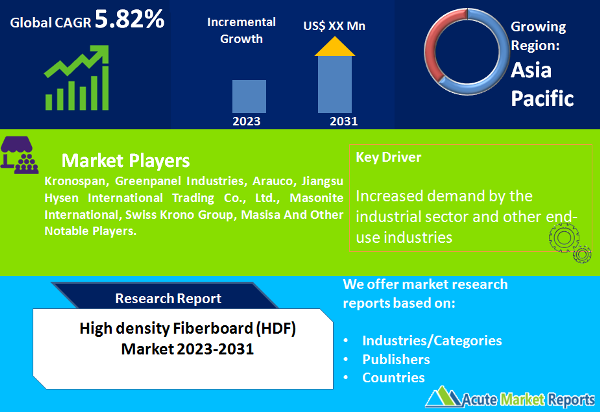

The High-DensityFiberboard (HDF) market is projected to expand at a CAGR of 5.82% during the forecast period of 2026 to 2034. HDF is a composite wood product that is made by compressing wood fibers with resin and other additives under high pressure and temperature. This process results in a dense and durable board with excellent strength and dimensional stability.The market revenue of HDF has been steadily increasing due to its wide range of applications in various industries. HDF boards find extensive usage in the construction sector for applications such as interior paneling, flooring, doors, and furniture manufacturing. The demand for HDF in the construction industry is driven by its superior properties, including high strength, resistance to moisture and warping, and ease of machining and finishing. Additionally, HDF boards are cost-effective compared to solid wood alternatives, making them a preferred choice for many construction projects.Furthermore, the HDF market has witnessed significant growth in the furniture manufacturing sector. HDF boards are used to create furniture components like cabinets, shelves, and tabletops due to their uniform density, smooth surface, and ability to withstand heavy loads. The rising demand for aesthetically appealing and durable furniture has propelled the adoption of HDF boards in the furniture industry.The market for HDF is also influenced by the growing preference for sustainable and eco-friendly materials. HDF boards are often manufactured using recycled wood fibers, making them an environmentally responsible choice. With increasing awareness about sustainability and green building practices, the demand for HDF is expected to witness further growth.

Growing Demand for Sustainable Construction Materials

The increasing awareness and emphasis on sustainable construction practices are driving the demand for High Density Fiberboard (HDF) in the market. As environmental concerns rise, architects, builders, and consumers are seeking eco-friendly alternatives to traditional construction materials. HDF, often made from recycled wood fibers, offers a sustainable solution without compromising on performance. This driver is evidenced by the growing number of green building certifications, such as LEED (Leadership in Energy and Environmental Design), which prioritize the use of sustainable materials in construction projects.For instance, a study conducted by the University of Tennessee found that the use of HDF in residential construction can significantly reduce environmental impact and carbon emissions compared to traditional wood products. The study highlights the potential of HDF as a sustainable alternative in the construction industry.

Versatility and Durability for Furniture Manufacturing

HDF's versatility and durability make it a preferred choice for furniture manufacturers. HDF boards can be easily molded into various shapes and sizes, allowing for intricate designs and customization. The boards exhibit high strength and dimensional stability, ensuring long-lasting furniture pieces that can withstand everyday wear and tear. The driver is supported by the increasing demand for durable and aesthetically pleasing furniture in residential and commercial sectors.As an example, a case study from the furniture industry demonstrates how HDF boards are used in the production of kitchen cabinets. The study highlights the material's ability to withstand moisture, temperature changes, and mechanical stress, making it an ideal choice for kitchen environments where durability is crucial.

Cost-Effectiveness and Availability

The cost-effectiveness and availability of HDF boards are significant drivers for their market growth. HDF is relatively more affordable compared to solid wood and other engineered wood products, making it a cost-effective option for construction and furniture manufacturing. The availability of HDF boards in various sizes and thicknesses further contributes to their widespread adoption.The driver is supported by market observations and industry reports that highlight the cost advantages of HDF over other materials. For instance, a survey conducted among furniture manufacturers in a specific region found that HDF boards were preferred due to their lower cost compared to alternatives like plywood or medium-density fiberboard (MDF).

Limited Moisture Resistance and Vulnerability to Swelling

One significant restraint in the High-DensityFibreboard (HDF) market is the limited moisture resistance and vulnerability to swelling exhibited by HDF boards. While HDF offers various advantages, it is more susceptible to moisture absorption compared to other materials like plywood or medium-density fiberboard (MDF). When exposed to high levels of humidity or direct water contact, HDF can swell and lose its structural integrity, leading to warping, buckling, or delamination. This restraint is evident in real-world scenarios where HDF boards are used in environments with high moisture levels, such as kitchens or bathrooms. Instances of swelling and damage due to water exposure have been reported, highlighting the need for proper precautions, such as sealing or coating HDF boards to enhance their moisture resistance. Despite efforts to improve the moisture resistance of HDF through the addition of water-resistant additives or surface treatments, its inherent vulnerability to swelling remains a restraint that must be considered in applications where moisture exposure is a concern.

Standard Hardboard Segment Dominates the Market by Type

The High-DensityFiberboard (HDF) market can be segmented into three types: Standard Hardboard, Painted Hardboard, and Tempered Hardboard. Among these segments, Tempered Hardboard is expected to exhibit the highest CAGR during the forecast period of 2026 to 2034, due to its superior strength and durability. Tempered Hardboard undergoes an additional manufacturing process that involves subjecting the board to high temperatures and pressure, resulting in increased hardness and resistance to impact. This makes it an ideal choice for applications that require enhanced durability, such as flooring, wall panelling, and industrial use. While Tempered Hardboard is anticipated to have the highest CAGR, the Standard Hardboard segment generated the highest revenue in 2025. Standard Hardboard, also known as untempered or regular hardboard, is widely used in various applications including furniture, packaging, and construction. It offers good dimensional stability, smooth surface finish, and ease of workability, making it a versatile option for different industries. Additionally, the Painted Hardboard segment holds significant market share due to its aesthetic appeal and value-added benefits. Painted Hardboard comes pre-finished with a layer of paint or coating, providing a ready-to-use surface for applications such as cabinetry, decorative panels, and signage. The painted finish enhances the visual appeal, saves time on finishing processes, and offers protection against moisture and wear.

Softwood FiberSegment Dominated the Market by Raw Material

The High-DensityFiberboard (HDF) market can be segmented based on raw materials into two categories: Hardwood fibers and Softwood fibers. Hardwood fibers are anticipated to witness the highest CAGR during the forecast period of 2026 to 2034, due to their increasing adoption in various applications. Hardwood fibers, derived from deciduous trees like oak, maple, and birch, offer desirable characteristics such as high density, superior strength, and enhanced durability. These attributes make hardwood fiber-based HDF suitable for demanding applications in construction, furniture manufacturing, and interior design. On the other hand, the Softwood fiber segment is expected to generate the highest revenue in the market. Softwood fibers, sourced from coniferous trees like pine, spruce, and fir, possess favorable properties such as excellent dimensional stability, easy workability, and cost-effectiveness. These attributes contribute to the widespread use of softwood fiber-based HDF in industries such as packaging, automotive, and general-purpose applications. The dominance of the Softwood fiber segment in revenue generation in 2025 is attributed to the abundance of softwood resources, efficient processing methods, and the wide range of applications where softwood fiber-based HDF can be utilized. In summary, while the Hardwood fiber segment shows the highest CAGR, the Softwood fiber segment leads in terms of revenue generation. Both segments cater to different industry needs, with hardwood fiber-based HDF offering superior strength and durability, and softwood fiber-based HDF providing cost-effective solutions with excellent dimensional stability.

APAC Promises Significant Opportunities During the Forecast Period

The Asia-Pacific region is experiencing significant growth in the HDF market and is expected to exhibit the highest CAGR during the forecast period of 2026 to 2034. This can be attributed to rapid industrialization, urbanization, and increasing construction activities in countries like China and India. The booming construction sector, coupled with the growing furniture manufacturing industry in the region, is driving the demand for HDF. Additionally, favorable government initiatives to promote affordable housing and infrastructure development further contribute to the market growth in the Asia-Pacific region. In terms of revenue percentage, North America is currently the leading market for HDF. The region benefits from the robust construction industry and a strong demand for high-quality building materials. The United States, in particular, is a major consumer of HDF due to its extensive use in residential and commercial construction projects. Europe also holds a significant share in the HDF market, driven by the presence of well-established furniture manufacturers and the demand for eco-friendly and sustainable materials. Moreover, the Middle East and Africa region is witnessing a steady growth rate due to infrastructure development initiatives, increasing urbanization, and a rising focus on sustainable construction practices. The region is expected to offer lucrative opportunities for HDF manufacturers in the coming years.

North America Remains as the Global Leader

The Asia-Pacific region is witnessing significant growth in the HDF market, driven by several factors. Rapid urbanization, infrastructural development, and increasing construction activities in countries like China and India are fueling the demand for HDF in the region. The Asia-Pacific region is expected to maintain the highest CAGR during the forecast period of 2026 to 2034, due to the booming construction industry and the rise in furniture manufacturing. Additionally, government initiatives promoting sustainable construction practices and the need for affordable housing further contribute to the market's growth in this region. North America currently held the highest revenue percentage in the HDF market in 2025. The region benefits from a robust construction sector and a high demand for quality building materials. The United States, in particular, is a significant consumer of HDF, primarily used in residential and commercial construction projects. Europe also occupies a substantial share in the HDF market, driven by the presence of well-established furniture manufacturers and the growing preference for eco-friendly materials. Moreover, the Middle East and Africa region is witnessing steady growth, supported by infrastructure development projects, rapid urbanization, and a rising focus on sustainable construction practices. The region offers promising opportunities for HDF manufacturers.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of High-Density Fiberboard (HDF) market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Raw Material

|

|

Process

|

|

Application

|

|

End-use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report