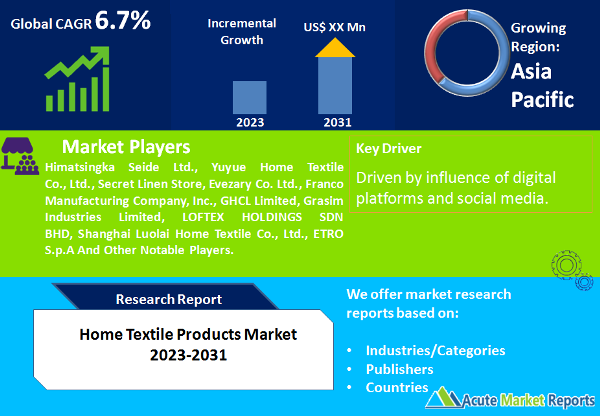

The home textile products market encompasses a wide array of textiles used for home decor and furnishing. This includes items like beddings, curtains, carpets, table cloths, and more. As aesthetics play an ever-crucial role in personal spaces and homes, the demand for diverse and quality home textile products has witnessed an upswing. Home textile products marketis expected to continue at a steady CAGR of 6.7% during the forecast period from 2026 to 2034, driven by influence of digital platforms and social media.

Rising Disposable Income and Home Ownership

The past few years have seen a significant increase in disposable income across numerous regions. In many emerging economies, as of 2026, higher disposable incomes led to heightened purchasing power among consumers. This, in tandem with favorable mortgage rates in several countries, boosted home ownership. With more people owning homes, the demand for home furnishing items, including textiles, surged. One could observe the proliferation of high-end home decor boutiques and stores in urban areas as evidence of this trend.

Influence of Digital Platforms and Social Media

The digital age, characterized by the omnipresence of social media, has redefined home aesthetics. Platforms like Instagram and Pinterest, in 2025, teemed with home decor inspirations, DIY projects, and influencer home tours. This constant exposure to trendy interiors propelled consumers to frequently update and upscale their home textiles. E-commerce sites further eased the purchasing process, with portals offering myriad textile options catering to diverse tastes. An uptick in online home textile sales last year stands testament to this influence.

Evolving Consumer Preferences Towards Sustainable and Organic Products

The 21st-century consumer is environmentally conscious. In 2025, a notable shift was observed as people gravitated towards sustainable, organic, and ethically produced home textiles. The demand for textiles like organic cotton bedsheets or bamboo fabric curtains saw an upward trajectory. Brands advertising eco-friendly practices and certifications witnessed higher traction and sales, marking a definitive turn in consumer preferences.

Fluctuations in Raw Material Prices

The home textile market, while lucrative, wasn't without its challenges in 2025. Raw material prices, especially for natural fibers like cotton and silk, faced fluctuations, owing to factors like climate changes, trade restrictions, and regional political instabilities. Such unpredictable costs posed significant budgeting challenges for textile producers, occasionally leading to increased end-product prices, consequently dampening consumer enthusiasm.

Market Segmentation by Material

In terms of revenue in 2025, natural materials, given their comfort and organic appeal, dominated the home textiles market. Consumers showed a pronounced preference for cotton, linen, and silk, especially in products like beddings and curtains. However, synthetic materials, led by innovations in polyester and nylon, weren't far behind. These offered durability and were often more affordable. Blended materials, combining the best of natural and synthetic fibers, found favor in specialized applications, like outdoor furnishing. Considering CAGR, blended materials are projected to grow at a promising rate from 2026 to 2034, as they offer a balance of quality and cost-efficiency.

Market Segmentation by Woven Fabric Type

In 2025, sheeting fabric, owing to its broad applications in bed linens and curtains, accounted for the highest revenue. The comfort and versatility of sheeting fabric made it a staple in households. Georgette fabric, with its lightweight and aesthetic appeal, trailed closely, mainly popular for curtains and drapes. While buckram and casement fabrics had niche applications, their growth wasn't negligible. From 2026 to 2034, Georgette fabric is expected to experience the highest CAGR, propelled by evolving aesthetic tastes favoring its delicate appearance.

Asia Pacific Remains as a Global Leader

Asia-Pacific, in 2025, led in revenue generation for the home textiles market. Countries like India and China, with their rich textile histories and vast production capabilities, played pivotal roles. Furthermore, Europe, with its luxury home decor brands, wasn't far behind in revenue. However, for the period 2026 to 2034, Latin America is anticipated to have the highest CAGR, driven by increasing disposable incomes and urbanization trends.

Competitive Trends

The competitive landscape in 2025 was dynamic, with leading players such as Himatsingka Seide Ltd., Yuyue Home Textile Co., Ltd., Secret Linen Store, Evezary Co. Ltd., Franco Manufacturing Company, Inc., GHCL Limited, Grasim Industries Limited, LOFTEX HOLDINGS SDN BHD, Shanghai Luolai Home Textile Co., Ltd., ETRO S.p.A, Trident Ltd., and Welspun Group making notable impacts. These companies, banking on expansive product ranges and strategic global placements, raked in significant revenues. The prevalent strategy observed was innovation, be it in materials, designs, or sustainability practices. Collaboration with designers and online influencers also emerged as a key trend. For the forecast period of 2026 to 2034, these market leaders are expected to delve deeper into research, eco-friendly practices, and online retail strategies to sustain and enhance their market positions.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Home Textile Products market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Material

|

|

Woven Fabric Type

|

|

End-Use

|

|

Distribution Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report