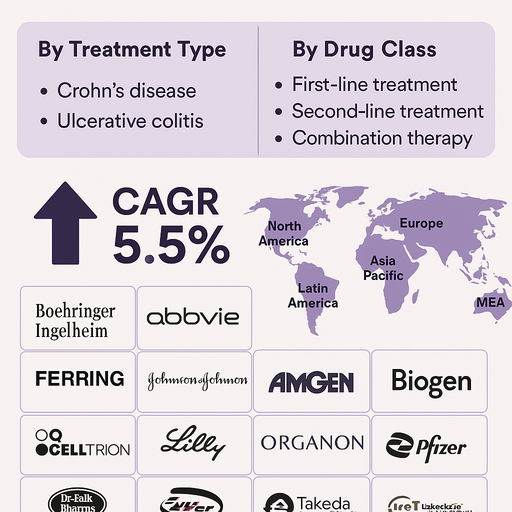

The global inflammatory bowel disease (IBD) treatment market is projected to grow at a CAGR of 5.5% from 2025 to 2033, driven by the rising prevalence of Crohn’s disease and ulcerative colitis, increasing diagnosis rates, and continuous innovation in biologics and advanced therapies. IBD, a chronic gastrointestinal disorder, requires long-term treatment strategies aimed at reducing inflammation, controlling symptoms, and preventing disease progression. The adoption of advanced monoclonal antibodies, biosimilars, and targeted therapies is reshaping patient management and improving outcomes.

Rising Demand for Targeted Therapies and Biologics

Growing understanding of IBD pathophysiology is driving demand for targeted treatment options, especially biologics and biosimilars. Physicians are increasingly prescribing advanced therapies for moderate-to-severe cases, while patients seek better quality of life with treatments that reduce hospitalizations and surgery rates. The entry of cost-effective biosimilars is also accelerating access to biologic therapies globally. Combination therapy and personalized treatment strategies, often incorporating biologics with immunomodulators, are further expanding treatment approaches.

Challenges: High Costs and Variable Access

Despite the expanding market, challenges persist. High treatment costs, particularly for biologics and novel agents, limit accessibility in price-sensitive markets. Uneven reimbursement policies and healthcare infrastructure disparities across regions also hinder adoption. In addition, safety concerns such as infection risk, loss of response to biologics, and the need for lifelong treatment complicate long-term management. However, broader biosimilar availability, ongoing R&D in oral small molecules, and increased healthcare funding are expected to reduce these barriers over time.

Market Segmentation by Treatment Type

By treatment type, the market is divided into Crohn’s disease and ulcerative colitis therapies. Crohn’s disease represents a significant portion of the market due to the complexity of treatment and high relapse rates, requiring ongoing innovation in biologics and immunotherapies. Ulcerative colitis remains a substantial segment, with recent approvals of targeted therapies improving long-term disease management and remission rates.

Market Segmentation by Drug Class

By drug class, the market is segmented into first-line treatment, second-line treatment, and combination therapy. First-line treatments include corticosteroids, aminosalicylates, and immunosuppressants, primarily used for mild-to-moderate cases. Second-line treatment, dominated by biologics such as TNF inhibitors, JAK inhibitors, and integrin antagonists, accounts for the largest revenue share due to adoption in moderate-to-severe IBD cases. Combination therapy is emerging as a critical strategy, offering enhanced efficacy for patients unresponsive to single-agent treatments.

Regional Insights

In 2024, North America led the IBD treatment market, supported by high disease prevalence, strong healthcare infrastructure, and widespread biologic adoption. Europe followed, driven by reimbursement support for biologics and the rising uptake of biosimilars in countries such as Germany, the UK, and France. Asia Pacific is the fastest-growing region, as increasing awareness, expanding diagnostic facilities, and the launch of biosimilars fuel market penetration in China, Japan, and India. Latin America and Middle East & Africa (MEA) remain emerging markets, where limited access to advanced therapies is gradually improving due to rising healthcare investment and patient support programs.

Competitive Landscape

The 2024 market was dominated by leading pharmaceutical companies focusing on biologics, biosimilars, and next-generation therapies. AbbVie remains a key player with its blockbuster drug Humira and next-generation Rinvoq and Skyrizi for IBD treatment. Johnson & Johnson, Takeda Pharmaceuticals, Pfizer, and Amgen have strong portfolios in biologics and immunotherapies. UCB, Biogen, and Eli Lilly are expanding through targeted therapies and pipeline candidates. Celltrion, Alvotech, and Organon are prominent in the biosimilars segment, offering cost-effective alternatives. Boehringer Ingelheim, Ferring, and Dr Falk Pharma contribute specialized gastrointestinal treatment portfolios. Competitive strategies are driven by biologic lifecycle management, biosimilar entry, patient-focused programs, and expansion into emerging markets.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Inflammatory Bowel Disease Treatment market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Treatment Type

| |

Drug Class

| |

Route of Administration

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report