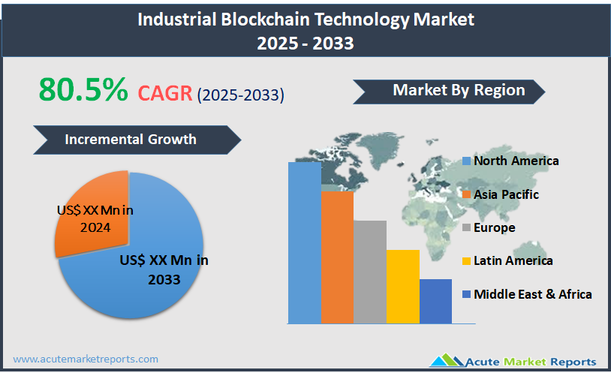

The industrial blockchain technology market refers to the application of blockchain-based systems across various industrial sectors such as manufacturing, supply chain management, energy, automotive, and construction. Blockchain technology in these industries focuses on decentralization, transparency, security, and immutability of data transactions and records. Unlike traditional centralized systems, industrial blockchain platforms enable multiple stakeholders to access and verify shared data in real-time without intermediaries, reducing costs, fraud, and operational inefficiencies. Solutions under this market include blockchain-as-a-service (BaaS), smart contracts, digital identity, asset tracking, and decentralized finance (DeFi) tools customized for industrial use cases. The industrial blockchain technology market has witnessed strong momentum in 2024, driven by the need for secure and transparent data management solutions across global supply chains, manufacturing operations, and industrial asset management. Key industries have adopted blockchain technology to enhance traceability, automate contractual processes, and safeguard intellectual property, laying the foundation for increased operational resilience. In 2024, the market recorded notable adoption in areas such as industrial IoT integration, predictive maintenance, and energy trading platforms. With an impressive CAGR of 80.5% expected from 2025 to 2033.

Increasing Demand for Supply Chain Transparency

The growing complexity of global supply chains has led to an urgent need for enhanced visibility and traceability, acting as a major driver for the industrial blockchain technology market. Industries such as manufacturing, automotive, and food and beverage are under pressure to ensure the authenticity of products, comply with regulations, and mitigate risks associated with counterfeiting, recalls, and unethical sourcing practices. Blockchain’s decentralized ledger system provides immutable and real-time recording of transactions, allowing all stakeholders in the supply chain (from raw material suppliers to end consumers) to verify each step. For example, IBM's Food Trust platform has demonstrated significant reductions in tracing food origins, cutting tracking time from days to seconds. Moreover, regulatory initiatives such as the European Union’s mandatory due diligence laws for supply chains are creating a compliance-driven market for blockchain-based solutions. According to the European Parliament, failure to provide supply chain traceability could result in substantial penalties, further pushing industries toward blockchain adoption. The COVID-19 pandemic exposed vulnerabilities in global supply networks, with industries now seeking resilient, transparent systems that blockchain can uniquely address.

Integration with Industrial Internet of Things (IIoT)

The convergence of blockchain with Industrial Internet of Things (IIoT) ecosystems presents a major growth opportunity for the industrial blockchain technology market. IIoT involves interconnected devices that collect, exchange, and act on industrial data, and blockchain’s secure and decentralized data architecture complements IIoT by ensuring data integrity, preventing tampering, and enabling trusted device-to-device communication. For example, the Industrial Internet Consortium (IIC) emphasized that blockchain could secure IIoT networks against cyberattacks that traditionally exploit centralized vulnerabilities. In energy management, Siemens has initiated pilot projects integrating blockchain with IIoT devices for decentralized energy trading, improving real-time visibility and automating transactions through smart contracts. Similarly, manufacturing plants are deploying blockchain-enabled IIoT networks for predictive maintenance, where machine data recorded on blockchain is used to forecast equipment failures and automate maintenance schedules without human intervention. In addition, government bodies such as the U.S. Department of Energy have funded projects combining blockchain with IIoT for enhancing grid security. As industries increasingly automate operations through connected devices, the need for trusted, tamper-proof communication among billions of endpoints creates a substantial opportunity for blockchain technology to gain industrial foothold.

High Implementation Costs

Despite its transformative potential, the high costs associated with deploying industrial blockchain systems remain a significant restraint on market growth. Implementing blockchain at an industrial scale involves considerable expenses related to software development, hardware upgrades, network infrastructure, integration with existing legacy systems, and ongoing maintenance. In sectors such as manufacturing and energy, enterprises must invest heavily in re-engineering operational models to accommodate decentralized technologies, which can delay return on investment (ROI) timelines. For example, an industrial blockchain network for supply chain tracking must ensure interoperability among different ERP systems, sensor devices, and production facilities, all of which require extensive customization and testing. According to estimates from multiple academic studies, small and medium-sized enterprises (SMEs) often find the upfront blockchain implementation costs prohibitive, thereby limiting widespread adoption to larger corporations with higher capital reserves. Moreover, blockchain networks’ energy consumption, particularly those utilizing Proof-of-Work (PoW) consensus mechanisms, can drive up operational costs, contradicting sustainability initiatives. Enterprises also face hidden costs related to employee training, compliance updates, and cybersecurity reinforcement, adding further financial burdens. Hence, while blockchain solutions offer long-term efficiencies, the initial capital investment and complex deployment processes present a formidable restraint for the industrial sector.

Scalability Issues in Industrial Applications

One of the major challenges facing the industrial blockchain technology market is achieving scalability in high-volume, real-time applications. Industrial environments, such as automated manufacturing plants and large-scale supply chains, generate massive amounts of data that need to be processed and verified quickly to maintain operational efficiency. Traditional blockchain platforms, particularly public blockchains, suffer from limited transaction throughput and high latency due to consensus mechanisms like Proof-of-Work and Proof-of-Stake. For instance, Bitcoin and Ethereum networks process far fewer transactions per second compared to centralized databases, making them unsuitable for industrial environments requiring millisecond-level response times. Furthermore, storage limitations arise as industrial blockchain systems must manage extensive historical datasets, significantly increasing node storage requirements and network congestion. Efforts to improve scalability, such as Layer 2 solutions and sharding, are still in developmental stages and have not been widely adopted across industrial sectors. Additionally, interoperability among different blockchain networks and existing enterprise systems remains a complex issue, preventing seamless data flow across platforms. These scalability and performance challenges not only hinder real-time industrial applications but also create operational bottlenecks, making it difficult for blockchain to meet the industrial sector’s high-speed and high-volume processing needs effectively.

Market Segmentation by Component

Based on component, the industrial blockchain technology market is segmented into Platform and Services. The Platform segment accounted for the highest revenue share in 2024 owing to the growing demand for robust blockchain frameworks that enable secure, decentralized operations across supply chains, energy grids, and manufacturing processes. Companies across industrial sectors have increasingly invested in developing or adopting blockchain platforms that allow integration with IoT networks, enterprise resource planning (ERP) systems, and cloud services, thereby enhancing operational transparency, traceability, and automation. Examples such as IBM Blockchain Platform and Hyperledger Fabric have been widely deployed across industries, contributing to the segment’s dominant revenue position. From 2025 to 2033, the Services segment is expected to register the highest CAGR, driven by the growing need for consulting, integration, deployment, and managed services tailored for industrial applications. Industrial enterprises often require specialized blockchain services to customize platforms for specific needs such as asset tokenization, smart contract development, and regulatory compliance, leading to a surge in demand for professional services. As industrial blockchain projects become more complex, involving cross-industry collaborations and consortium-led initiatives, service providers offering technical expertise, end-to-end implementation support, and post-deployment maintenance are expected to witness rapid growth. Furthermore, industries are increasingly outsourcing blockchain development and management to third-party vendors to reduce capital expenses and operational risks, thus fueling the service segment’s strong expansion during the forecast period.

Market Segmentation by Enterprise Size

Based on enterprise size, the industrial blockchain technology market is segmented into Large Enterprises and SMEs. In 2024, the Large Enterprises segment generated the highest revenue, as large corporations possess the financial resources, technical expertise, and strategic imperatives to adopt blockchain technology at scale. Multinational companies in sectors such as automotive, manufacturing, and energy are leveraging blockchain to streamline cross-border supply chains, automate industrial processes, and secure data exchanges. Initiatives like BMW’s blockchain-backed supply chain transparency program and Shell’s blockchain-enabled energy trading platform highlight how large enterprises have aggressively adopted blockchain to drive innovation and operational efficiencies. Moreover, large enterprises are forming consortia to establish industry-wide blockchain standards, further strengthening their market dominance. From 2025 to 2033, the SMEs segment is projected to witness the highest CAGR, driven by the growing availability of affordable blockchain-as-a-service (BaaS) platforms and the increasing need for smaller businesses to ensure regulatory compliance, operational transparency, and competitive differentiation. The democratization of blockchain through cloud-based solutions enables SMEs to access scalable, flexible blockchain infrastructure without heavy upfront investments. Governments across regions are also providing funding and regulatory support to encourage blockchain adoption among SMEs, recognizing their role in driving economic growth. For instance, initiatives by the European Union and the Government of South Korea offer grants and technical support for SMEs implementing blockchain solutions. As awareness increases and technological barriers lower, SMEs are expected to rapidly integrate blockchain technologies into their business models, contributing significantly to market expansion during the forecast period.

Geographic Segment

Based on geography, the industrial blockchain technology market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. In 2024, North America accounted for the highest revenue share due to strong early adoption across sectors such as manufacturing, energy, and supply chain management. Companies across the United States and Canada leveraged blockchain solutions to enhance transparency, data security, and operational efficiency, supported by a favorable regulatory landscape and significant venture capital investments. Leading industrial players and technology giants collaborated to deploy blockchain projects aimed at automating procurement, managing supplier relationships, and securing operational data. Europe followed North America closely, driven by stringent regulations such as the General Data Protection Regulation (GDPR) and the European Union’s blockchain initiatives under the European Blockchain Services Infrastructure (EBSI). Europe’s focus on sustainability and supply chain traceability further accelerated blockchain adoption across automotive, manufacturing, and energy sectors. Asia Pacific is expected to record the highest CAGR from 2025 to 2033, fueled by rapid industrialization, government support for blockchain innovation, and large-scale digital transformation initiatives. Countries like China, Japan, South Korea, and India are investing heavily in integrating blockchain with industrial IoT, smart factories, and logistics networks. For instance, China’s 14th Five-Year Plan emphasized blockchain as a key strategic technology, while Japan’s Ministry of Economy, Trade and Industry promoted blockchain for supply chain and manufacturing applications. Meanwhile, Latin America and Middle East & Africa are expected to witness steady growth as industries in these regions increasingly explore blockchain for resource management, trade finance, and supply chain optimization, though challenges such as lack of technical expertise and infrastructure constraints may moderate adoption rates compared to developed regions.

Competitive Trends

The industrial blockchain technology market in 2024 was characterized by intense competition among technology providers, consulting firms, and specialized blockchain developers. Hewlett Packard Enterprise Development LP focused on providing scalable enterprise-grade blockchain infrastructure integrated with edge computing capabilities to meet the needs of industrial clients, while SAP SE expanded its blockchain-as-a-service offerings targeting supply chain and asset management applications. Oracle Corporation developed blockchain platform services that emphasized interoperability with existing ERP systems, making it attractive to manufacturing and energy enterprises. Amazon Web Services, Inc. (AWS) maintained a strong presence with its managed blockchain services tailored for industrial clients seeking rapid deployment and scalability. Microsoft Corporation reinforced its Azure Blockchain Service offerings by emphasizing integration with IoT and cloud ecosystems. IBM Corporation continued its leadership by driving blockchain deployments through IBM Blockchain Platform and Hyperledger Fabric initiatives, particularly focusing on automotive, logistics, and manufacturing sectors. Infosys and Accenture capitalized on their consulting expertise to provide end-to-end blockchain integration services for industrial clients, offering strategic advisory, customization, and managed services. Wipro expanded its industrial blockchain portfolio with solutions for energy trading and smart contracts for manufacturing, while Huawei invested heavily in blockchain-enabled IoT platforms for smart factories and grid management. EY emphasized blockchain audit and compliance solutions, enabling industrial enterprises to meet regulatory standards efficiently. LeewayHertz specialized in building customized blockchain applications for supply chain and asset tracking, whereas Ripple promoted blockchain-based payment and finance solutions applicable to industrial cross-border transactions. Chainalysis KYT offered blockchain analytics and compliance solutions to secure industrial blockchain networks. Digital Asset Holdings, LLC focused on smart contract development platforms such as DAML to automate industrial workflows, and BTL Group Ltd. concentrated on inter-enterprise blockchain solutions for energy and logistics sectors.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Industrial Blockchain Technology market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Component

| |

Enterprise Size

| |

Type

| |

Application

| |

End-user

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report