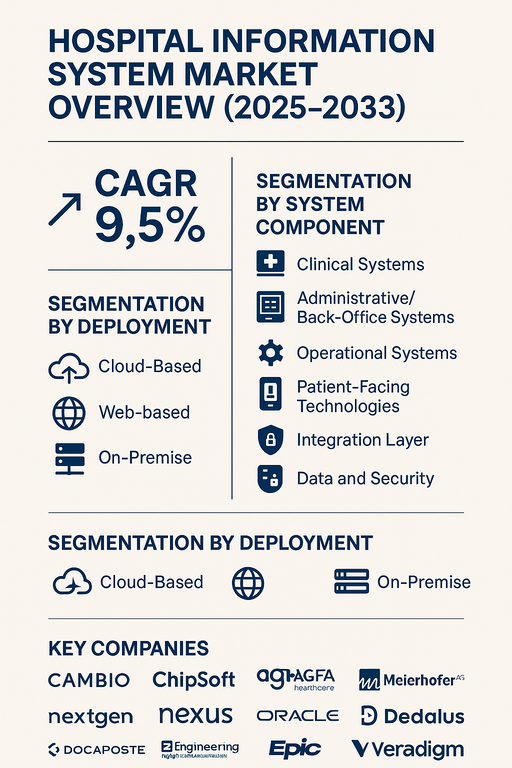

The global hospital information system (HIS) market is projected to grow at a CAGR of 9.5% from 2025 to 2033, driven by increasing digital transformation in healthcare, rising demand for integrated patient care platforms, and growing emphasis on data-driven decision-making. Hospital information systems encompass a wide range of clinical, administrative, and operational solutions designed to improve hospital efficiency, enhance patient outcomes, and ensure compliance with healthcare regulations. With expanding adoption of electronic health records (EHRs), interoperability standards, and AI-driven analytics, HIS is becoming a central enabler of modern hospital ecosystems.

Rising Need for Integrated and Patient-Centric Healthcare

Healthcare providers worldwide are increasingly focused on seamless integration of clinical, administrative, and patient-facing functions. The demand for HIS is accelerating as hospitals seek platforms that unify workflows, improve clinical decision support, and reduce errors. The integration of telehealth, mobile health apps, and patient portals into HIS systems is strengthening engagement and continuity of care. Cloud-based and AI-enabled HIS platforms are also empowering healthcare providers with real-time analytics, predictive modeling, and enhanced resource allocation. These advancements are reshaping hospital operations, particularly in large urban hospitals and multi-facility networks.

Challenges: High Costs and Interoperability Barriers

Despite the strong outlook, HIS adoption is hindered by high upfront investment costs and complex implementation requirements. Many hospitals, especially in emerging markets, face budgetary limitations that restrict large-scale deployments. Interoperability challenges between legacy systems, security concerns related to cloud-based platforms, and resistance to organizational change also act as barriers. In addition, varying regional regulations regarding patient data privacy complicate deployment strategies for global vendors. However, ongoing government initiatives, healthcare digitization programs, and gradual cost reduction through SaaS-based HIS models are expected to mitigate these barriers and boost adoption.

Market Segmentation by System Component

By system component, the market is segmented into clinical systems, administrative/back-office systems, operational systems, patient-facing technologies, integration layer, and data and security. Clinical systems remain the largest contributor, driven by the widespread adoption of EHRs, computerized physician order entry (CPOE), and decision support tools. Patient-facing technologies, such as portals and mobile apps, are the fastest-growing segment as hospitals emphasize patient empowerment and remote engagement. The integration layer and data/security modules are gaining traction due to rising demand for seamless interoperability and enhanced cybersecurity measures.

Market Segmentation by Deployment

By deployment, the market is segmented into cloud-based, web-based, and on-premise solutions. Cloud-based HIS dominates growth trends due to scalability, cost efficiency, and flexibility, making it particularly attractive for mid-sized hospitals and healthcare networks. Web-based systems remain relevant in regions with robust internet infrastructure, while on-premise deployments continue to serve hospitals with strict data residency and compliance requirements. The gradual shift toward cloud adoption is expected to accelerate as vendors introduce AI-driven and subscription-based service models.

Regional Insights

In 2024, North America led the hospital information system market, supported by advanced healthcare infrastructure, favorable government initiatives for EHR adoption, and strong vendor presence. Europe followed closely, with Germany, the UK, and France driving digitization initiatives and implementing robust healthcare IT frameworks. Asia Pacific is the fastest-growing region, with China, India, and Japan spearheading adoption due to rising healthcare expenditure, government-backed digital health programs, and increased private investment. Latin America and Middle East & Africa (MEA) are emerging markets, where improving hospital infrastructure and increasing focus on digital transformation are creating new opportunities.

Competitive Landscape

The 2024 market was dominated by established healthcare IT players and regional specialists focusing on modular and interoperable platforms. Epic Systems and Oracle lead the market with comprehensive, enterprise-grade HIS platforms deployed across global hospital networks. InterSystems, Dedalus, and CompuGroup Medical hold strong positions in Europe with scalable and integration-focused solutions. NextGen, Veradigm, and CAMBIO are expanding through specialty-specific and patient-centric HIS offerings. AGFA Healthcare, SECTRA, and ChipSoft continue to leverage imaging integration and clinical workflow strengths. Emerging players like Docaposte, Meierhofer AG, Nexus, and Engineering Ingegneria Informatica are gaining ground through niche capabilities and regional presence. Competitive differentiation is being shaped by interoperability, AI-enabled analytics, patient experience enhancement, and cloud-first deployment strategies.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Hospital Information System market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

System Component

| |

Deployment

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report