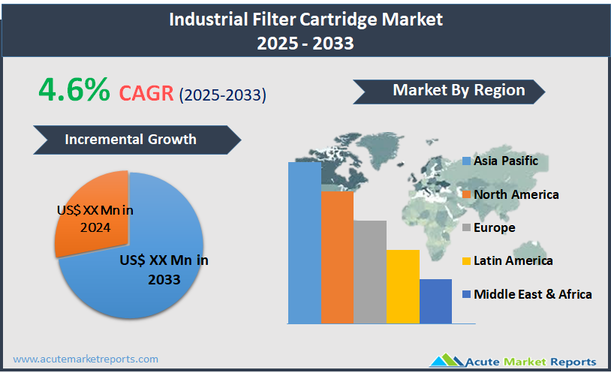

The industrial filter cartridge market involves the production and distribution of cylindrical filtration units designed to remove contaminants and particulates from liquids or gases in various industrial processes. These cartridges are used in a multitude of sectors including chemicals, pharmaceuticals, food and beverage, and water treatment. They play a crucial role in maintaining system efficiency, protecting components, and ensuring product purity by filtering out unwanted substances. The industrial filter cartridge market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.6%. This growth is spurred by increasing industrialization and stringent environmental and safety regulations across the globe. As industries continue to expand and modernize, the need for more efficient and effective filtration solutions becomes critical. The market is further driven by technological advancements in filter media and design, which improve the performance and efficiency of filter cartridges.

Increasing Regulatory Standards in Environmental and Process Safety

A major driver for the industrial filter cartridge market is the escalating regulatory standards regarding environmental protection and process safety. Industries such as chemicals, pharmaceuticals, and food processing are under increasing pressure to adhere to strict environmental and quality control regulations. For instance, the enforcement of regulations by the U.S. Environmental Protection Agency (EPA) and the European Union aims at reducing industrial emissions and effluents, necessitating the use of efficient filtration systems. These regulations mandate the removal of pollutants from emissions and waste streams before disposal or release into the environment, driving the demand for high-efficiency filter cartridges that can capture fine particulates and contaminants effectively. Additionally, industries are adopting these filter cartridges to not only comply with regulations but also to enhance their operational efficiency and protect their equipment from damage caused by particulate matter, further fueling market growth.

Technological Advancements and Innovation in Filter Media

The industrial filter cartridge market presents significant opportunities through technological advancements and innovations in filter media. The development of advanced materials that can provide higher filtration efficiency, increased durability, and resistance to a wide range of chemicals is a major focus area. New filter designs that offer easier installation, longer service life, and better contaminant holding capacity are particularly appealing. For example, the use of nano-coated filters and membranes capable of filtering sub-micron level particles is expanding. These innovations cater to the growing needs of industries that operate under stringent cleanliness and quality guidelines, such as semiconductor manufacturing and biopharmaceuticals. By capitalizing on these technological advancements, manufacturers can cater to a broader range of applications, creating a substantial growth avenue for the market.

High Initial Installation and Maintenance Costs

One significant restraint facing the industrial filter cartridge market is the high initial installation and maintenance costs associated with advanced filtration systems. The procurement and operation of sophisticated filter cartridges that meet specific industrial standards can be cost-prohibitive, especially for small to medium-sized enterprises (SMEs). These costs are often exacerbated by the need for regular maintenance, replacement of cartridges, and disposal of spent filters, which must comply with environmental regulations. The economic burden can deter businesses from upgrading their existing systems, thus slowing down the adoption rate of advanced filter technologies in certain segments of the market.

Adapting to Rapidly Changing Industry Requirements

A key challenge in the industrial filter cartridge market is keeping pace with rapidly changing industry requirements and technological advancements. As production processes evolve and new types of contaminants emerge, filter technologies must also advance to handle these changes effectively. The challenge lies in developing filter cartridges that can adapt to a variety of conditions and contaminant types without compromising filtration efficiency or operational cost. Additionally, the market demands solutions that contribute to sustainability, such as reusable or recyclable filters, adding another layer of complexity to the design and manufacturing process. Staying ahead in this dynamic environment requires continuous research and development efforts, which can be resource-intensive and necessitate ongoing investment from companies within the market.

Market Segmentation by Product Type

In the industrial filter cartridge market, segmentation by product type includes Melt Blown Filter Cartridge, String Wound Filter Cartridge, Pleated Filter Cartridge, Membrane Filter Cartridge, Sintered Filters Cartridge, Carbon Filter Cartridge, and Others. The Pleated Filter Cartridge segment leads in terms of revenue generation due to their wide application across various industries including pharmaceuticals, food and beverage, and water treatment. Pleated cartridges are favored for their high surface area, which enhances their dirt-holding capacity and efficiency in filtering fine particles. Meanwhile, the Membrane Filter Cartridge segment is expected to register the highest Compound Annual Growth Rate (CAGR). These cartridges are increasingly utilized in critical and high-purity filtration applications due to their precise pore size and high efficiency in removing microorganisms and other contaminants. The growth in biotechnological applications, stringent regulations in water filtration, and advancements in membrane technology are driving the adoption of membrane filter cartridges.

Market Segmentation by Category

Regarding market segmentation by category, the industrial filter cartridge market is divided into Surface Filtration and Depth Filtration. Depth Filtration dominates in terms of revenue due to its extensive use in applications requiring high-load dirt capacity and long service life, such as in the chemicals and petrochemicals industry. Depth filters, with their multiple layers of media, are effective in capturing a wide range of particle sizes throughout the medium, making them ideal for high-contaminant-load environments. On the other hand, Surface Filtration is anticipated to exhibit the highest CAGR, propelled by its efficiency and ease of maintenance, especially in applications where high purity is essential, such as in semiconductor manufacturing and pharmaceutical processes. Surface filters typically offer easier cleaning and backwashing processes, contributing to lower operational costs and enhanced filter longevity, factors that are expected to drive their increased adoption.

Geographic Segment

The industrial filter cartridge market exhibits strong geographic trends, with Asia Pacific leading in terms of revenue generation in 2024. This dominance is primarily due to rapid industrialization across major economies such as China and India, coupled with stringent environmental regulations driving the demand for effective filtration solutions in the region. Additionally, the Asia Pacific's expanding manufacturing base across pharmaceuticals, food and beverage, and chemicals sectors heavily contributes to the market's growth. Meanwhile, the region projected to experience the highest Compound Annual Growth Rate (CAGR) from 2025 to 2033 is also Asia Pacific. This growth is fueled by continued industrial expansions, increasing environmental awareness, and rising investments in water and wastewater treatment infrastructure, particularly in less developed countries within the region.

Competitive Trends

In 2024, the competitive landscape of the industrial filter cartridge market was shaped by active engagements from key players such as Brother Filtration Equipment Co., Ltd, Delta Pure Filtration, Eaton, Filtcare Technology Pvt. Ltd., Filter Concept Private Limited, Filtration Group BV, Gopani, Merck Millipore, Nordic Air Filtration, Pall Corporation, Rosedale Products Inc., and S S Filters Pvt. Ltd. These companies focused on expanding their product lines and improving technological capabilities to address the diverse needs of a global clientele. For instance, Eaton and Pall Corporation were prominent in advancing filtration technology, particularly in developing high-efficiency, low-maintenance filter cartridges suitable for critical applications in pharmaceuticals and biotechnology. Merck Millipore and Filtration Group BV emphasized innovations in life sciences and industrial applications, respectively, introducing products that offer superior performance in stringent conditions. Strategic alliances and acquisitions were common strategies to extend market reach and enhance technological portfolios. From 2025 to 2033, these companies are expected to intensify their focus on sustainability and efficiency. Innovations are anticipated to center around developing environmentally friendly materials and processes that reduce operational costs and improve filtration efficiency. The incorporation of digital technologies, such as IoT and automation in filter systems, will likely be key to enhancing product offerings and meeting the increasingly complex demands of industries requiring precise contamination control.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Industrial Filter Cartridge market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Category

| |

Material

| |

Media Type

| |

End-use Industry

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report