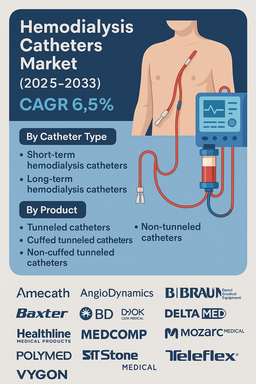

The global hemodialysis catheters market is projected to grow at a CAGR of 6.5% from 2025 to 2033, driven by rising cases of chronic kidney disease (CKD), increasing demand for long-term dialysis access solutions, and ongoing innovation in catheter materials and designs. Hemodialysis catheters play a crucial role in ensuring efficient vascular access for blood filtration in patients undergoing dialysis. The growing prevalence of diabetes and hypertension - key risk factors for CKD - is significantly expanding the patient pool requiring hemodialysis worldwide. Additionally, advancements in biocompatible materials, antimicrobial coatings, and tunneled catheter technologies are improving device performance, safety, and patient comfort.

Growing Need for Chronic Kidney Disease Management

The increasing global burden of end-stage renal disease (ESRD) is a primary growth driver for the hemodialysis catheters market. According to international health organizations, millions of patients depend on dialysis for survival, with vascular access catheters being essential for treatment initiation and maintenance. Technological developments such as antithrombogenic coatings, kink-resistant materials, and MRI-compatible polymers are enhancing procedural safety and reducing infection risk. Moreover, growing adoption of home-based dialysis and expansion of dialysis centers across emerging economies are fostering steady market growth.

Challenges: Infection Risk and Preference for Arteriovenous Access

Despite growth opportunities, the market faces challenges such as high infection risk, catheter malfunction, and increased preference for arteriovenous (AV) fistulas and grafts, which are considered safer for long-term dialysis. Catheters are often used as a temporary access solution, which limits long-term utilization rates. Moreover, regulatory complexities and reimbursement variations across regions influence pricing and adoption rates. However, the development of antimicrobial-coated and tunneled catheters and growing awareness about infection prevention are expected to mitigate these issues over time.

Market Segmentation by Catheter Type

In 2024, long-term catheters dominated the market due to the increasing number of patients requiring ongoing hemodialysis treatment. These catheters offer extended durability and reduced need for frequent replacement, improving patient outcomes. Short-term catheters, while primarily used in emergency and acute settings, remain vital for temporary vascular access in hospitals and intensive care units, especially for patients with sudden renal failure.

Market Segmentation by Product

In 2024, tunneled catheters held the largest share, as they are widely used for long-term dialysis due to their lower infection rates and improved patient comfort. Cuffed tunneled catheters are particularly favored for chronic dialysis patients, offering enhanced fixation and reduced microbial colonization. Non-tunneled catheters remain dominant in acute dialysis cases and intensive care units where short-term access is required. The non-cuffed tunneled segment serves a transitional role for patients requiring intermediate-duration dialysis therapy.

Regional Insights

In 2024, North America accounted for the largest market share, driven by high ESRD prevalence, advanced dialysis infrastructure, and favorable reimbursement systems in the U.S. and Canada. Europe followed closely, with Germany, France, and the UK leading due to established healthcare systems and growing investments in infection-resistant vascular devices. The Asia Pacific region is expected to experience the fastest growth, led by China, India, and Japan, where rapid urbanization, aging populations, and rising incidence of diabetes are driving dialysis demand. Latin America and Middle East & Africa (MEA) are emerging regions where expanding healthcare infrastructure and government initiatives for renal care are gradually improving market penetration.

Competitive Landscape

The global hemodialysis catheters market is moderately competitive, characterized by a mix of multinational and regional players focusing on innovation and biocompatibility. B. Braun, Baxter, and Becton, Dickinson and Company (BD) lead with strong product portfolios, established brands, and global distribution networks. Amecath, AngioDynamics, and Cook Medical are recognized for their advanced tunneled catheter systems and infection-resistant designs. Merit Medical, Medcomp, and Vygon emphasize product safety, durability, and procedural precision through proprietary coating and lumen technologies. Mozarc Medical, a recent joint venture between Baxter and Medtronic, is advancing digital-enabled dialysis solutions. Regional manufacturers such as Polymed, Bain Medical Equipment, and Delta Med provide cost-efficient options catering to emerging economies. Competitive differentiation in this market is driven by infection control, flow efficiency, catheter flexibility, and ease of insertion, with continuous R&D investment focused on extending catheter lifespan and minimizing complications.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Hemodialysis Catheters market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Catheter Type

| |

Product

| |

Material

| |

Tip Configuration

| |

Lumen

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report