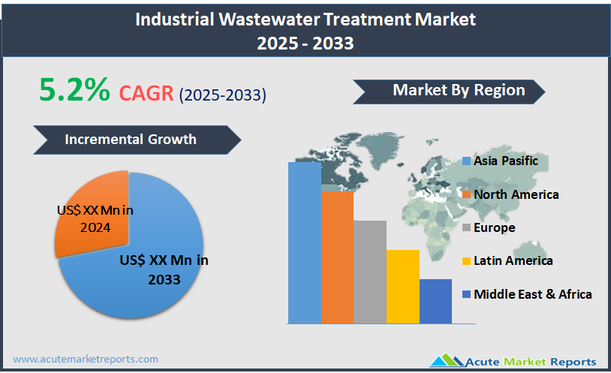

The industrial wastewater treatment market involves the technologies and services used to treat water that has been contaminated by industrial or commercial activities before it is released back into the environment or reused. This sector includes various physical, chemical, and biological treatment processes designed to remove pollutants such as hazardous chemicals, heavy metals, organic and inorganic compounds, and pathogens from wastewater. The primary goal is to mitigate the environmental impact of industrial effluents and comply with government regulations regarding wastewater discharge. The industrial wastewater treatment market is projected to grow at a compound annual growth rate (CAGR) of 5.2%. This growth is driven by the increasing industrialization and stringent environmental regulations that mandate the treatment of wastewater to meet specific standards before discharge. As industries such as chemicals, pharmaceuticals, food and beverage, and oil and gas continue to expand, the volume of wastewater needing treatment rises significantly.

Stringent Environmental Regulations

A primary driver for the industrial wastewater treatment market is the stringent environmental regulations being enforced globally to protect water bodies from industrial pollution. Governments are imposing strict limits on the levels of toxins and contaminants that can be legally discharged into the environment. This regulatory pressure compels industries to adopt advanced wastewater treatment solutions to comply with these norms and avoid hefty fines. For instance, regulations such as the Clean Water Act in the United States and the European Water Framework Directive in the EU mandate the treatment of industrial effluents before discharge, driving the installation of sophisticated treatment systems that include technologies like membrane filtration, chemical treatment, and biological treatment processes.

Water Reuse and Recycling

An emerging opportunity within the industrial wastewater treatment market is the growing emphasis on water reuse and recycling. As freshwater resources become increasingly scarce, particularly in arid regions and developing economies, industries are pressured to reduce water consumption and increase the recycling of wastewater. This trend not only helps companies mitigate the risk of water scarcity impacting their operations but also aligns with global sustainability goals. Reusing treated wastewater can significantly decrease the demand for fresh water in industrial processes and help companies achieve more sustainable water management practices.

High Capital and Operational Costs

A significant restraint in the industrial wastewater treatment market is the high capital and operational costs associated with establishing and maintaining advanced wastewater treatment facilities. The initial setup for comprehensive treatment systems that include high-end technologies like reverse osmosis membranes, UV disinfection, and advanced bio-reactors requires substantial investment. Additionally, the ongoing costs of energy consumption, chemical supplies, and skilled labor for system operation and maintenance can be prohibitively high, particularly for small and medium-sized enterprises (SMEs).

Technological Complexity and Integration

A major challenge facing the industrial wastewater treatment market is the technological complexity and integration of advanced treatment systems within existing industrial processes. As wastewater streams from industrial activities vary widely in composition, developing and implementing a treatment solution that effectively addresses specific contaminants can be technically demanding. Moreover, integrating new treatment systems with existing operations without disrupting production poses additional challenges. The need for continuous innovation in treatment technologies to keep pace with evolving industrial processes and pollution norms requires ongoing R&D investment, which can strain resources and complicate the adoption of new solutions.

Market Segmentation by Application

In the industrial wastewater treatment market, applications include Boiler Feed Water, Chemical Production, Cooling Towers, Closed Loop Chillers, Air Compressors, Air Washers, Pharmaceutical Production, and Others. Cooling Towers hold the highest revenue due to their widespread use across various industries, including power plants, manufacturing facilities, and refineries, where cooling is critical to operations. This segment benefits from stringent regulations requiring effective water treatment to prevent scaling, corrosion, and biological growth, which can affect efficiency and operational safety. The Pharmaceutical Production segment is projected to exhibit the highest CAGR, driven by the critical need for ultra-pure water in drug manufacturing and stringent compliance with health regulations, which mandate rigorous treatment standards to avoid contamination.

Market Segmentation by Technology

Regarding technology in the industrial wastewater treatment market, categories include Biological Treatment, Membrane Bioreactor (MBR), Activated Sludge, Reverse Osmosis, Membrane Filtration, Sludge Treatment, and Others. Reverse Osmosis (RO) dominates in terms of revenue and is also anticipated to grow at the highest CAGR. This prominence is due to RO's effectiveness in removing a wide range of contaminants, including particulates, microorganisms, and dissolved minerals, making it essential for producing high-purity water required in many industrial processes, particularly in the pharmaceutical and semiconductor industries. The technology's ability to meet stringent effluent criteria and its versatility in handling various waste streams contribute to its widespread adoption. Additionally, advancements in membrane technology have improved the efficiency and reduced the operational costs of RO systems, further boosting their market growth.

Geographic Segment

The industrial wastewater treatment market showcases significant geographic trends with Asia Pacific emerging as the region with both the highest revenue and the highest CAGR as of 2024. This region's growth is driven by rapid industrialization, increasing environmental awareness, and stringent governmental regulations regarding industrial effluents in major economies such as China, India, and Japan. These factors have necessitated the adoption of advanced wastewater treatment solutions to meet regulatory standards and support sustainable industrial growth. North America and Europe also maintain substantial market shares, propelled by technological advancements, existing regulatory frameworks, and the modernization of aging industrial infrastructure, which demand upgraded wastewater treatment systems.

Competitive Trends

In 2024, the competitive landscape of the industrial wastewater treatment market was characterized by the strategic initiatives of leading players such as Aquatech International LLC, WaterProfessionals, Culligan, Creative Water Solutions, MIOX, M. W. Watermark, Minerals Technologies Inc, PURONICS, Sapphire Water, Veolia, GEA Group Aktiengesellschaft, SUEZ, and ALFA LAVAL. These companies focused on technological innovation and global expansion strategies to enhance their market positions. They invested in developing more efficient and sustainable treatment technologies, including advanced membrane systems, biological treatment processes, and chemical treatment solutions. Strategic partnerships and acquisitions were common as firms sought to expand their technological capabilities and geographical footprint to new markets, particularly in regions experiencing rapid industrial growth and tightening environmental regulations. From 2025 to 2033, these companies are expected to continue their focus on innovation, particularly in the areas of energy-efficient and low-waste treatment solutions. The adoption of digital technologies, such as IoT and AI, to optimize treatment processes and reduce operational costs, will likely be key in their strategies. These advancements will enable companies to offer more competitive and environmentally friendly solutions, catering to the evolving needs of global industries seeking to comply with stringent environmental standards.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Industrial Wastewater Treatment market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Application

| |

Technology

| |

End-use Industry

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report