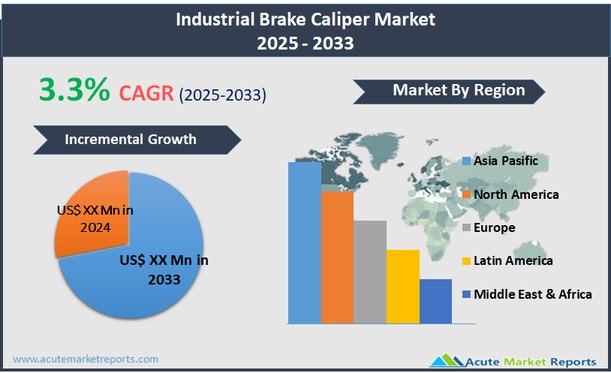

The industrial brake caliper market encompasses the production, distribution, and sale of braking systems specifically designed for use in industrial machinery and heavy vehicles. Industrial brake calipers are critical components used to slow down or stop large machines, such as cranes, forklifts, wind turbines, and mining equipment, by applying friction to brake rotors. These devices are engineered for robust performance, durability, and reliability under harsh operating conditions. The market includes various types of brake calipers, including hydraulic, pneumatic, and electric, tailored to meet the specific needs and safety standards of different industrial applications. The industrial brake caliper market is experiencing steady growth, primarily driven by the expansion of industries such as manufacturing, construction, and mining, where safety and operational efficiency are paramount. With a projected Compound Annual Growth Rate (CAGR) of 3.3%, the market is responding to increasing demands for advanced safety features and regulatory compliance across these sectors.

Expansion of Industrial and Construction Sectors

The primary driver for the industrial brake caliper market is the expansion of industrial and construction sectors globally. As economies develop and urbanize, there is a significant increase in construction activities and industrial operations that require heavy machinery and equipment. These machines, including cranes, excavators, and heavy trucks, rely heavily on robust braking systems to ensure safety and operational efficiency. For instance, in the construction of high-rise buildings, transportation infrastructure, and industrial plants, the demand for machinery equipped with advanced braking systems is critical to manage the heavy loads and prevent accidents. This need is underscored by stringent safety regulations that mandate the use of high-performance brake systems in industrial applications. The ongoing infrastructural developments, particularly in emerging economies, further fuel the demand for these specialized braking solutions, supporting market growth in this segment.

Technological Advancements in Brake Systems

Emerging opportunities in the industrial brake caliper market are largely centered around technological advancements in brake systems. With the integration of IoT and smart technologies in industrial machinery, there is a growing demand for brake calipers that can seamlessly integrate with these modern systems to provide enhanced performance monitoring, predictive maintenance, and better control. Innovations such as electronically controlled brake systems and improvements in materials that offer lighter, more durable, and more heat-resistant brake calipers are becoming increasingly desirable. These advancements not only improve the safety features of industrial equipment but also contribute to operational efficiency by reducing maintenance downtime and extending the lifespan of the brake systems. The ability to incorporate these technological enhancements presents significant growth prospects for manufacturers within this market.

High Cost of Advanced Brake Systems

A significant restraint in the industrial brake caliper market is the high cost associated with advanced braking systems. The development and manufacturing of high-performance brake calipers involve substantial investments in research and development, high-quality materials, and compliance with stringent safety standards, all of which contribute to higher production costs. These costs are often passed on to the end users, making these advanced systems less accessible to smaller operations or those in developing regions where budget constraints are more pronounced. Additionally, the need for specialized maintenance and repairs for these advanced systems can further increase the total cost of ownership, posing a barrier to widespread adoption.

Complexity in Compliance and Integration

A major challenge facing the industrial brake caliper market is the complexity involved in complying with various international safety and performance standards. Manufacturers must ensure that their brake systems meet a wide range of regulations that can vary significantly from one region to another, complicating the design, testing, and certification processes. Furthermore, integrating these brake systems into diverse types of industrial machinery, each with its own specific requirements and operating conditions, adds an additional layer of complexity. This requires manufacturers to have highly specialized engineering capabilities and to maintain close collaborations with machinery manufacturers to ensure that their brake systems are not only compliant but also effectively integrated into the end users’ operations. Overcoming these challenges is crucial for manufacturers to capitalize on the growth opportunities in the global market.

Market Segmentation by Product Type

In the industrial brake caliper market, Electrically Applied, Spring Released brake calipers are emerging as the segment with both the highest revenue and highest CAGR. This category benefits from the growing integration of electronic control systems within industrial machinery, offering precise braking control, reliable performance, and compatibility with automated systems. These calipers are particularly favored in applications requiring quick, controlled stops and are easily integrated into modern control systems, enhancing their adoption in sophisticated manufacturing and processing equipment. Another notable segment is Hydraulic Applied, Spring Released, known for their robustness and reliability in heavy-duty applications such as mining and construction equipment. While these systems also represent a significant portion of the market revenue, their growth is slightly slower compared to electrically applied systems due to the increasing shift towards automation and electrification in industrial applications, which demands more electronically compatible solutions.

Market Segmentation by Caliper Design

Regarding caliper design, the Direct Double Acting calipers hold the largest market share and are projected to have the highest CAGR. This design's popularity stems from its ability to provide force from both sides of the rotor, resulting in more even brake wear and increased braking force, which is crucial for heavy industrial applications. The superior performance and reliability of direct double-acting calipers make them suitable for high-load environments, such as heavy manufacturing and metallurgical operations, where safety and efficiency are paramount. The Scissor Style design, while popular for its compact nature and ease of installation, tends to cater more to light to medium-duty applications, leading to moderate growth in specific sectors like light manufacturing and packaging. Direct Single Acting calipers, although effective, often face limitations in heavy-duty applications due to their unilateral actuation, which can lead to uneven wear and less effective braking in more demanding operations, thus experiencing slower growth compared to double-acting systems. These dynamics reflect the critical need for reliability and efficiency in industrial brake systems, guiding the technological advancements and market preferences within this sector.

Geographic Segment

In 2024, the Asia Pacific region dominated the industrial brake caliper market in terms of revenue and is forecasted to continue leading with the highest CAGR from 2025 to 2033. This growth is driven by significant industrialization, the expansion of manufacturing facilities, and increased investments in infrastructure projects across countries like China, India, and Southeast Asia. The region benefits from robust growth in sectors such as automotive, construction, and mining, all of which require reliable and efficient braking systems. Additionally, Asia Pacific's focus on adopting new technologies and improving industrial safety standards contributes to the growing demand for advanced braking solutions. Meanwhile, North America and Europe also maintain substantial market shares, supported by their mature industrial sectors and stringent regulatory standards regarding equipment safety, which enforce the adoption of high-performance braking systems.

Competitive Trends and Key Strategies

The competitive landscape in the industrial brake caliper market in 2024 was marked by the presence and strategic initiatives of key players including Hongqiao Brakes By Shares Co., Ltd., Kobelt Manufacturing Co. Ltd., KTR Systems GmbH, Hilliard Corporation, Hindon, LLC, RINGSPANN GmbH, Johnson Industries Ltd., DELLNER BUBENZER, Altra Industrial Motion Corp., Stromag, Twiflex, Svendborg Brakes, and other notable companies like Industrial Clutch and Wichita Clutch. These players focused on enhancing their product offerings through technological innovations aimed at improving the efficiency, reliability, and safety of brake systems. There was a significant emphasis on R&D activities to develop products that meet the specific requirements of various heavy industries while complying with global safety standards. Many companies also expanded their geographic footprint by establishing new facilities and entering strategic partnerships and acquisitions to strengthen their market positions and expand their customer base. For instance, companies like DELLNER BUBENZER and Altra Industrial Motion Corp. leveraged mergers and acquisitions to enhance their service capabilities and product portfolios, particularly targeting emerging markets to capitalize on growing industrial activities. From 2025 to 2033, it is expected that these companies will continue to focus on technological advancements, particularly in automation and smart braking solutions, to gain a competitive edge. Emphasis will likely also be placed on sustainability, with innovations aimed at reducing environmental impact while enhancing operational efficiencies. The integration of IoT and data analytics into braking systems to predict maintenance and improve performance will also be key strategies moving forward. These efforts will be crucial for companies aiming to meet the evolving demands of the industrial sector and maintain leadership in the increasingly competitive market.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Industrial Brake Caliper market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Caliper Design

| |

Braking Force

| |

Maximum Torque

| |

Diameter

| |

End-user

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report