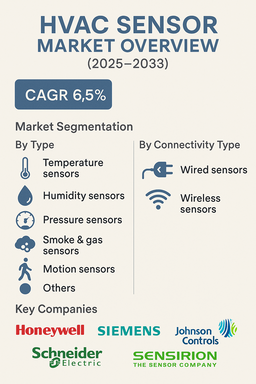

The global HVAC sensor market is projected to grow at a CAGR of 6.5% between 2025 and 2033, driven by the increasing demand for energy-efficient building systems, growing urbanization, and regulatory initiatives promoting smart infrastructure. HVAC sensors play a crucial role in optimizing heating, ventilation, and air conditioning systems by ensuring accurate monitoring and control of temperature, humidity, airflow, and indoor air quality. With the expansion of smart homes, commercial real estate, and industrial automation, demand for advanced and connected HVAC sensors is rising steadily across developed and emerging markets.

Rising Demand for Energy Efficiency and Smart Buildings

The HVAC sensor market is benefitting from rising global focus on energy conservation and sustainability. Building operators are increasingly investing in intelligent HVAC solutions that reduce energy consumption while enhancing occupant comfort. Sensors such as temperature, humidity, and pressure detectors are integral to demand-based HVAC operation, which lowers costs and minimizes environmental impact. The integration of wireless connectivity, IoT platforms, and AI-driven analytics is reshaping the market by enabling predictive maintenance and remote monitoring. In addition, government incentives and green building certifications such as LEED are accelerating adoption of sensor-enabled HVAC systems in commercial and institutional projects.

Challenges: Cost, Integration, and Cybersecurity

Despite strong growth, challenges remain. High installation costs and retrofitting expenses limit adoption, particularly in older buildings and cost-sensitive markets. Integration complexity with existing HVAC systems can also slow deployment in legacy infrastructures. Moreover, as wireless and cloud-connected sensors expand, cybersecurity concerns regarding data privacy and unauthorized access are gaining importance. Limited technical expertise in developing economies further hampers large-scale rollout. Nevertheless, advancements in sensor miniaturization, wireless protocols, and falling component prices are expected to overcome these barriers in the medium term.

Market Segmentation by Type

By type, the HVAC sensor market includes temperature sensors, humidity sensors, pressure sensors, smoke & gas sensors, motion sensors, and others. Temperature and humidity sensors dominate the market due to their critical role in climate control, indoor air quality monitoring, and energy optimization. Pressure sensors contribute significantly to ventilation management and airflow control, while smoke and gas sensors enhance safety compliance in residential and commercial buildings. Motion sensors are gaining traction in occupancy-driven systems, enabling automated energy savings in smart homes and offices.

Market Segmentation by Connectivity Type

By connectivity type, the market is segmented into wired sensors and wireless sensors. Wired sensors continue to hold a large share due to reliability, stable performance, and long-established use in traditional HVAC systems. However, wireless sensors are experiencing the fastest growth as IoT adoption expands, offering flexibility, ease of installation, and compatibility with cloud-based monitoring solutions. The trend toward digital building management systems is further accelerating the shift toward wireless sensor technologies.

Regional Insights

North America led the HVAC sensor market in 2024, supported by early adoption of smart building technologies, strong presence of leading manufacturers, and stringent energy efficiency regulations. Europe followed closely, with Germany, the UK, and France investing heavily in sustainable construction and retrofitting of older building stock. Asia Pacific is expected to be the fastest-growing region during the forecast period, with China, India, and Southeast Asia driving demand due to rapid urbanization, smart city initiatives, and rising industrialization. Latin America and Middle East & Africa (MEA) are emerging markets, where rising commercial construction and infrastructure development are gradually creating adoption opportunities for advanced HVAC sensor systems.

Competitive Landscape

The 2024 HVAC sensor market was shaped by leading global players with strong expertise in building technologies and smart infrastructure. Honeywell International, Siemens, Johnson Controls, and Schneider Electric dominate the competitive landscape with diversified product portfolios, extensive distribution networks, and long-standing partnerships in HVAC and building management systems. Sensirion, a specialist in high-precision environmental and flow sensors, is carving a strong niche through advanced sensor innovation and IoT integration. Competitive differentiation is increasingly defined by connectivity, energy analytics, miniaturization, and interoperability with building automation platforms. With rising adoption of wireless solutions and IoT integration, the competitive landscape is expected to evolve rapidly through partnerships, acquisitions, and product innovations.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of HVAC Sensor market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Type

| |

|

Type | |

Connectivity Type

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report