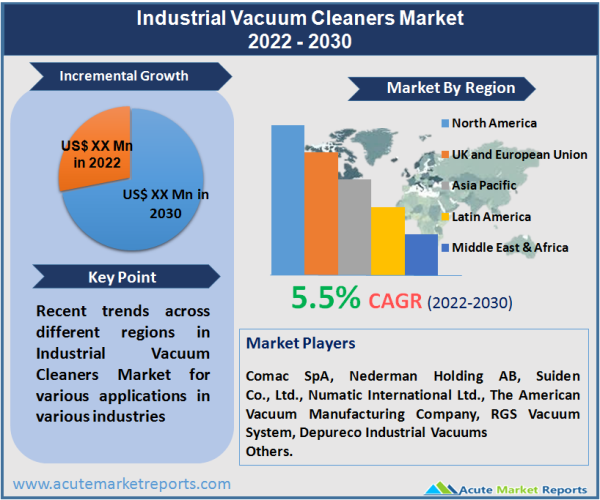

The global industrial vacuum cleaners market is anticipated to grow at a CAGR of 5.5% during the forecast period of 2026 to 2034. The market for industrial vacuum cleaners is growing as end-user enterprises become increasingly concerned about the hygiene, health, and safety of their employees and customers. Environments in the workplace that are unclean and hazardous can have a significant negative influence on the health of employees. The market for industrial vacuum cleaners has also benefited from the growth of a variety of projects and activities. The fast increase in demand from the industrial sector has a substantial impact on the market, and the development of e-commerce platforms has significantly increased the growth prospects for sales of wet vacuum cleaners. Recent developments in the market for industrial vacuum cleaners include, but are not limited to, the application of cutting-edge technology, expansion across geographic regions and increases in production capacity, and the incorporation of artificial intelligence, the internet of things, and other enhancements in the final product.

In the year 2021, there was an exponential increase in the demand for vacuum cleaners in both the residential and commercial sectors. This was mostly attributable to the increased need to maintain hygiene in hospitals and households in the wake of an increase in the number of COVID-19 cases. Some firms have reported a rise in revenues in these sectors, whilst the demand for vacuum cleaners in the industrial sector has observed a fall due to the closure of industrial units internationally, which has caused several of these companies to report an increase in revenues. One of the most important factors contributing to the continued expansion of the industry is the growing importance of online sales platforms and social media as influential platforms. Platforms for social media have been extremely helpful in improving people's awareness of the importance of maintaining proper hygiene, as well as spreading information about technologically improved items and new product launches.

Stringent Regulations and Norms Pertaining to Hygiene and Cleanliness at Workplace Promoting the Market for Industrial Vacuum Cleaners

The expansion of the market is being driven in large part by an uptick in end-user industries' worries about the state of their hygiene, health, and safety. The increase in productivity of labor or employees is directly correlated to the cleanliness of the workplace. Cleaning up after being in an industrial setting presents its own special set of issues. Workplaces that are unclean and full of contaminants can have a substantial negative influence on an employee's health. The Occupational Safety and Health Administration (OSHA), which is part of the United States Department of Labor, has outlined the regulations that must be followed in order to maintain a clean and sanitary work environment. Because of this, numerous manufacturers of industrial cleaning equipment provide industrial vacuum cleaners that are in accordance with OSHA guidelines. It is unavoidable for businesses in the food and beverage sector to conform to the requirements of the Food Safety Modernization Act (FSMA). In a similar manner, businesses involved in the production of pharmaceuticals are expected to adhere to what is known as Current Good Manufacturing Practices (cGMPs), which govern the cleanliness of manufacturing equipment and facilities.

Increasing Innovation and Convenient Range of Products is Creating Significant Market Opportunities

In June of 2022, Hencon introduced a lightweight and portable industrial vacuum cleaner under the brand name 'EVY' for usage in the mining and aluminum industries. Hencon has committed to the ongoing improvement of its technology in order to raise the company's standards for product efficacy, safety, affordability, and long-term viability. In June of 2022, Samsung debuted its line of cordless stick vacuum cleaners called the Samsung Jet. The new Samsung Jet features a wonderful user interface and can produce up to 200W (or 150W for the Samsung Jet 70) of the most powerful suction power available in its class. Vacuum cleaners of the modern era provide a solution that is both time-efficient and convenient for the majority of cleaning activities. The skyrocketing demand for innovative cleaning tools of all shapes and sizes is prompting manufacturers to produce new items that use the most cutting-edge technologies. For example, in February 2026, Travelodge, the leading hotel brand in the United Kingdom, entered into a partnership with Killis, a producer of cleaning equipment, to launch an innovative robot vacuum cleaner known as "robovac buddy" at their hotel. The housekeeping staff will be able to clean the room thoroughly with the assistance of the robot because it is equipped with cutting-edge features and the most recent technology. This will include cleaning under the bed, public areas, hotel hallways, and bar cafes. Aside from that, the Chinese smartphone manufacturer realme. introduced two new smart technology vacuum robots in September 2022. These were referred to as the "realme tech-life robot vacuum" and the "realme tech-life handheld vacuum." Both of these machines have cutting-edge cleaning capabilities, including a LiDAR navigation system, which allows them to efficiently clean and mop the floor. They are also capable of being voice-controlled and can be connected to either Alexa or Google Assistant. In addition, businesses are concentrating their efforts on improving the quality of the cleaning experience by utilizing digital capabilities, such as personalized recommendations and cleaning solutions based on smartphone apps. These technological advances bring about the emergence of brand-new opportunities for the product on the market.

High Energy Requirement is Limiting the Usage of Industrial Vacuum Cleaners

The operation of industrial vacuum cleaners requires a significant amount of energy. Certain nations have made it illegal to own or operate vacuum cleaners with particularly high energy requirements. For instance, sales of vacuum cleaners that generate more noise and heat than suction are limited in Europe. In order to comply with the new standards for vacuum cleaners, makers of home appliances are required to attach a label to each vacuum cleaner that details the product's energy usage as well as its efficiency. Additionally, the body of an industrial vacuum cleaner is typically too bulky to allow for sufficient flexibility. Because of its cumbersome metal housing, it is difficult to access the nooks and crannies. It is not possible to clean up the industrial garbage in the corners. The expansion of the market is hampered by these many variables.

Significant Market Potential in Developing Economies

It is projected that the rising demand for industrial vacuum cleaners across a variety of industries in developing countries offers players in the global market enormous market potential. Manufacturers of industrial vacuum cleaners are primarily motivated to meet the demands of consumers for devices that are compact, efficient, and reasonably priced. These devices should also have the ability to reduce the amount of noise produced, the amount of power consumed, the number of components, and their weight, as well as increase suction by using more powerful motors.

Canister Vacuum Cleaners Commanded the Revenue Share, Robotic Products to Lead the Growth Over the Forecast Period

In the coming years, we anticipate that there will be a rise in demand for products and services related to robotics. As a direct response to the COVID-19 epidemic, new cleaning criteria and demands have surfaced, with the goal of freeing up human labour so that they can focus on other responsibilities, particularly within healthcare facilities. Due to the nature of these requirements, the commercial sector has been forced to employ automated or robotic vacuum cleaners. In 2022, the canister vacuum cleaners segment dominated the market for industrial vacuum cleaners, as measured by its revenue share, which was greater than 26.5%. It is anticipated that the development of canister vacuum cleaners equipped with a HEPA filter will help future growth prospects for the sector. These vacuum cleaners have a very low risk of causing pulmonary adverse effects, such as allergies and asthma, making them an attractive option for consumers. It is projected that there will be an increase in demand for items related to robotics during the period under consideration. As a direct result of the COVID-19 epidemic, new cleaning requirements have emerged in order to free up the work of humans so that they can focus on other responsibilities, particularly within healthcare facilities. The commercial sector has been compelled to move to robotic or autonomous vacuum cleaners as a result of these requirements.

Food to Dominate the Revenues While Hospitals to be the Fastest Growing Market Segment

In 2022, the food industry dominated the market in terms of revenue. The food and beverage sector has a number of standards and regulations that vacuum cleaners must adhere to in order to be employed in the business. According to estimates provided by OSHA, foodborne diseases cost the food industry about $15.6 billion annually and send a significant number of people in the United States to medical facilities. Consequently, it is necessary for facilities that prepare food to uphold high standards of sanitation and hygiene throughout the whole food processing area. Industrial vacuum cleaners are an essential component in ensuring not only the safety of plants and workers but also the safety of food. Industrial vacuum cleaners are an essential component in ensuring not only the safety of plants and workers but also the safety of food. In the food and beverage industry, they are used for cleaning equipment, such as an oven, that is used to make the food, removing allergens from the production line, getting rid of bacteria that cause contamination issues, and cleaning places, such as air vents, that are difficult to reach. In addition, they are used to clean places that are difficult to reach, such as hard-to-reach places.

Because the vast majority of drugs and medicines, such as tablets and syrups, are manufactured on a mass scale, the pharmaceutical sector places a greater emphasis on maintaining a clean environment for its apparatus and equipment. Therefore, all procedures and pieces of equipment utilized in this sector need to be able to satisfy severe regulations in order to ensure that producers are confident in the safety, purity, and efficacy of the items they create. Current Good Manufacturing Practices are the most important industry standard in the pharmaceutical sector that must be adhered to (cGMPs). Therefore, specialist industrial vacuum cleaners used in the pharmaceuticals business that is compliant with the GMP standard and need to be ATEX (Atmospheric Explosibles) and L-M-H certified are required. These vacuum cleaners are fitted with HEPA/ULPA absolute filters.

Heavy Duty Applications Dominated More than 50% of the Revenue Shares

The heavy-duty application category contributed over 55% of the overall revenue share in the year 2022. The most lucrative industrial vacuum cleaners are those that are utilized in applications that require heavy-duty cleaning, most notably in the food, beverage, and pharmaceutical industries. As a result of the demand for higher fuel efficiency and stronger environmental laws, it is anticipated that there will be a significant increase in the number of sales of industrial vacuum cleaners throughout the period covered by the forecast.

North America Remains the Global Leader

As compared to markets in other regions, the North American market accounts for the highest share in terms of revenue contribution. This is due to the increased adoption of vacuum cleaners in various end-use industries in North America, such as the food and beverage, metalworking, and pharmaceuticals industries so on. The expanding use of e-commerce channels in the United States, growth in the consumption of both wet and dry industrial vacuum cleaners, and an increase in the level of automation are all variables that contribute.

The relaxation of lockdown procedures and the opening of educational institutions in significant portions of Europe are likely to have a positive impact on global sales of vacuum cleaners in the not-too-distant future. This will be especially true in Europe. It is anticipated that the requirement to maintain high hygiene standards in order to prevent and decrease the spread of COVID-19 will drive a number of establishments, including businesses and schools, to make investments in vacuum cleaners. For example, in December 2022, Brain Corporation, a company that specializes in robotic artificial intelligence software, collaborated with Alfred Karcher SE & Co. KG (Karcher), a company that specializes in cleaning technology, to launch "KIRA CV 60/1," an autonomous commercial vacuum cleaner. The vacuum cleaner is equipped with cutting-edge features to facilitate effortless cleaning and navigation. These features include cloud-connected artificial intelligence software, cutting-edge sensors and cameras, and vacuum bags that have been given a HEPA rating. The KIRA CV 60/1 is a vacuum cleaner that was developed specifically for use in large buildings such as airports, convention centers, schools, and offices.

It is anticipated that the market for industrial vacuum cleaners would experience substantial expansion in APAC during the forecast period of 2026 to 2034. This expansion is being significantly fuelled, in large part, by stringent regulatory and economic constraints. One of the reasons for the increased use of industrial vacuum cleaners in developing countries like China and India is the rising cost of labour in those countries. The rapid pace of industrialization in India has resulted in an increased demand for specialized cleaning equipment. The growth of India's industrialization is being fueled, in large part, by the country's special economic zones and dedicated industrial corridors. In addition to this, there has been a notable rise in the total number of small and medium-sized businesses all over the country. Various manufacturers are based in China offering industrial vacuum cleaners to several industries. The rapid rate of industrialization in India is anticipated to generate demand for specialized cleaning equipment in the country, which is anticipated to push the expansion of the market for industrial vacuum cleaners in India.

R&D Investment Remains Indispensable to Sustain Competition

The current industry trend reveals that original equipment manufacturers are focusing on developing smart vacuum cleaners that are energy-efficient, environment-friendly, and easy to use. The key market players are making significant investments in research and development activities in order to create and offer vacuum cleaners that are intelligent, portable, and lightweight. For example, in April 2026, Guandong Joy Intelligent Technology Co., Ltd. (LeSheng Smart), a company that specializes in household cleaning appliances, announced that it had successfully completed A+ financing for USD 200 million. Research, development, and testing centers for cleaning appliances like car vacuum cleaners, sweeping robots, handheld vacuum cleaners, and ground cleaning tools were established with the money. Market participants are gaining an additional advantage in the race for customers as a result of the practice of forming strategic partnerships with vendors in their industry. The following are some of the most well-known companies competing in the market for vacuum cleaners. In order to broaden their customer base, businesses are putting effort into the creation of new products and expanding existing ones. In addition, major corporations are increasingly turning to the strategy of merger and acquisition in order to increase their share of the market revenue on a global scale. The following are examples of some of the major companies operating in the market for industrial vacuum cleaners Comac SpA, Nederman Holding AB, Suiden Co., Ltd., Numatic International Ltd., The American Vacuum Manufacturing Company, RGS Vacuum System, Depureco Industrial Vacuums and Others. The fast-shifting technological environment is having a negative influence on the market players in the industrial vacuum cleaners industry since it is pushing them to routinely update their product line. This is a necessary step for them to do in order to remain competitive. As a direct consequence of this, big industrial companies are investing significant sums of money into research and development programs in order to develop more effective industrial vacuum cleaners. For instance, in 2021, the Nilfisk Company allocated $27.7 million to be spent on research and development. The company has placed a significant amount of attention on digitalization as well as the development of a function to satisfy forthcoming demands for modernization and independent cleanliness. In addition to enhancing their products' digital capabilities, many businesses are working to develop environmentally friendly goods that produce fewer emissions and generate less noise. Environments in the workplace that are unclean and hazardous can have a significant negative influence on the health of employees.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Industrial Vacuum Cleaners market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Mode of Operation

|

|

System

|

|

Product

|

|

Application

|

|

End Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report