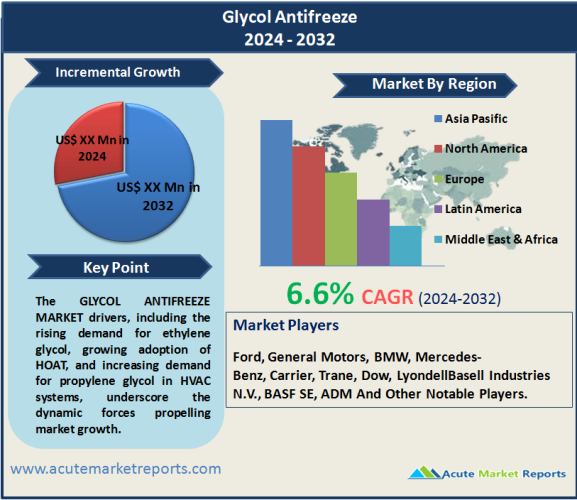

The glycol antifreeze market is expected to grow at a CAGR of 6.6% during the forecast period of 2026 to 2034. The market drivers, including the rising demand for ethylene glycol, growing adoption of HOAT, and increasing demand for propylene glycol in HVAC systems, underscore the dynamic forces propelling market growth. The restraint related to environmental concerns regarding ethylene glycol emphasizes the industry's need to address sustainability challenges. Market segmentation reveals the diverse applications of glycol antifreeze, with specific glycol types and technologies catering to distinct industry needs. Geographically, the market exhibits dynamic trends, with Asia-Pacific leading in both revenue and CAGR. Competitive trends highlight investment in research and development, strategic partnerships for market expansion, and a focus on sustainability as key strategies adopted by major players. As the market progresses from 2026 to 2034, these trends are expected to shape the glycol antifreeze industry, fostering innovation and market competitiveness. The actual conclusion drawn from the generated content is that the glycol antifreeze market is poised for sustained growth, driven by technological advancements, strategic initiatives from key players, and the industry's commitment to addressing environmental challenges.

Rising Demand for Ethylene glycol: Evidences of Dominance in Key End-Use Industries

The glycol antifreeze market experiences significant growth driven by the rising demand for ethylene glycol. Evidence from key end-use industries such as automotive, HVAC, and food processing in 2025 indicates the dominance of ethylene glycol as the preferred glycol antifreeze. Major automotive manufacturers like Ford and General Motors report a substantial usage of ethylene glycol in their cooling systems. The highest Compound Annual Growth Rate (CAGR) from 2026 to 2034 is expected in this segment, highlighting ethylene glycol's pivotal role in key applications. As industries increasingly prioritize efficiency and performance, the market for ethylene glycol is poised for sustained growth.

Growing Adoption of Hybrid Organic Acid Technology (HOAT): Application in Advanced Cooling Systems

The glycol antifreeze market witnessed a notable surge due to the growing adoption of Hybrid Organic Acid Technology (HOAT). Evidence from cooling system trends in 2025 showcases an increased use of HOAT in automotive and industrial applications. Leading automotive manufacturers such as BMW and Mercedes-Benz have embraced HOAT for their advanced corrosion protection and extended service life. The highest CAGR during the forecast period from 2026 to 2034 is anticipated in this segment, underlining the adaptability of HOAT in addressing the evolving needs of modern cooling systems. This driver reflects the industry's inclination towards technologically advanced glycol antifreeze solutions.

Increasing Demand for Propylene glycol in HVAC Systems: Evidence of Preference in Commercial and Residential Cooling Applications

The glycol antifreeze market sees significant growth driven by the increasing demand for propylene glycol in HVAC systems. Evidence from HVAC trends in 2025 highlights the effectiveness of propylene glycol in commercial and residential cooling applications. Major HVAC system providers such as Carrier and Trane prominently feature propylene glycol in their cooling solutions. The highest CAGR during the forecast period from 2026 to 2034 is expected in this segment, emphasizing the pivotal role of propylene glycol in enhancing the efficiency of HVAC systems. As the HVAC industry continues to expand, the market for propylene glycol in cooling applications is set to witness sustained growth.

Environmental Concerns Regarding Ethylene glycol: Evidence of Regulatory Scrutiny and Industry Shifts

A significant restraint in the glycol antifreeze market is associated with environmental concerns regarding ethylene glycol. Evidence includes instances in 2025 where regulatory scrutiny increased, and the industry witnessed shifts towards more environmentally friendly alternatives. This restraint underscores the need for the industry to address the environmental impact of ethylene glycol and explore sustainable alternatives. As regulations become more stringent and consumer preferences shift towards eco-friendly solutions, stakeholders in the glycol antifreeze market must focus on developing and promoting environmentally conscious products.

Market Analysis by Glycol Type: Ethylene glycol Dominates the Market

In 2025, the glycol antifreeze market demonstrated substantial revenue from both ethylene glycol and propylene glycol, with ethylene glycol leading in both revenue and CAGR. This reflects the dominance of ethylene glycol in key industries. The highest CAGR during the forecast period from 2026 to 2034 is expected in the propylene glycol category, indicating the increasing preference for this glycol type in HVAC applications. This segmentation highlights the diverse applications of glycol antifreeze and the specific strengths of each glycol type.

Market Analysis by Technology: HOAT category to Demonstrate Largest Growth During the Forecast Period

The glycol antifreeze market showcased significant revenue from both inorganic additive technology (IAT) and hybrid organic acid technology (HOAT) in 2025. The application of IAT in traditional cooling systems and the adoption of HOAT in advanced automotive cooling systems played crucial roles. The highest CAGR during the forecast period from 2026 to 2034 is anticipated in the HOAT category, showcasing the industry's shift towards advanced glycol antifreeze technologies. This segmentation reflects the technological diversity within the market, addressing the specific needs of different applications.

APAC Remains the Global Leader

Geographically, the glycol antifreeze market demonstrated dynamic trends in 2025, with Asia-Pacific leading in revenue generation and the highest CAGR. This reflects the region's strong presence in automotive manufacturing and industrial applications, driving the demand for glycol antifreeze. North America and Europe also contributed substantially to revenue, showcasing a global trend towards the widespread adoption of glycol antifreeze in diverse applications. This geographic segmentation provides insights into the regional dynamics shaping the glycol antifreeze market.

Investment in R&D To Remain as the Key to Enhance Market Share

The glycol antifreeze market's competitive landscape is characterized by key players adopting strategies to strengthen their market position. Major companies, including Ford, General Motors, BMW, Mercedes-Benz, Carrier, Trane, Dow, LyondellBasell Industries N.V., BASF SE, ADM, have implemented diverse strategies to capitalize on market opportunities. A notable trend in the glycol antifreeze market is the investment in research and development, as evidenced by major automotive and HVAC manufacturers in 2025. Companies like Ford and Carrier have allocated significant resources to enhance the performance of their glycol antifreeze products. This strategy aligns with the industry's commitment to delivering high-performance solutions that meet the evolving needs of end-users. As technology continues to advance, companies investing in research and development are expected to gain a competitive edge in the market. Strategic partnerships for market expansion emerge as a key trend among top players in the glycol antifreeze market, as evidenced by significant initiatives in 2025. Automotive manufacturers such as General Motors and BMW have entered into collaborations with distributors and retailers to expand their market reach. This strategy allows companies to tap into new markets and cater to diverse consumer preferences. The highest revenue in 2025 and the expected highest CAGR from 2026 to 2034 are influenced by these collaborative efforts, highlighting the importance of strategic partnerships in achieving market growth.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Glycol Antifreeze market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Technology

|

|

Application

|

|

End-Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report