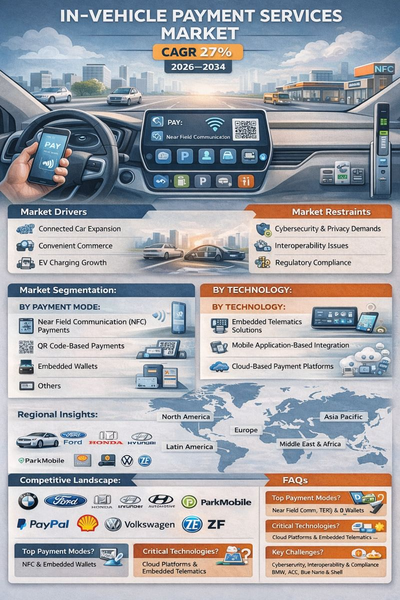

The in-vehicle payment services market is expected to grow at a CAGR of 27.0% during 2026–2034, driven by rising connected car penetration, growing demand for seamless driver experiences, and expanding partnerships between automakers, payment providers, and merchants. In-vehicle payments enable drivers to pay for services such as fuel, parking, tolls, charging, drive-through, and selected in-car commerce using the vehicle head unit or connected apps. Growth is supported by increased adoption of digital wallets, wider NFC and QR acceptance at merchants, and stronger integration of infotainment and telematics platforms with cloud-based payment orchestration.

Market Drivers

Market growth is driven by consumer demand for convenience and reduced friction in routine mobility transactions such as parking and fuel payments, especially in urban areas. Automakers are increasing focus on software-defined vehicles, connected infotainment ecosystems, and subscription-based services, which expands opportunities to embed payments directly into the vehicle UI. Growth is also supported by expansion of EV charging networks and digital parking platforms, where integrated payments improve experience and can increase transaction conversion. Partnerships between OEMs, payment processors, and merchants are accelerating rollout by enabling standardized payment flows and broader coverage across locations. Increasing deployment of embedded telematics and cloud connectivity supports real-time authentication, tokenization, and transaction routing. Fleet operators also support adoption where integrated payments simplify expense management and reporting.

Market Restraints

The market faces restraints due to security, privacy, and liability requirements, as in-vehicle payments involve sensitive personal and financial data and require strong authentication and fraud prevention. Interoperability challenges can occur because vehicles, infotainment systems, merchants, and payment providers often use different standards and integration models. Regulatory compliance requirements across regions, including data protection and payment regulations, can increase complexity and slow scaling. User adoption can be limited by trust concerns, setup friction, and inconsistent merchant acceptance across geographies. Technical constraints such as connectivity gaps, platform fragmentation across vehicle models, and long automotive product cycles can also delay upgrades and features compared to mobile-first payment ecosystems.

Market Segmentation

By Payment Mode

By payment mode, the market is segmented into near field communication (NFC) payments, QR code-based payments, embedded wallets, and others. Embedded wallets are expected to gain strong adoption as OEMs and payment partners aim to provide a unified checkout experience inside the vehicle, with stored credentials, tokenized payments, and recurring purchase capability for mobility services. NFC payments are relevant in use cases where tap-to-pay flows are enabled through vehicle-linked devices or integrated systems, supporting quick transactions in compatible environments. QR code-based payments remain important where QR acceptance is widespread, particularly for parking and selected merchant payments, offering lower deployment cost and broad compatibility. Others include account-based billing, license plate-based payments for parking, and integrations tied to merchant-specific apps or loyalty ecosystems.

By Technology

By technology, the market is segmented into embedded telematics solutions, mobile application-based integration, and cloud-based payment platforms. Embedded telematics solutions enable direct vehicle-to-cloud connectivity and support in-vehicle identity, authentication, and transaction initiation through the infotainment system. Mobile application-based integration remains a major route for adoption, as many payment flows are enabled through OEM apps or third-party apps linked to the vehicle, reducing hardware dependency and supporting faster feature rollout. Cloud-based payment platforms are becoming central as they support tokenization, fraud controls, merchant routing, and scalable integration across services such as fuel, charging, tolling, and parking, while enabling analytics and personalization features that increase user engagement.

Regional Insights

North America represents a strong growth region supported by high connected-car penetration, mature digital payments adoption, and large-scale parking and mobility platforms that can integrate with OEM ecosystems. Europe shows strong potential driven by connected vehicle rollout, cross-border travel use cases, and growing focus on integrated mobility services, although data privacy and regulatory compliance requirements can be stricter. Asia Pacific is expected to be a high-growth region due to rapid digital wallet adoption, expanding connected car sales in selected markets, and strong QR-based payments acceptance in many countries. Latin America shows developing demand supported by digital payment expansion and growing urban mobility services, although infrastructure and acceptance variability can affect scaling. The Middle East & Africa shows selective growth linked to premium vehicle adoption, smart city programs, and expansion of digital parking and fuel payment ecosystems, with rollout shaped by partnerships and regulatory frameworks.

Competitive Landscape

The market is partnership-driven, with competition shaped by the strength of OEM ecosystems, payment platform integrations, merchant coverage, and security performance. Automakers compete by expanding in-car commerce features, improving user experience in infotainment, and bundling payments with navigation, parking discovery, and loyalty programs. Payment providers and platforms compete through tokenization, fraud prevention, compliance readiness, and ability to integrate across multiple OEMs and merchants. Merchant-side participation is important for scale, especially in fuel, parking, tolling, and EV charging networks. Key strategies include expanding OEM-payment partnerships, integrating loyalty and offers to increase repeat usage, strengthening authentication models, and building cloud payment orchestration layers that can support multiple services and geographies. Key companies operating in the market include BMW, Ford Motor Company, Honda Motor, Hyundai Motor, Jaguar Land Rover Automotive, ParkMobile, PayPal, Shell, Volkswagen, and ZF.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of In-Vehicle Payment Services market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Payment Mode

|

|

Technology

|

|

Vehicle

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Frequently Asked Questions

What is the growth outlook for the in-vehicle payment services market?

The market is expected to grow at a CAGR of 27.0% during 2026–2034, supported by connected car growth, expanding partnerships, and increasing demand for seamless in-car commerce.

Which payment modes are expected to see strong adoption?

Embedded wallets are expected to grow strongly due to better user experience and recurring payment capability, while QR-based payments remain important where QR acceptance is high.

Which technologies are most important for scaling in-vehicle payments?

Cloud-based payment platforms and embedded telematics are critical for secure authentication, tokenization, transaction routing, and multi-service integration across geographies.

What are the key challenges in this market?

Key challenges include cybersecurity and privacy requirements, interoperability across vehicle platforms and merchants, regulatory compliance, and user trust and adoption barriers.

Who are the key players in this market?

Key participants include BMW, Volkswagen, Ford, Hyundai, Honda, Jaguar Land Rover, ZF, and ecosystem partners such as PayPal, ParkMobile, and Shell.