The home sleep screening devices market is projected to grow at a CAGR of 7.2% during the forecast period 2025 to 2033, driven by increasing awareness of sleep disorders, technological innovations in compact monitoring systems, and the rising preference for non-invasive and accessible home-based diagnostics. Home sleep screening devices, including wearable and non-wearable types, offer an affordable and patient-centric alternative to in-lab polysomnography, enabling continuous data tracking for accurate sleep analysis. Factors such as an aging population, rising healthcare costs, and the convenience of testing in a familiar home environment are encouraging patients and healthcare providers to adopt these devices at scale.

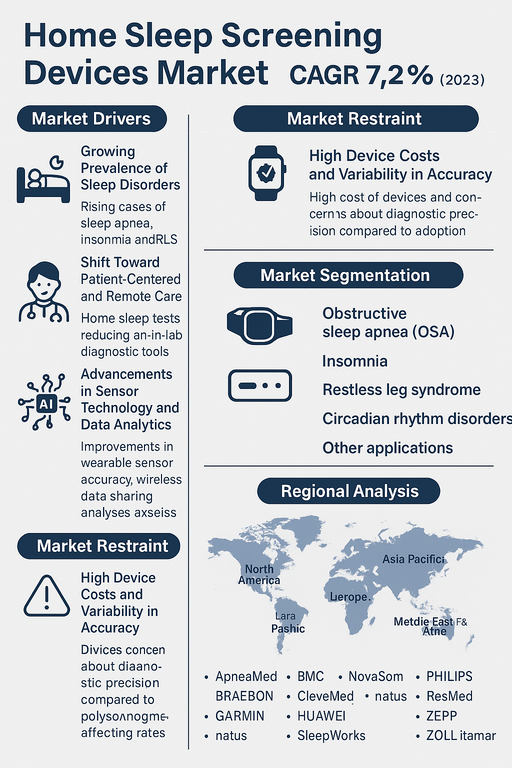

Market Drivers

Growing Prevalence of Sleep Disorders

The increasing global burden of sleep-related conditions such as obstructive sleep apnea (OSA), insomnia, restless leg syndrome, and circadian rhythm disorders is driving demand for home sleep monitoring solutions. Awareness campaigns by healthcare bodies and patient advocacy groups continue to highlight the risks of undiagnosed sleep disorders, especially their impact on cardiovascular health, obesity, mental health, and work productivity. The need for accurate at-home diagnostic tools that can identify sleep patterns and disruptions early is fueling widespread device adoption.

Shift Toward Patient-Centered and Remote Care

Home-based sleep diagnostics reduce the need for costly and often intimidating overnight stays in sleep labs. With healthcare systems worldwide moving toward remote care models, home sleep screening devices allow physicians to monitor patients’ sleep data through telemedicine platforms and cloud-based portals. Portable, user-friendly devices make compliance easier, ensuring better follow-up rates and enabling healthcare professionals to manage larger patient pools without overburdening clinic resources.

Advancements in Sensor Technology and Data Analytics

Continuous innovation in wearable biosensors, wireless data transmission, and AI-powered analytics enhances diagnostic accuracy and usability. These devices track multiple sleep metrics such as heart rate, oxygen saturation, body movements, and respiratory flow to provide actionable insights into patients’ sleep quality. The integration of smartphone apps and cloud connectivity allows real-time data sharing and personalized coaching to improve sleep habits, further boosting market demand.

Market Restraint

High Device Costs and Variability in Accuracy

Despite the strong growth outlook, high device prices and the perceived lower accuracy of home-based devices compared to polysomnography remain a barrier to adoption, especially in developing countries with limited reimbursement policies. Additionally, the lack of standardization and regulatory approvals across geographies may slow market penetration for new entrants and constrain healthcare provider confidence.

Market Segmentation by Product Type

Wearable Devices accounted for a significant market share in 2024 due to the proliferation of comfortable wrist-worn trackers, finger clips, and headbands with integrated pulse oximeters and accelerometers. Wearable devices enable continuous, unobtrusive overnight data collection with app-based interfaces for user-friendly self-monitoring. Rising consumer preference for lifestyle and fitness tech is further supporting strong growth in this segment. Non-Wearable Devices are expected to grow steadily through 2033, driven by bedside or under-mattress sensors that require no direct contact with the user. These devices monitor respiratory effort, movement, and snoring without disrupting the patient’s sleep. Popular with clinical professionals for their passive monitoring capabilities and durability, non-wearable devices will continue to cater to specialized medical and geriatric care needs.

Market Segmentation by Application

Obstructive Sleep Apnea (OSA) led the market in 2024 due to increasing diagnoses of OSA and its recognition as a serious health issue with cardiovascular and metabolic implications. Home screening devices play a key role in detecting apnea-hypopnea index (AHI) and supporting continuous positive airway pressure (CPAP) therapy compliance. Insomnia is projected to register the highest CAGR through 2033 as stress, shift work, and lifestyle factors contribute to a rise in chronic insomnia cases. Devices that can capture sleep-wake cycles and offer data-driven behavioral interventions and cognitive therapy support are seeing rapid adoption among consumers and clinics. Restless Leg Syndrome (RLS) is seeing moderate uptake as wearable and non-wearable monitors help document leg movements and identify triggers for periodic limb movements during sleep. Circadian Rhythm Disorders are also a significant segment, with devices supporting accurate monitoring of sleep timing and exposure to light-dark patterns for targeted chronotherapy interventions. Other Applications include parasomnias and fragmented sleep patterns in pediatric, elderly, and post-operative patient populations.

Regional Analysis

North America accounted for the largest share of the market in 2024 due to the region’s robust healthcare infrastructure, well-established reimbursement frameworks, and high awareness of sleep health. The presence of major companies such as ResMed, Philips, and NovaSom further drives the region’s leadership. In particular, the U.S. market benefits from rising obesity rates and increased prevalence of obstructive sleep apnea (OSA), coupled with telemedicine adoption and direct-to-consumer sales of home testing devices. Europe also holds a significant share, driven by strong demand from countries like Germany, France, and the U.K., where healthcare systems encourage early diagnosis of sleep disorders to reduce long-term treatment burdens. EU medical device regulations and data privacy standards support innovation in connected devices and AI-based sleep monitoring solutions, fostering steady growth through 2033. Asia Pacific is projected to register the highest CAGR during the forecast period. Rapid urbanization, increased stress, and lifestyle changes especially in countries like China, Japan, and India are leading to more insomnia and sleep apnea cases. Rising disposable income, improving healthcare awareness, and partnerships with local distributors and sleep clinics will fuel adoption of affordable, easy-to-use home sleep testing products across the region. Latin America and MEA present emerging opportunities. Increasing investments in public and private healthcare, greater awareness of sleep apnea risks, and the introduction of low-cost home monitoring kits support gradual market penetration. However, limited reimbursement policies and lack of trained sleep specialists may slow adoption in some underdeveloped areas.

Competitive Trends

The home sleep screening devices market is competitive, with companies differentiating based on device accuracy, cloud integration, wearable design, and partnerships with sleep clinics and healthcare systems. In 2024, leading companies included ApneaMed, BMC, BRAEBON, CleveMed, GARMIN, HUAWEI, Natus, NovaSom, PHILIPS, ResMed, SleepWorks, SOMNOmedics, VIRTUOX, ZEPP, and ZOLL Itamar. ResMed and PHILIPS maintained strong leadership positions owing to broad device portfolios, cloud analytics capabilities, and established global service networks. GARMIN and HUAWEI leveraged their wearable technology expertise to introduce intuitive consumer wearables that monitor overnight vitals with an emphasis on fitness and wellness. CleveMed, SOMNOmedics, and VIRTUOX specialize in FDA-cleared home diagnostic platforms and cloud-based sleep test interpretation. Going forward, competition will focus on continuous innovation around AI-driven diagnostics, user-centered design, subscription-based telehealth models, and partnerships with healthcare payers to boost accessibility and reimbursement.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Home Sleep Screening Devices market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Application

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report