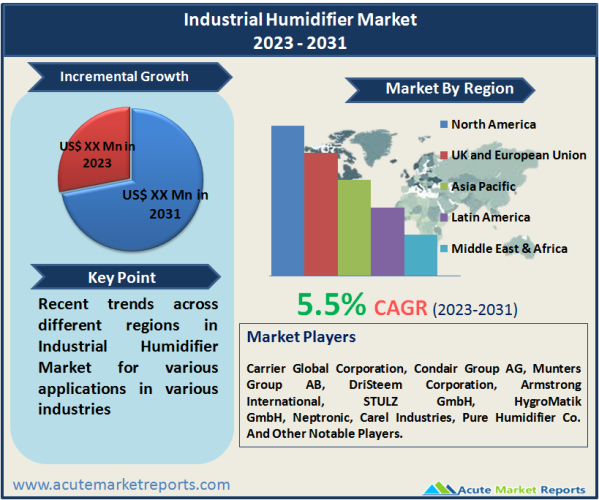

The industrial humidifier market is expected to witness a CAGR of 5.5% during the forecast period of 2026 to 2034, propelled by various driving forces that have reshaped the industry landscape. As of 2026, the industrial humidifier market has witnessed consistent growth driven by increased health awareness, technological advancements, and sustainability imperatives. As the market advances towards 2034, these factors are expected to shape its growth trajectory, catering to diverse industries seeking optimal humidity control solutions. The growing awareness of maintaining optimal indoor air quality for health and comfort has emerged as a significant driver in the industrial humidifier market. Various industries, from healthcare to hospitality, have recognized the profound impact of air quality on occupants' well-being. This awareness has led to a surge in demand for humidification systems that can create and maintain suitable humidity levels, thereby enhancing human comfort and minimizing health risks.

Advancements in Technology

The integration of industrial humidifiers with advanced technologies, including the Internet of Things (IoT) and automation, has revolutionized humidity control in diverse industries. IoT-enabled humidifiers allow for real-time monitoring and adjustment of humidity levels, offering enhanced accuracy and efficiency. Automation further optimizes the operation of these systems, reducing the need for manual intervention. This technological progress also includes the development of self-cleaning mechanisms and remote diagnostics, ensuring smooth operation and reducing maintenance downtime.

Energy Efficiency Imperative

As sustainability takes center stage, the industrial humidifier market has responded by prioritizing energy-efficient solutions. Manufacturers are developing humidification systems that minimize energy consumption without compromising performance. This approach resonates with industries striving to reduce their environmental footprint and operating costs. Certifications awarded to energy-efficient humidification systems underscore the industry's commitment to sustainable practices. Additionally, research into alternative power sources, such as solar and wind, aims to further enhance the energy efficiency of these systems.

Initial Costs and Ongoing Maintenance

The significant initial investment required for advanced humidification systems, coupled with the ongoing maintenance costs, poses a notable restraint in the industrial humidifier market. However, manufacturers are actively exploring innovative financing models to alleviate the upfront financial burden on businesses. Lease-to-own options and subscription-based services are emerging as viable solutions. Moreover, predictive maintenance technologies utilizing AI and machine learning are being integrated to optimize maintenance schedules, reducing costs and enhancing system reliability.

Distribution Channel Segmentation: Direct Sales Dominate the Market

In 2025, direct sales emerged as the primary contributor to revenue within the industrial humidifier market. Manufacturers effectively targeted industries with specific humidity control needs, showcasing their expertise and customization capabilities. Direct sales enable manufacturers to establish direct relationships with clients, providing tailored solutions based on unique requirements. This approach facilitates effective communication and support, ensuring optimal system implementation and performance. The rise of virtual demonstrations and online consultation further strengthens the direct sales model. The indirect sales channel, comprising distributors and retailers, played a pivotal role in broadening the market reach. These partners facilitate access to a wider customer base, making them integral to the industry's growth.

North America Remains as the Global Leader

As of 2026, North America retains its position as the leader in terms of revenue generation within the industrial humidifier market. The region's well-established industrial infrastructure, stringent regulatory environment, and heightened awareness of workplace health and safety contribute to its market dominance. Moreover, strategic partnerships between North American manufacturers and research institutions drive continuous innovation. As a result, North America continues to lead in the development and adoption of advanced humidity control technologies. The Asia-Pacific region is projected to experience the highest CAGR during the forecast period of 2026 to 2034. Rapid industrialization in countries like China and India, coupled with an increasing emphasis on indoor air quality, is anticipated to drive the adoption of humidification systems.

Market Competition to Intensify during the Forecast Period

The industrial humidifier market features a competitive landscape with key players shaping its evolution and growth trajectory. The top companies, including Carrier Global Corporation, Condair Group AG, Munters Group AB, DriSteem Corporation, Armstrong International, STULZ GmbH, HygroMatik GmbH, Neptronic, Carel Industries, Pure Humidifier Co., and others, are poised to intensify their competition during the forecast period. These industry leaders are anticipated to vie for market share through strategic partnerships, technological innovations, and a heightened focus on customer-centric solutions. Emerging players are also expected to contribute to market competition by introducing disruptive technologies and enhancing regional market presence.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Industrial Humidifier market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

End-Use

|

|

Distribution Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report