"Hemoglobin A1c Testing Devices market to exhibit dynamic growth during the forecast period"

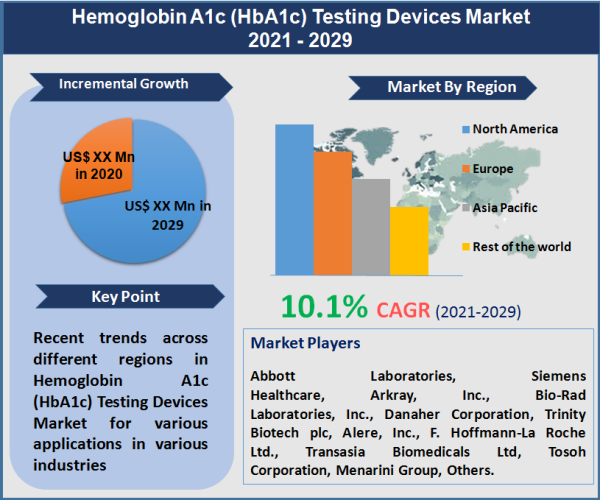

The global HbA1c testing devices market is growing at a significant rate, expected to grow at a CAGR of 10.1%. Worldwide, the increasing incidences of diabetes and other lifestyle diseases will drive the market growth globally. As per the data by International Diabetes Federation, in 2021, more than 430 Mn people were reported to have diabetes, i.e. 9.3% of the world’s population. The rate is going to increase by 10.3% by 2030 and 10.9% by 2045, i.e. around 700 Mn.

Increasing penetration of bench top and handheld devices with HPLC and immunoassay tests in the developing nations will drive the market growth globally. Increasing geriatric population worldwide with type I and II diabetes, and U.S. FDA clearance for top end devices and increased healthcare concern along with improved awareness will enhance the market growth in the emerging nations.

"Handheld devices expected to register higher growth by the end of 2029"

Advancement in benchtop and handheld devices with the development in the field of point of care testing will drive the market growth. For e.g. Afinion™ HbA1c Dx assay, by Abbott Laboratories. Increasing incidence of diabetes is a key factor for the overall HbA1c testing market globally. Major growth is observed for self-testing. Professional HbA1c testing also contribute a significant share on a global scale. Benchtop and compact devices hold more than 55% market share in the global market. Rapid diagnostic testing at point of care along with accurate results with no time will boost market growth. Manufacturing of advanced workstations in clinical laboratories, analyzers, kits & reagents, and point of care devices will support the global HbA1c devices market. Advancement in digital transformation along with miniaturizing tests (mobile pathology lab) for enhanced patient outcomes will drive the market growth in the near future. For e.g. dianax diagnostic technology, include main connector and disposable test cartridge.

"HPLC to witness a significant CAGR"

In 2020, the ion-exchange HPLC segment generated maximum revenue share in the HbA1c Testing Devices market globally and expected to contribute maximum revenue share in the coming years. High Performance Liquid Chromatography is used widely on a global scale, provide accurate results with higher accuracy as compared to other tests. New launch of analyzers along with improved test kits for home use, point of care settings and clinical laboratories will drive the market growth globally. As it has the capability to show results in real time of analyze variants along with increased ionic strength. For e.g. ADAMS A1c HA-8182, Glucose GA-1172. Launch of fully automated analyzers with advanced features will drive the market growth on a global scale. For e.g. HbA1c & HbA2/F-fully automated analyzer with unique CLE technology by Transasia Bio-Medicals, G8 HPLC Analyzer, i-Series Plus Integrated HPLC System and others.

"Increased research and development with increased prevalence for diabetes in the developed regions"

New device launch with automated features along with enhanced precision, FDA clearance for new analyzers and assay tests, technology expansion and partnerships in the developing and developed nations for HbA1c Testing Devices will drive the overall growth of the market during the forecast period. The North America region accounted for major revenue share globally. Presence of top manufacturers and suppliers along with top research centers with advanced diagnostic testing and approaches will hold the U.S market in dominant position. As per Centers for Disease Control and Prevention (CDC) report, in 2016, the prevalence of type 2 diabetes was around 21 Mn, and type 1 was 1.3 Mn adults. Increasing incidences in the U.S. will upsurge the demand for HbA1c devices across the region. Additionally, as per American Diabetes Association, in 2020, 34.2 Mn individuals were had diabetes, and every year more than 1.5 Mn US citizens are diagnosed with diabetes.

Key Developments:

Top Companies:

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Hemoglobin A1c (HbA1c) Testing Devices market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Type

| |

Technology

| |

End-user

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report