatings specifically formulated for steel substrates, providing superior adhesion, flexibility, and durability. Moreover, advancements in surface preparation techniques, such as abrasive blasting and surface profiling, enhance coating adhesion and performance, ensuring long-term asset protection in challenging environments.

Concrete

Glass flake coatings applied on concrete substrates witnessed substantial revenue growth in 2025, driven by the increasing use of concrete in infrastructure projects, marine construction, and wastewater treatment facilities. Concrete structures are prone to degradation due to factors such as chemical exposure, freeze-thaw cycles, and chloride ingress, necessitating protective coatings to prevent deterioration and extend service life. Glass flake coatings offer excellent adhesion to concrete surfaces, forming a seamless barrier against moisture intrusion, chemical attack, and carbonation. Industries such as water & wastewater, transportation, and building & construction utilize glass flake coatings to protect concrete assets such as bridges, highways, parking structures, and water tanks. Companies like Sherwin-Williams Company and Akzo Nobel N.V. offer specialized glass flake coatings for concrete substrates, featuring high-build formulations, crack-bridging properties, and resistance to alkalis and chlorides. Additionally, the growing focus on sustainable infrastructure and green building practices has led to the development of eco-friendly coatings with low VOC emissions and enhanced durability, driving market adoption and growth in the concrete segment.

Market Segmentation by End-Use

Oil & Gas

The oil & gas industry emerged as the largest end-user segment for glass flake coatings in 2025, driven by the extensive use of coatings in upstream, midstream, and downstream operations. Oil & gas facilities, including refineries, pipelines, storage tanks, and offshore platforms, require corrosion protection to mitigate the impact of corrosive environments, temperature fluctuations, and chemical exposure. Glass flake coatings offer superior resistance to corrosion, abrasion, and cathodic disbondment, ensuring asset integrity and regulatory compliance in harsh operating conditions. Companies like Hempel A/S and PPG Industries, Inc. provide corrosion protection solutions tailored to the oil & gas industry, including epoxy, vinyl ester, and phenolic coatings designed for immersion, splash zone, and subsea applications. Moreover, the expansion of offshore exploration and production activities, along with investments in pipeline infrastructure and storage terminals, drives the demand for glass flake coatings in the oil & gas sector, presenting opportunities for market growth and innovation.

Marine

The marine industry represents a significant market for glass flake coatings, encompassing applications in shipbuilding, marine vessels, offshore structures, and port facilities. Glass flake coatings are widely used to protect marine assets from corrosion, fouling, and biofouling in aggressive seawater environments. Ship hulls, ballast tanks, offshore platforms, and underwater structures require effective corrosion protection to maintain operational efficiency, regulatory compliance, and asset value. Glass flake coatings offer advantages such as abrasion resistance, adhesion to various substrates, and compatibility with cathodic protection systems, making them preferred solutions for marine applications. Companies like Sherwin-Williams Company and Akzo Nobel N.V. offer marine coatings with antifouling properties, high chemical resistance, and low surface roughness, contributing to fuel efficiency and hull performance. Additionally, stringent environmental regulations, such as the International Maritime Organization's (IMO) anti-fouling systems convention (AFS), drive the adoption of eco-friendly coatings and alternative technologies, shaping market trends and product development initiatives in the marine segment.

Chemical & Petrochemical

The chemical & petrochemical industry utilizes glass flake coatings to protect assets such as storage tanks, pipelines, reactors, and processing equipment from corrosion, chemical attacks, and temperature extremes. Chemical plants, refineries, and petrochemical facilities operate in aggressive environments with exposure to corrosive chemicals, acids, and solvents, necessitating robust coating solutions to ensure safety, reliability, and regulatory compliance. Glass flake coatings offer superior chemical resistance, thermal stability, and mechanical properties, making them ideal for protecting steel and concrete substrates in chemical processing and storage applications. Companies like Jotun A/S and Nippon Paint Holdings Co., Ltd. provide a range of glass flake coatings tailored to the chemical & petrochemical industry, including novolac epoxy, vinyl ester, and fluoropolymer coatings designed for immersion, containment, and high-temperature service conditions. Moreover, advancements in coating technology, such as high-temperature curing, solvent-free formulations, and rapid return-to-service coatings, address the evolving needs of the chemical & petrochemical sector, driving market growth and innovation.

Others

The "others" category encompasses diverse end-user industries such as power generation, water & wastewater, transportation, and building & construction, which utilize glass flake coatings for corrosion protection, abrasion resistance, and surface enhancement. Glass flake coatings find applications in power plants, desalination plants, bridges, tunnels, and infrastructure projects requiring long-term durability and maintenance-free performance. Companies like Carboline Company and RPM International Inc. offer specialized coatings for niche applications, including thermal spray coatings, fusion-bonded epoxy (FBE) coatings, and intumescent coatings for fire protection. Moreover, regulatory requirements, industry standards, and performance specifications drive the adoption of glass flake coatings in various sectors, creating opportunities for market expansion and differentiation.

North America Remains the Global Leader

Geographic trends in the glass flake coatings market reflect regional variations in industrial activity, infrastructure development, and regulatory landscape. North America emerged as the largest market for glass flake coatings in 2025, driven by robust demand from industries such as oil & gas, marine, and chemical processing. The region's mature industrial base, technological innovation, and stringent regulatory standards contribute to market leadership and product differentiation. Moreover, strategic partnerships, mergers & acquisitions, and investments in research and development strengthen the competitiveness of North American companies in the global coatings market. However, Asia Pacific is expected to exhibit the highest CAGR during the forecast period, fueled by rapid industrialization, urbanization, and infrastructure investment in countries such as China, India, and Southeast Asian nations. The Asia Pacific region offers significant growth opportunities for glass flake coatings, driven by expanding end-user industries, rising environmental awareness, and regulatory compliance requirements. Additionally, Europe and Latin America are expected to witness steady growth in the glass flake coatings market, supported by infrastructure renewal projects, automotive manufacturing, and investments in sustainable coatings technologies.

Market Competition to Intensify during the Forecast Period

Key players operating in the glass flake coatings industry include Hempel A/S, PPG Industries, Inc., Sherwin-Williams Company, Akzo Nobel N.V., Jotun, Chugoku Marine Paints, Ltd., Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Berger Paints India Limited, RPM International Inc., Chemco International Ltd., Clean Coats, and DENSO Corporation. The glass flake coatings market is characterized by intense competition, with key players adopting various strategies to gain market share and maintain competitiveness. Hempel A/S, a leading player in the market, focuses on product innovation, quality assurance, and customer service to strengthen its market position. The company offers a comprehensive portfolio of glass flake coatings, including high-performance epoxy, vinyl ester, and phenolic coatings, tailored to different industries and applications. Moreover, Hempel A/S emphasizes sustainability initiatives and environmental stewardship, aligning its product development efforts with green coatings technologies and regulatory compliance standards. By investing in research and development, Hempel A/S aims to address emerging market trends, customer needs, and industry challenges, ensuring long-term growth and profitability. PPG Industries, Inc., another major player in the glass flake coatings market, focuses on diversification, geographic expansion, and strategic partnerships to enhance its competitive position. The company offers a wide range of glass flake coatings with advanced performance attributes, such as chemical resistance, UV stability, and abrasion resistance, catering to diverse end-user industries and applications. PPG Industries, Inc. leverages its global presence, brand recognition, and technical expertise to provide innovative coating solutions and value-added services to customers worldwide. Additionally, the company emphasizes continuous improvement, operational excellence, and cost optimization to drive efficiency and profitability in its coatings business.

Sherwin-Williams Company, a prominent player in the coatings industry, pursues growth through acquisitions, product differentiation, and market diversification strategies. The company's glass flake coatings portfolio includes high-build epoxy, vinyl ester, and polyester coatings designed for corrosion protection, immersion service, and structural enhancement applications. Sherwin-Williams Company focuses on customer-centric solutions, technical support, and aftermarket services to build long-term relationships and loyalty among its customer base. Furthermore, the company invests in digitalization, supply chain optimization, and innovation hubs to accelerate product development cycles and meet evolving market demands. Akzo Nobel N.V., a global leader in paints and coatings, emphasizes sustainability, innovation, and operational excellence to drive growth and competitiveness in the glass flake coatings market. The company offers a comprehensive range of glass flake coatings, including solvent-based and water-based formulations, tailored to specific end-user requirements and environmental regulations. Akzo Nobel N.V. leverages its strong brand portfolio, distribution network, and technological capabilities to penetrate new markets, expand product offerings, and capture market share. Moreover, the company prioritizes sustainability throughout its value chain, from raw material sourcing to product disposal, aiming to minimize environmental impact and maximize resource efficiency.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Glass Flake Coatings market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Resin Type

|

|

Substrate Type

|

|

End-Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report