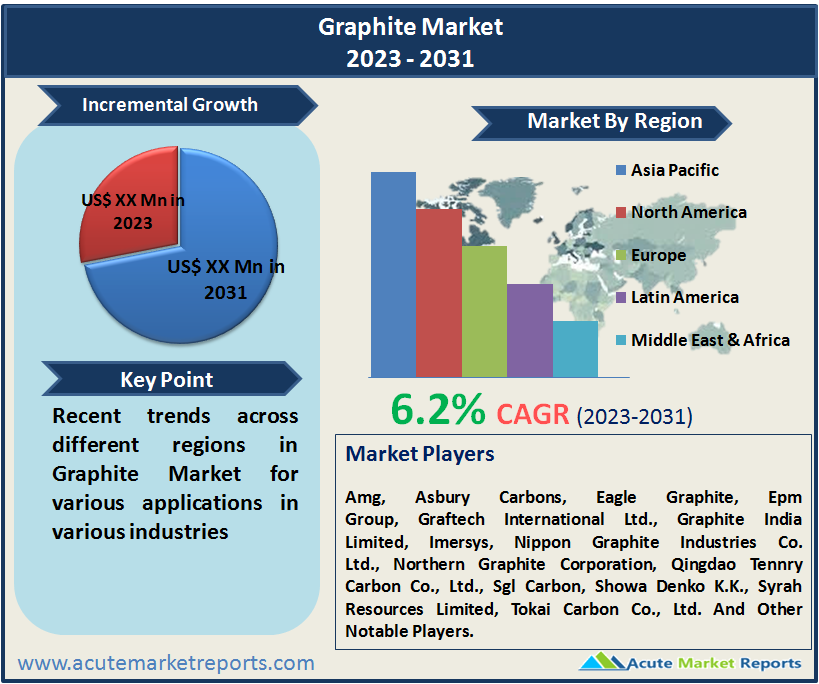

The graphite market, historically rooted in its diverse range of applications, has been a cornerstone for many industries. Renowned for its exceptional conductivity, lubrication properties, and heat resistance, graphite remains indispensable. In 2025, this market witnessed substantial momentum, chiefly owing to its heightened demand in burgeoning sectors like electronics, energy storage, and metallurgy. Transitioning into the forecast period of 2026 to 2034, the graphite industry's trajectory is slated to be compelling, fueled by technological advancements and new application avenues. Graphite Market is estimated to grow at a CAGR of 6.2% from 2026 to 2034.

Electrification and the Need for Efficient Energy Storage

One of the most profound growth catalysts for the graphite market has been the global push towards electrification, notably in the automotive sector. Graphite, being a primary component in lithium-ion batteries, witnessed surging demand. Electric vehicles (EVs), which are expected to play a pivotal role in the future of transportation, extensively rely on these batteries. A case in point is the 2026 disclosure from Tesla, underlining how its advanced battery technology employs a significant graphite composition to optimize energy storage and efficiency.

Proliferation of Electronics and Miniaturized Devices

The electronics industry's exponential growth has been another key driver. Graphite's conductivity properties make it an ideal fit for electronic applications, especially in miniaturized devices and components. A 2026 article from a leading tech journal detailed how graphite layers, especially in synthetic form, were integral to certain semiconductor components, ensuring faster processing speeds while reducing overheating risks.

Refractories and Metallurgical Boom

Graphite's role in refractories and metallurgical processes cannot be overstated. Its high heat resistance and stability make it crucial for producing steel, iron, and an array of other metals. Data from the World Steel Association in 2025 highlighted the rise in global steel production, hinting at the consequential increase in graphite demand for refractories.

Environmental Concerns and Mining Impacts

Graphite mining, especially natural graphite, is often associated with significant environmental footprints. Deforestation, water pollution, and habitat destruction are among the adverse impacts. A 2026 environmental assessment report highlighted the repercussions of a graphite mine in Madagascar, emphasizing the loss of unique biodiversity due to mining activities. Such instances have sparked debates on sustainable mining practices, potentially impeding unrestricted market growth.

Natural Graphite Commanded the Highest Share in Terms of Revenue

In terms of types, Natural and Synthetic graphite have carved their niche in the market landscape. In 2025, natural graphite commanded the highset share in terms of revenue. Its vast deposits and relatively simpler extraction processes, coupled with its purity, made it a preferred choice for various industries. However, the period from 2026 to 2034 is expected to witness synthetic graphite registering the highest CAGR. Synthetic graphite's uniformity, purity, and tailorability to specific applications make it increasingly favored in advanced technological applications.

Market Segmentation by Application

In 2025, the electrode segment was undeniably one of the most lucrative segments in the graphite application spectrum. Graphite electrodes, predominantly used in electric arc furnace steel production, saw escalating demand as industries sought efficient, eco-friendly steel production methods. With a shift towards cleaner production techniques Moreover, the tech industry's drive for miniaturized components necessitated precision electrodes for intricate etching, marking another growth avenue.and a departure from blast furnaces, the demand for high-quality graphite electrodes intensified. Electrodes also found extensive applications in electrolysis and other electrochemical processes, further boosting the segment's revenue. Perhaps one of the most exciting segments for graphite, battery production, especially lithium-ion batteries, has revolutionized its demand dynamics. With the world inching closer to an electric future, the onus on efficient, long-lasting, and high-performance batteries has never been higher. Graphite, being a pivotal component in these batteries, saw its demand skyrocket. In 2025, as EV sales surged and energy storage solutions became more mainstream, this segment's revenue contribution became substantial. Projections from 2026 to 2034 indicate even steeper growth curves as the world continues its march towards sustainable energy solutions.

Asia Pacific Leads the Market

From a geographic standpoint, Asia-Pacific dominated the 2026 market landscape, courtesy of its massive industrial base and significant natural graphite reserves. China's significant contribution, both as a producer and a consumer, anchored this dominance. However, the span between 2026 and 2034 is predicted to see Africa, with its untapped graphite reserves, register the highest CAGR. Europe and North America are also expected to maintain steady growth trajectories, given their technological advancements and growing EV markets.

Competitive Trends, Top Players, and Key Strategies

In the competitive arena of 2026, giants like Amg, Asbury Carbons, Eagle Graphite, Epm Group, Graftech International Ltd., Graphite India Limited, Imersys, Nippon Graphite Industries Co. Ltd., Northern Graphite Corporation, Qingdao Tennry Carbon Co., Ltd., Sgl Carbon, Showa Denko K.K., Syrah Resources Limited, Tokai Carbon Co., Ltd. held substantial market influence. Their dominance was maintained through continuous innovation, strategic acquisitions, and expansion into new markets. The overarching strategy for most was to enhance production capacities and invest in R&D to cater to the growing demand from the electronics and energy storage sectors. Moving forward, as the market landscape evolves from 2026 to 2034, collaborations with technology firms, sustainable mining practices, and expansion in emerging markets are anticipated to be the prime strategies.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Graphite market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report